For the first time in history, wind and solar generated more electricity than coal, oil, and gas combined across the European Union in 2025, marking a fundamental shift in the continent's energy landscape. The transition, driven by explosive solar growth and coal's rapid decline, now faces its next challenge: phasing out natural gas.

The European Union's power sector has crossed a historic threshold. For the first time ever, wind and solar generated more electricity than fossil fuels across the 27-nation bloc in 2025, according to a new analysis from the London-based energy think tank Ember.

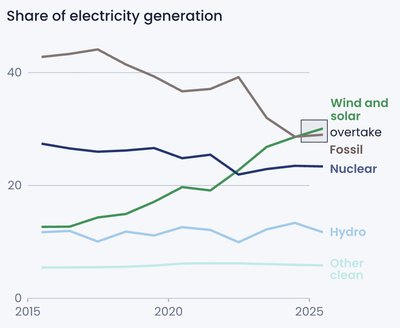

The numbers tell a clear story of acceleration. Wind and solar collectively produced 30% of the E.U.'s electricity last year, while coal, oil, and gas combined for 29%. When hydropower is included, renewable sources accounted for nearly half of all power generation across the continent. This represents a dramatic reversal from just a decade ago, when fossil fuels dominated the European grid.

The shift is being propelled by solar's unprecedented expansion. Solar energy is now growing faster than any other electricity source in Europe, making gains in every single E.U. country. In five nations—Hungary, Cyprus, Greece, Spain, and the Netherlands—solar alone supplied more than 20% of power generation in 2025.

Meanwhile, coal is in broad retreat. In 19 European countries, coal accounted for less than 5% of power generation last year. The trend accelerated in 2025, with both Ireland and Finland joining the growing list of nations that have completely shuttered their last remaining coal plants. This represents a stunning turnaround for a fuel source that once powered Europe's industrial revolution.

The analysis from Ember highlights how this transition is reshaping energy economics and geopolitics. "The next priority for the E.U. should be to put a serious dent in reliance on expensive, imported gas," said Ember analyst Beatrice Petrovich. "Gas not only makes the E.U. more vulnerable to energy blackmail, it's also driving up prices."

Natural gas remains the final fossil fuel stronghold in Europe's power mix. While coal's share has collapsed, gas still provides significant baseload power, particularly during evening hours when solar output declines but demand remains high. This creates a price volatility problem, as gas prices are often tied to global markets and geopolitical tensions.

However, a new solution is emerging: battery storage. In parts of Europe, increasingly cheap batteries are beginning to displace natural gas during the critical early evening period, when power demand peaks but solar generation wanes. "As this trend accelerates it could limit how much gas is needed in evening hours, therefore stabilizing prices," Petrovich explained.

The cost of utility-scale battery storage has plummeted in recent years, making it economically viable to store excess solar power generated during midday and discharge it during evening demand peaks. This technological shift could accelerate the phase-out of gas plants that currently serve this role.

The transition hasn't been without challenges. Climate change itself is complicating the shift to clean energy. Last year, drought conditions reduced hydropower output across the E.U., forcing natural gas power plants to increase generation to compensate. This created a temporary setback in the overall trend toward decarbonization.

The regional nature of the transition is also noteworthy. While solar is gaining ground everywhere, the pace varies significantly by country. Southern European nations with abundant sunshine have seen the fastest solar adoption, while northern countries with stronger wind resources have leaned more heavily on offshore and onshore wind development.

The Ember analysis suggests that the E.U. is now entering a new phase of the energy transition. The initial goal of making renewables competitive with fossil fuels has largely been achieved—wind and solar are now the cheapest sources of new electricity generation in most of Europe. The current challenge is system integration: ensuring the grid can handle variable renewable generation while maintaining reliability and affordability.

This requires not just more solar panels and wind turbines, but also significant investment in grid infrastructure, storage technologies, and demand management systems. The E.U. has set ambitious targets for 2030, but the pace of deployment will need to accelerate further to meet climate goals.

The shift away from fossil fuels also carries geopolitical implications. Europe's historical dependence on imported natural gas, particularly from Russia, has been a source of vulnerability. A domestic renewable energy system reduces this exposure, though it creates new dependencies on critical minerals for batteries and solar panels.

The analysis underscores that while the transition is well underway, it remains fragile. Weather patterns, supply chain constraints, and policy decisions will all influence whether the trend toward clean energy continues or stalls. The next few years will be critical in determining whether Europe can maintain its momentum and complete the phase-out of fossil fuels from its power sector.

For now, the numbers speak for themselves: Europe's energy system is transforming faster than many predicted, with renewables now at the center of the continent's power generation. The question is no longer whether this transition will happen, but how quickly it can be completed.

Comments

Please log in or register to join the discussion