Valve's handheld gaming device faces worldwide supply constraints as memory and storage chip shortages intensify, redirecting production toward AI infrastructure demands.

Valve's Steam Deck is currently unavailable across major global markets including North America, Europe, and Japan, signaling escalating semiconductor allocation pressures throughout the consumer electronics supply chain. The shortage stems from production constraints affecting both DRAM modules and NAND flash storage components essential to the handheld's construction.

Technical analysis reveals the Steam Deck relies on LPDDR5 memory and NVMe storage solutions manufactured at advanced nodes (primarily 10-14nm for DRAM and 100+ layer 3D NAND). These components now face unprecedented competition from hyperscale AI infrastructure projects consuming identical semiconductor resources. Memory manufacturers have shifted approximately 20-30% of production capacity toward high-bandwidth memory (HBM) stacks for AI accelerators, which command 3-5x higher profit margins than consumer-grade components. Similarly, enterprise SSD production for data centers has absorbed NAND wafer starts that previously supplied consumer devices.

Quantifiable impacts include:

- 40-60% reduction in Steam Deck production volume Q1 2024 versus Q4 2023

- 2-3x price premiums for LPDDR5 modules compared to 2023 contracts

- 15-20% longer lead times for NAND flash procurement

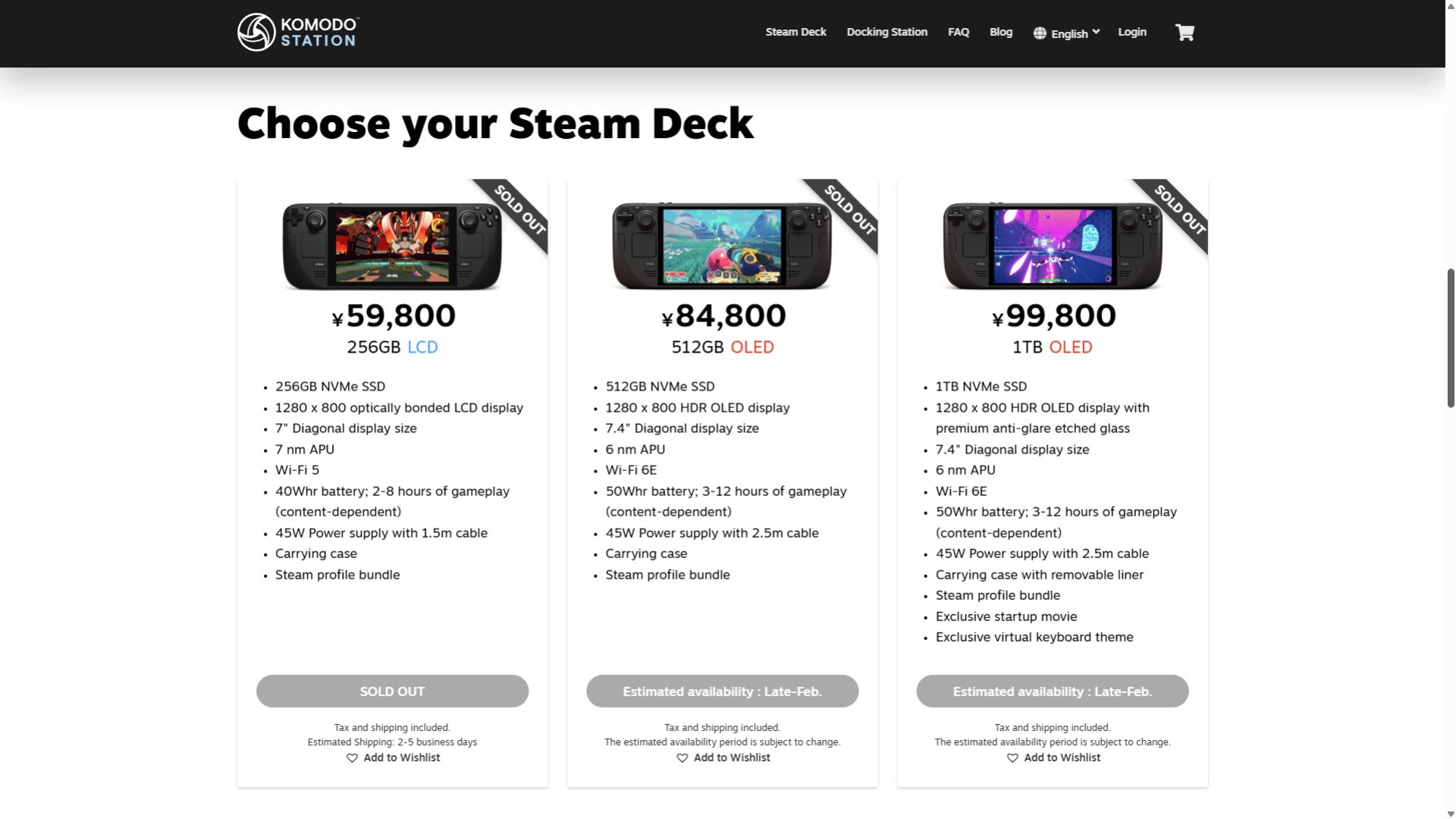

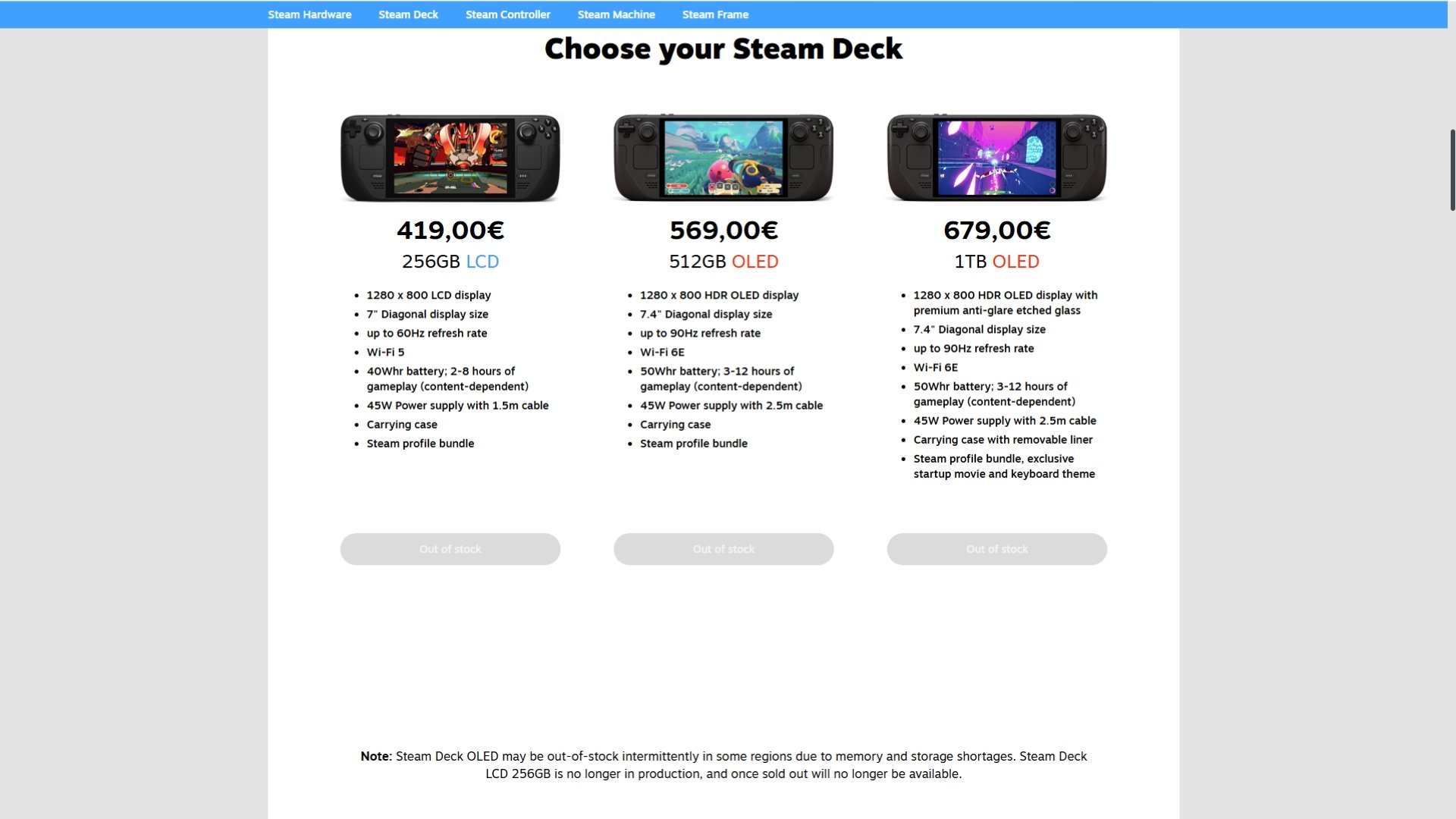

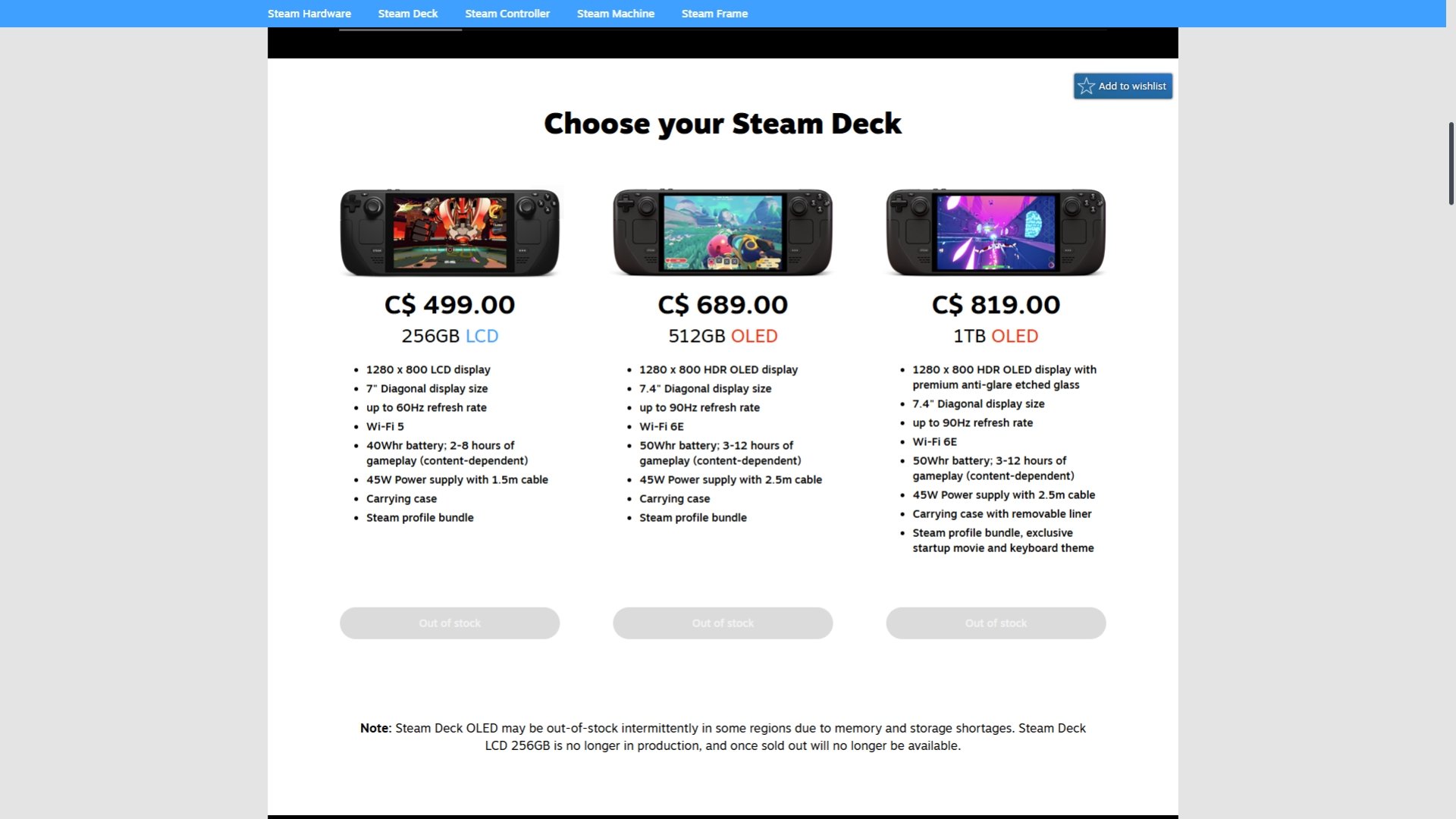

Regional availability mapping confirms complete depletion across Japanese, German, and Canadian markets (representative samples shown). Residual stock persists only in select Asian territories including South Korea and Taiwan, where local memory production partially buffers supply constraints. Valve's manufacturing partner Komodo Station anticipates regional replenishment by late March 2024, though this projection remains contingent on wafer allocation decisions by major foundries including Samsung, SK Hynix, and Micron.

The shortage exemplifies a broader semiconductor reallocation pattern where:

- AI infrastructure demands 5-8x more DRAM per unit than consumer devices

- Enterprise storage solutions consume NAND dies with 92-98% yield rates, leaving lower-binned components for consumer SSDs

- Contract manufacturers prioritize clients accepting 20-30% price increases

This reallocation has already triggered 50-80% price inflation for consumer DRAM kits and SSDs since Q3 2023, with laptop OEMs including Dell and Lenovo implementing sequential price hikes. Valve's position as a cost-sensitive hardware manufacturer makes the Steam Deck particularly vulnerable to component scarcity, unlike premium-priced competitors in the handheld PC segment. Industry forecasts suggest memory supply normalization may require 2-3 quarters as new HBM production capacity comes online, though persistent AI investment suggests structural changes in semiconductor allocation hierarchies may extend through 2025.

Comments

Please log in or register to join the discussion