Shared e-scooters failed to dethrone India's deep-rooted scooter culture, but a surprising pivot to powering quick-commerce delivery fleets is driving explosive growth. Startups like Yulu and Bounce are tripling revenues by solving last-mile logistics with purpose-built EVs and battery-swapping tech.

A few years ago, shared electric scooters promised to revolutionize urban transport in India's congested megacities. Startups like Bounce, Vogo, and Yulu flooded streets with dockless vehicles, aiming to solve the last-mile problem and reduce emissions. Yet, the initial consumer-facing (B2C) boom faltered dramatically. The dream of replacing the ubiquitous family scooter collided with harsh realities: entrenched ownership culture, inadequate infrastructure, and operational nightmares. However, declaring micromobility dead in India would be premature. Instead, the sector is undergoing a critical, tech-driven pivot—away from consumers and towards powering the booming quick-commerce delivery economy.

Why the B2C Model Stalled

The pandemic delivered a severe blow, causing revenue contractions like Bounce's 83% drop and forcing global operators to shrink. But deeper, structural issues proved fatal for widespread consumer adoption:

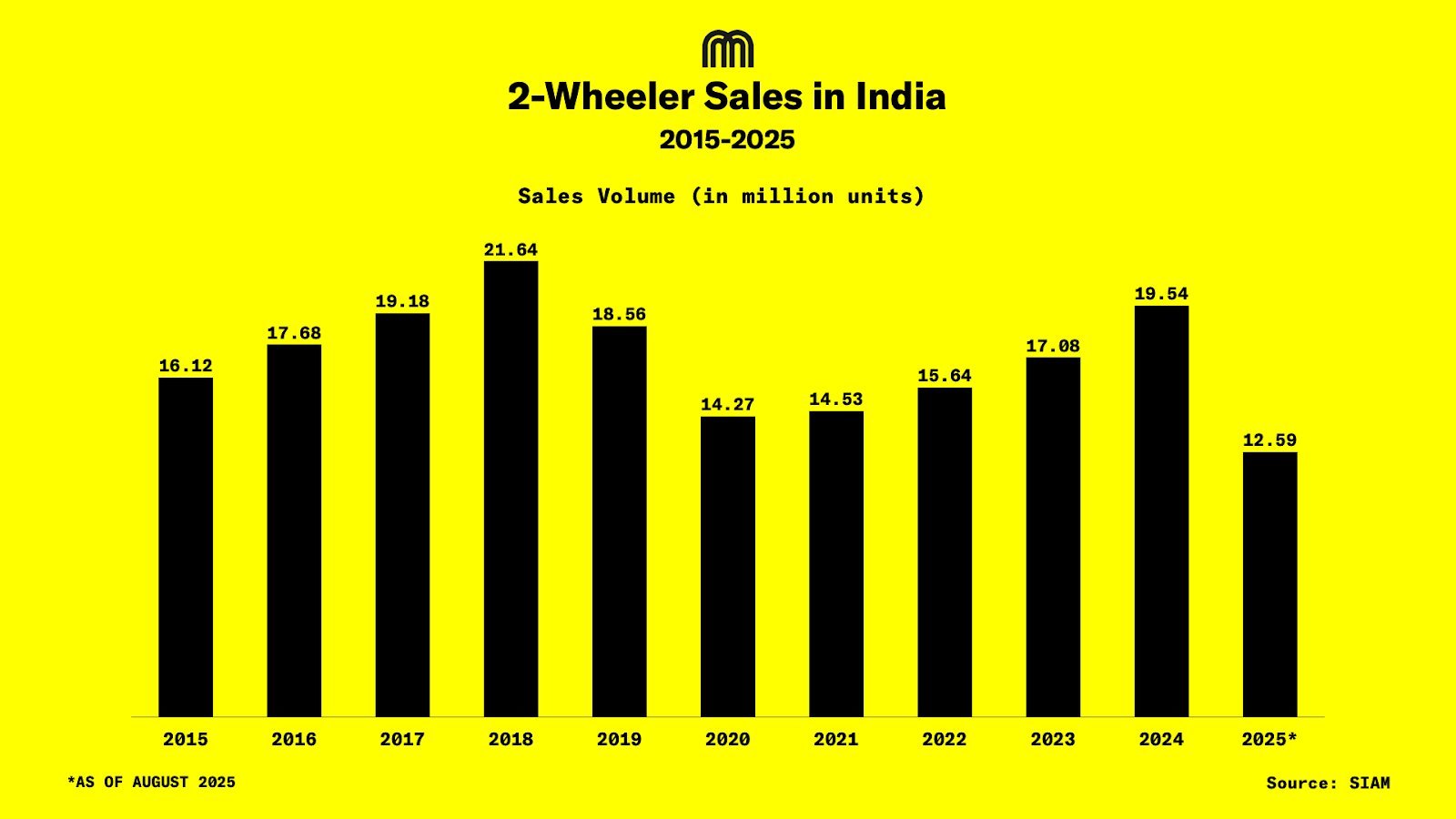

- The Ownership Imperative: With over 260 million two-wheelers on Indian roads and more than half of households owning one, personal scooters offer unmatched convenience and status. Renting felt superfluous for daily needs.

- Infrastructure Deficit: A critical lack of dedicated micro-vehicle lanes forced small EVs into chaotic traffic with cars and trucks, creating dangerous conditions. Poorly managed "free-floating" parking led to vandalism and public backlash, mirroring issues seen in Paris.

- Safety Perception: High-speed traffic mixed with inexperienced riders (studies show one-third of injuries involve first-timers) fueled safety concerns, deterring wider adoption.

Competing with the deeply ingrained culture of personal scooter ownership proved insurmountable for B2C shared micromobility. (Image Source: Micromobility.io)

Competing with the deeply ingrained culture of personal scooter ownership proved insurmountable for B2C shared micromobility. (Image Source: Micromobility.io)

The B2B Logistics Lifeline

While B2C stumbled, the explosive growth of India's quick commerce sector (GMV surging from $500M in FY22 to $3.3B in FY24, projected to hit $10B by 2029) created a massive opportunity. Delivery executives needed affordable, reliable, zero-emission vehicles. Micromobility startups pivoted hard:

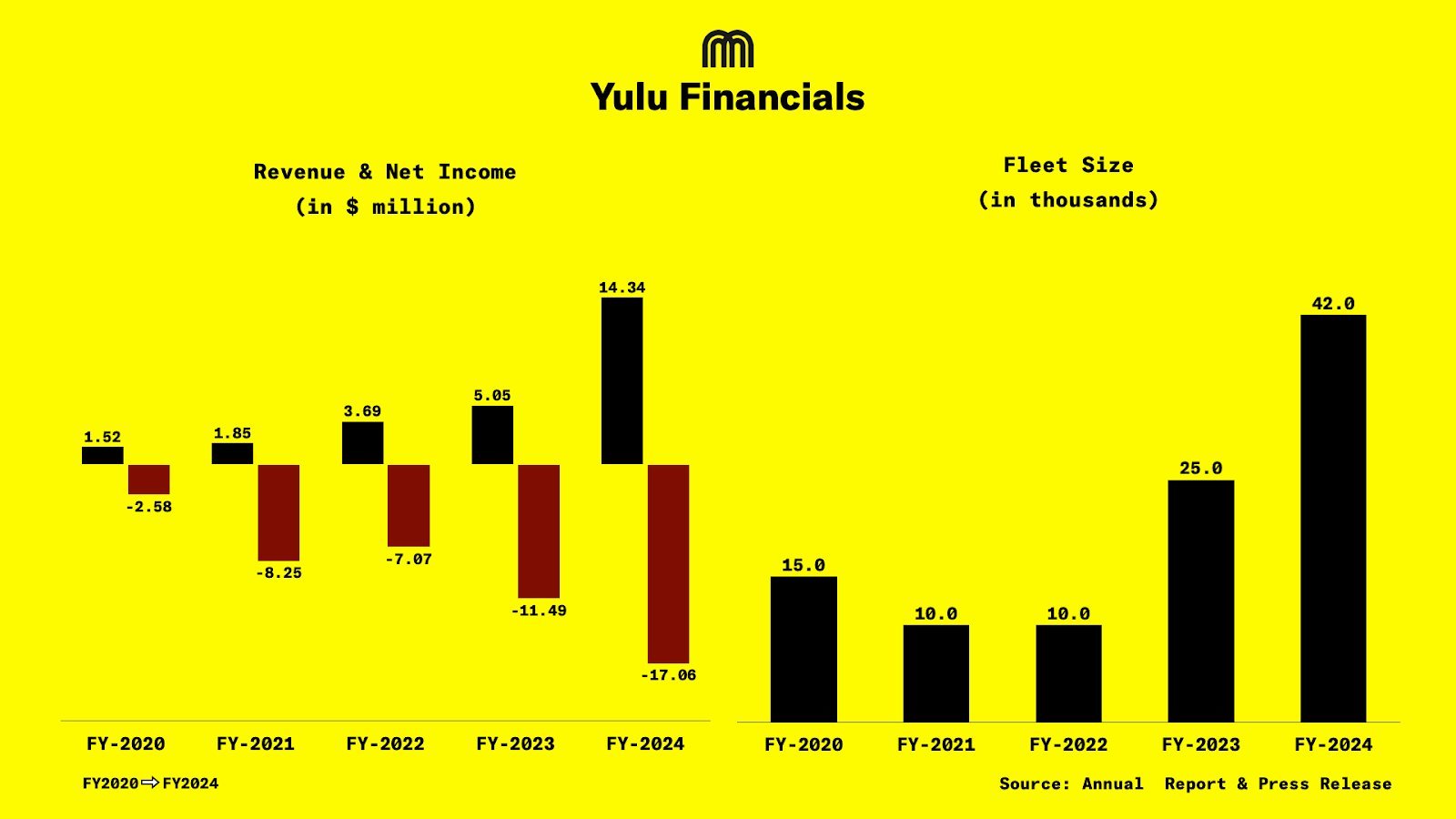

- Yulu's Dominance: Once focused on commuters, Yulu now generates 85-90% of its revenue from renting its purpose-built "DeX" e-bikes to gig workers for platforms like Blinkit, Swiggy Instamart, Zepto, and Zomato. Revenue tripled from $3.69M (FY22) to $14.34M (FY24). They're adding 4,000+ DeX vehicles monthly, targeting a 100,000-strong fleet by November 2025.

Yulu's DeX fleet, purpose-built for delivery, drives its massive B2B revenue growth. (Source: YourStory via Micromobility.io)

Yulu's DeX fleet, purpose-built for delivery, drives its massive B2B revenue growth. (Source: YourStory via Micromobility.io)

- Zypp Electric's Full Stack: Zypp offers end-to-end solutions – EVs, trained riders, battery swapping, and maintenance – handling millions of shipments monthly for e-commerce and grocery partners. Their 22,000+ fleet removes operational headaches for platforms.

- Bounce's Reinvention: After its dockless sharing model collapsed, Bounce shifted to EV manufacturing and leasing. Its plug-and-play leasing model offers scooters on long-term contracts (with maintenance, insurance, and battery swapping) at up to 30% lower cost for logistics partners. They added 3,000 scooters for logistics in just one quarter, targeting ₹100 crore revenue in FY25.

Bounce pivoted from failed sharing to EV leasing for delivery fleets, focusing on long-term contracts and battery tech. (Image credit: Bounce via Micromobility.io)

Bounce pivoted from failed sharing to EV leasing for delivery fleets, focusing on long-term contracts and battery tech. (Image credit: Bounce via Micromobility.io)

The Tech-Driven Economics of Success

The B2B model works where B2C failed because it solves core economic and operational challenges:

- High Utilization: Delivery vehicles are in near-constant use, maximizing asset ROI and enabling predictable revenue streams.

- Predictable Demand: The relentless growth of quick commerce guarantees steady need for delivery EVs.

- Operational Efficiency: Centralized fleet management, battery swapping networks (like Yulu's "Energy Infrastructure" and Zypp's systems), and purpose-built vehicles drastically reduce per-unit costs and maintenance downtime compared to scattered consumer fleets.

- Cost Advantage: Leasing EVs significantly lowers the barrier for gig workers compared to ownership, while still being vastly cheaper to operate than petrol vehicles.

Beyond Survival: A Sustainable Blueprint

India's shared micromobility dream hasn't vanished; it has evolved. The initial vision of replacing personal scooters underestimated cultural inertia and infrastructure gaps. However, by leveraging electric vehicle technology, battery swapping infrastructure, and sophisticated fleet management software, companies found a viable path by serving the exploding delivery economy. This B2B pivot demonstrates how technology adapts to market realities, finding sustainable niches where core strengths – low cost, zero emissions, and urban agility – deliver undeniable value. The future of Indian micromobility isn't the commuter on a shared scooter; it's the delivery executive on a Yulu DeX or leased Bounce Infinity, silently weaving through traffic with your next grocery order.

Source: Analysis based on reporting from Micromobility.io (https://micromobility.io/news/india-shared-micromobility-a-missed-turn-and-whats-next), incorporating data from ITDP, company financials, and India Briefing.

Comments

Please log in or register to join the discussion