Indonesia's stock market faces a critical juncture after MSCI's warning triggered a major selloff, prompting calls for urgent reforms from President Prabowo's influential brother.

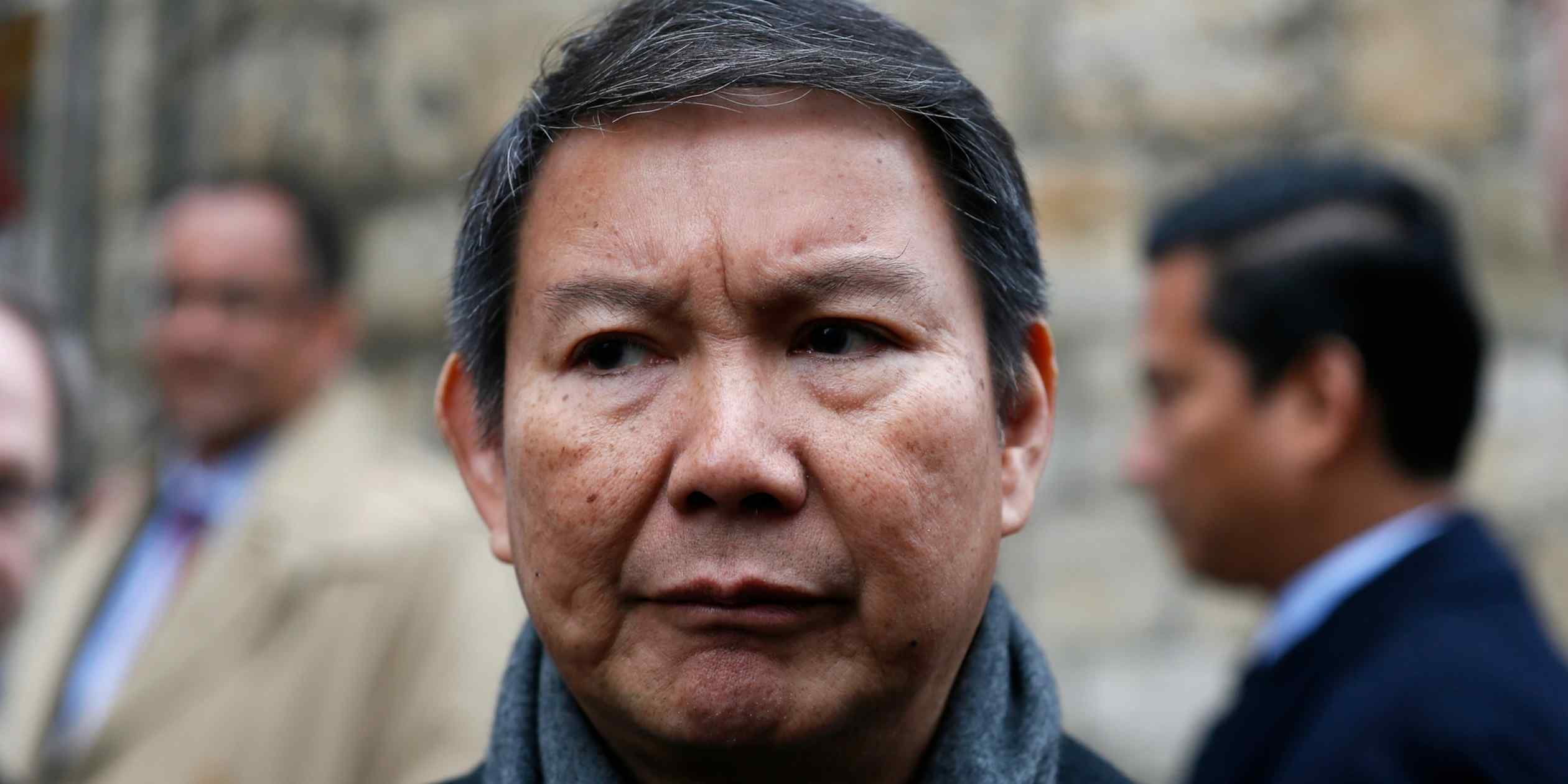

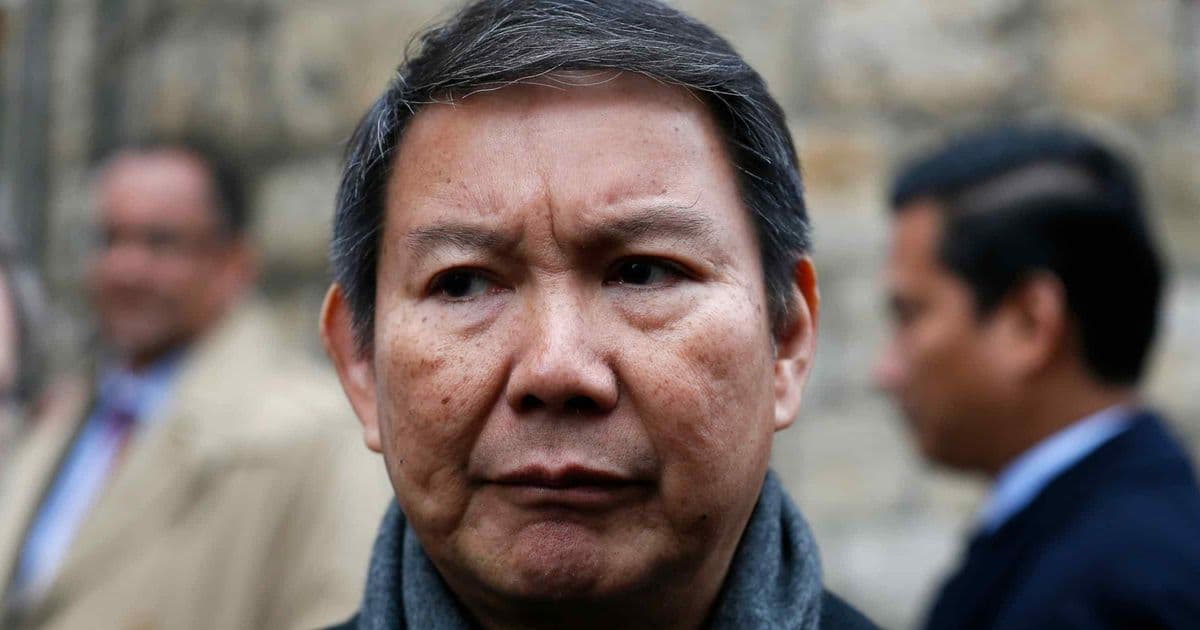

Indonesia's financial markets are in turmoil following a dramatic selloff that has wiped billions from market value and prompted the resignation of top regulatory officials. The crisis deepened this week when Hashim Djojohadikusumo, the influential younger brother of President Prabowo Subianto and his aide on climate change, delivered a stark warning to the Indonesian Stock Exchange's new management about the urgent need to restore investor confidence.

Market Rout Triggers Leadership Shakeup

The crisis began when global index provider MSCI placed Indonesia on review for potential market access restrictions, citing concerns about market manipulation and governance issues. The warning triggered a nearly 9% plunge in Indonesian stocks last week, exposing long-standing concerns about market transparency and regulatory oversight.

The market rout proved to be the final straw for Indonesia's financial leadership. Both the head of the country's financial regulator and the CEO of the Indonesian Stock Exchange resigned in rapid succession, acknowledging the need for fresh leadership to address systemic issues.

Djojohadikusumo's Intervention Signals Political Pressure

Hashim Djojohadikusumo's public intervention carries significant weight given his close relationship with President Prabowo and his reputation as a powerful behind-the-scenes figure in Indonesian politics. His warning to stock exchange bosses underscores the political dimension of the market crisis and the government's recognition that restoring investor confidence is crucial for Indonesia's economic ambitions.

The timing is particularly sensitive as Indonesia seeks to attract foreign investment to support its development goals and maintain its position as Southeast Asia's largest economy. The market turmoil threatens to derail these efforts and could have ripple effects across the region's emerging markets.

Broader Implications for Emerging Markets

Indonesia's crisis highlights the vulnerability of emerging markets to sudden shifts in investor sentiment and the importance of robust regulatory frameworks. The situation mirrors challenges faced by other developing economies that have struggled to balance market access with investor protection.

Market analysts estimate that continued instability could trigger outflows of up to $60 billion from Indonesian markets, representing a significant blow to the country's financial stability. The crisis also raises questions about the effectiveness of Indonesia's market oversight mechanisms and the need for comprehensive reforms.

Path Forward Remains Uncertain

The resignation of key officials creates an opportunity for fresh leadership and potentially more aggressive reforms. However, the underlying issues of market manipulation and governance concerns will require sustained effort to address.

Investors and market observers will be watching closely to see whether the new leadership can implement meaningful changes quickly enough to prevent further capital flight and restore Indonesia's reputation as an attractive investment destination.

As the situation continues to evolve, the Indonesian government faces a critical test of its ability to manage market crises and maintain investor confidence in one of Asia's most important emerging economies.

Comments

Please log in or register to join the discussion