Beijing-based Makera has raised over $10 million for its latest desktop CNC machine, tapping into a global maker movement that values precision over price. The company's direct-to-consumer model and rapid prototyping in China's supply chain have allowed it to compete with industrial equipment at a fraction of the cost.

The desktop CNC machine has long been a staple in professional workshops, but its complexity and cost kept it out of reach for most creators. That gap is closing. Beijing Makera Technology Co., Ltd., founded in 2019, is part of a wave of companies bringing industrial-grade manufacturing capabilities to desks and home workshops. Their latest machine, the Makera Z1, recently concluded a Kickstarter campaign with over $10 million in funding—a figure that underscores a growing appetite for accessible, high-precision fabrication tools.

Makera’s core products are desktop CNC (Computer Numerical Control) machines, which use computer programs to carve and cut materials like wood, plastic, and aluminum. For everyday users, these devices can produce crafts, personalized gifts, or prototypes. For educators and small manufacturers, they serve as practical tools for teaching digital fabrication or running small-batch production. The Carvera series, Makera’s earlier product line, already demonstrated the ability to handle complex carving and cutting, turning digital designs directly into physical objects. The newer Carvera Air and Makera Z1 push further with improved precision, broader material compatibility, and added features like laser engraving.

The Makera Z1 is designed to be compact and user-friendly, yet it maintains a precision of around 0.02 millimeters. This allows it to handle a wide range of projects: crafting wooden items, producing small metal parts, creating PCB prototypes, or building model components. Compared to traditional industrial CNC machines, the Z1 is more space-efficient and easier to operate, making it suitable for makerspaces, classrooms, and design studios. Its versatility is a key selling point—users can switch between materials and applications without needing a separate machine for each task.

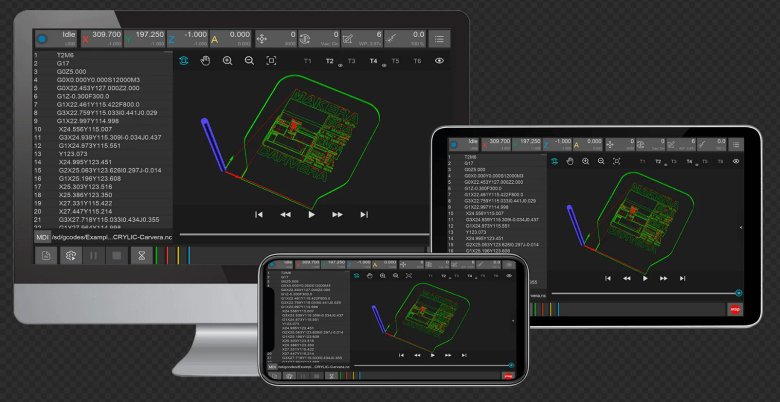

Beyond hardware, Makera invests in software and community to lower the learning curve. Its proprietary Makera Studio software converts design files into machining programs, allowing users to preview the process and make adjustments before cutting. The company also runs an online platform where creators share projects, tips, and troubleshooting advice. This community-driven approach helps beginners get started and enables experienced users to explore advanced techniques.

Makera’s market strategy has focused on global users from the start. The company sells directly to consumers through crowdfunding platforms, where demand has been strong. The Carvera and Carvera Air each raised over $1 million on Kickstarter, and the Makera Z1’s $10.24 million haul in just 45 days signals a significant shift. This response suggests that makers worldwide are willing to invest in tools that bridge the gap between hobbyist and professional equipment.

To understand Makera’s approach, we spoke with Dyson, the company’s Chief Marketing Officer. He explained that the company’s focus on overseas markets stems from cultural and economic differences. "In China, people are used to 'what you see is what you get.' If you need a chair, you simply buy one because it is cheap and fast," Dyson said. "In the US and Europe, especially in the US, there is a strong garage culture. People enjoy making things themselves and are more willing to pay for tools that save time and improve precision."

This cultural difference shapes Makera’s product development. The company packs industrial-grade features—like automatic tool changing and high-precision machining—into a desktop-sized machine, priced at a fraction of industrial equipment. "Storytelling doesn’t really work in the maker tools space—performance does," Dyson noted. "When users get their hands on it and see what it can do, the value is obvious."

Makera’s direct-to-consumer model also means close engagement with users. Initially, the team assumed their customers were hardcore geeks who could figure things out on their own. But many users are designers or jewelers who don’t want to be programmers. "They just want to press a button and make something," Dyson said. The company spends significant time in user communities on platforms like Discord and Facebook, listening to feedback and iterating quickly. "Today, our product decisions are shaped by real user feedback, not by assumptions made in meeting rooms."

A key advantage for Makera is its location in China, particularly the Greater Bay Area, which includes Shenzhen. This region’s supply chain allows for rapid prototyping and iteration. "Without China’s supply chain, Makera might not have survived the prototype stage," Dyson admitted. "What it gives us isn’t just lower cost, but speed. In Shenzhen, you can send out a design in the morning and receive the part the same afternoon. In the US, that might take two weeks. This means that in the same amount of time, we can make ten rounds of improvements, while overseas competitors manage just one."

The Kickstarter campaign for the Makera Z1 served as a defining moment for the company. "Before that, we weren’t sure—would people trust us? Would they believe that a high-precision desktop CNC machine at this price point was even real?" Dyson recalled. The campaign’s success confirmed that thousands of makers worldwide were willing to invest in professional-grade desktop machines. It validated Makera’s strategy of targeting the gap between hobbyist tools and industrial equipment.

Makera’s story reflects a broader trend in digital manufacturing: the democratization of tools once reserved for professionals. As software improves and supply chains become more agile, the barrier to entry for creators continues to drop. For Makera, the challenge now is scaling production and maintaining the quality that earned it a loyal following. The company’s bet on global makers appears to be paying off, but the real test will be whether it can sustain that momentum as competition intensifies.

Comments

Please log in or register to join the discussion