Internal documents reveal Intuit's systematic campaign to block IRS efforts to simplify tax filing while deploying deceptive 'dark patterns' in TurboTax to lure users with false 'free' promises. The company leveraged lobbying, regulatory capture, and psychological manipulation to protect billions in revenue from a system critics argue should be public infrastructure.

For two decades, Intuit has waged a covert war against efforts to simplify tax filing in the United States, exploiting regulatory loopholes, deploying deceptive design practices, and spending millions to ensure Americans keep paying for what should be a free public service. Internal documents and whistleblower accounts obtained by ProPublica expose how the maker of TurboTax systematically undermined government initiatives for a free filing system while deliberately confusing users with predatory UX tactics.

The Free File Facade

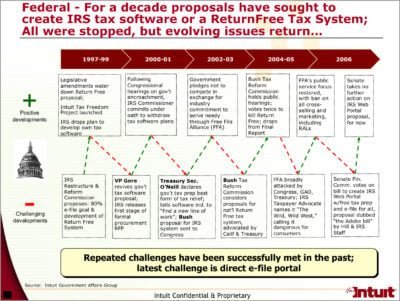

In 2003, Intuit brokered a deal with the IRS called the Free File Alliance, ostensibly offering free tax preparation to 60% of taxpayers. In reality, it was a strategic maneuver to prevent the IRS from developing its own system. Confidential board presentations bluntly stated the goal: "Proposals to create IRS tax software [...] All were stopped." The program was deliberately crippled—Intuit added code to hide Free File pages from search engines, while aggressively marketing its own similarly named "TurboTax Free Edition" that funnels users toward paid products.

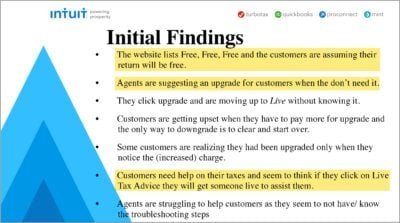

Internal analysis shows thousands of customers complained TurboTax wasn't 'free' despite advertising

Internal analysis shows thousands of customers complained TurboTax wasn't 'free' despite advertising

Dark Patterns and the 'FUD' Doctrine

Former employees describe an institutionalized strategy exploiting "Fear, Uncertainty, and Doubt" (FUD):

- Search suppression: Deliberately hiding the IRS Free File option from Google

- Bait-and-switch: Luring users with "free, free, free" ads, then blocking filing behind paywalls for common forms

- Psychological manipulation: Adding meaningless animations to imply complex calculations, reinforcing anxiety

- Steering: Using phrases like "maximize your deductions" to push eligible users toward paid tiers

"Customers are getting upset," admitted an internal 2019 presentation analyzing calls where users protested: "It says free free free on the commercial!"

Regulatory Capture Playbook

Intuit's influence machine proved devastatingly effective:

- Revolving door: Hired former IRS negotiator Dave Williams as "Chief Tax Officer" after he oversaw Free File

- Covert alliances: Funded minority advocacy groups to lobby against free filing (documents show plans to "buy ads in African American and Latino media")

- Congressional manipulation: Secured appropriations riders banning IRS from developing competing systems

- Antitrust evasion: Pressured competitors to limit free offerings, triggering a DOJ antitrust warning

The $1.5 Billion Toll

With Free File participation collapsing to 2.8 million users (from 5.1 million in 2005), ProPublica estimates 15 million paying TurboTax customers earning under $66,000 could file free via IRS programs—representing over $1.5 billion in annual revenue. Retirees, students, and low-income filers are disproportionately affected.

Slide from Intuit board presentation boasting of blocking government filing initiatives

Slide from Intuit board presentation boasting of blocking government filing initiatives

Reckoning or Resilience?

Despite 2019 setbacks—including dropped legislation and investigations by New York/California—Intuit remains defiant. New CEO Sasan Goodarzi assured staff: "We’re working with the IRS and Congress to ensure the facts are clear." With TurboTax revenue projected to grow 10% next year, the battle between public infrastructure and private profit continues—with American taxpayers paying the price.

Comments

Please log in or register to join the discussion