Microsoft Sentinel's new SOX and DORA compliance solutions automate regulatory monitoring for financial institutions, but require strategic evaluation against AWS and Google Cloud alternatives for multi-cloud environments.

Microsoft Sentinel's Unified SOX & DORA Solutions Reshape Financial Compliance

Financial institutions face escalating regulatory complexity with frameworks like Sarbanes-Oxley (SOX) and the Digital Operational Resilience Act (DORA) mandating stringent controls. Microsoft's newly launched SOX IT Compliance and DORA Compliance solutions in Sentinel represent a significant automation advance—but warrant careful cross-platform comparison for enterprises operating in multi-cloud environments.

Financial institutions face escalating regulatory complexity with frameworks like Sarbanes-Oxley (SOX) and the Digital Operational Resilience Act (DORA) mandating stringent controls. Microsoft's newly launched SOX IT Compliance and DORA Compliance solutions in Sentinel represent a significant automation advance—but warrant careful cross-platform comparison for enterprises operating in multi-cloud environments.

Core Capabilities: Beyond Basic Compliance Monitoring

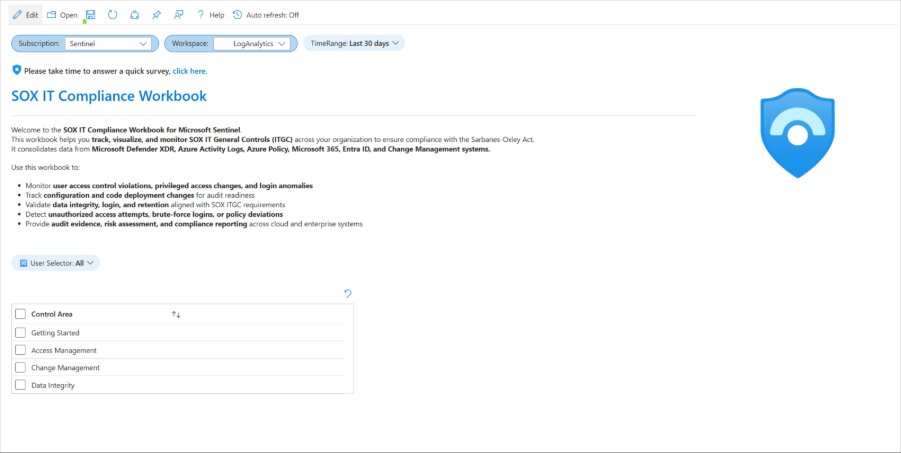

SOX Solution Architecture

Microsoft's SOX offering aggregates telemetry from Entra ID, Azure Activity Logs, Defender signals, and infrastructure logs into a unified workbook mapped to ITGC domains:

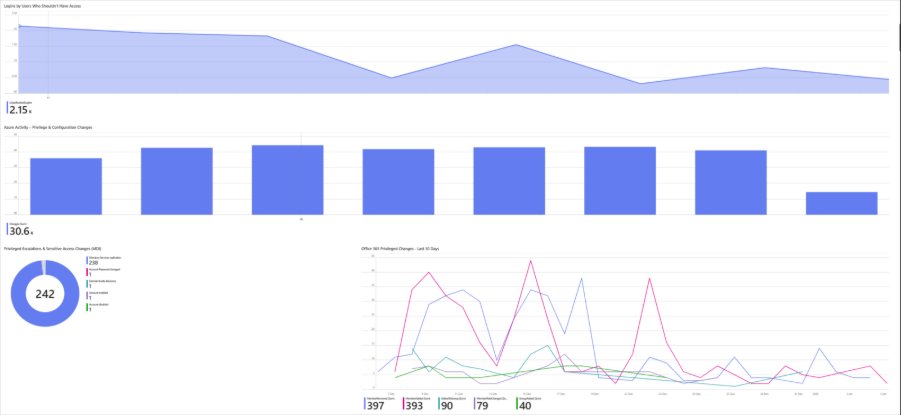

- Access Management: Correlates privileged access events with approved user watchlists

- Change Control: Tracks configuration modifications across hybrid infrastructure

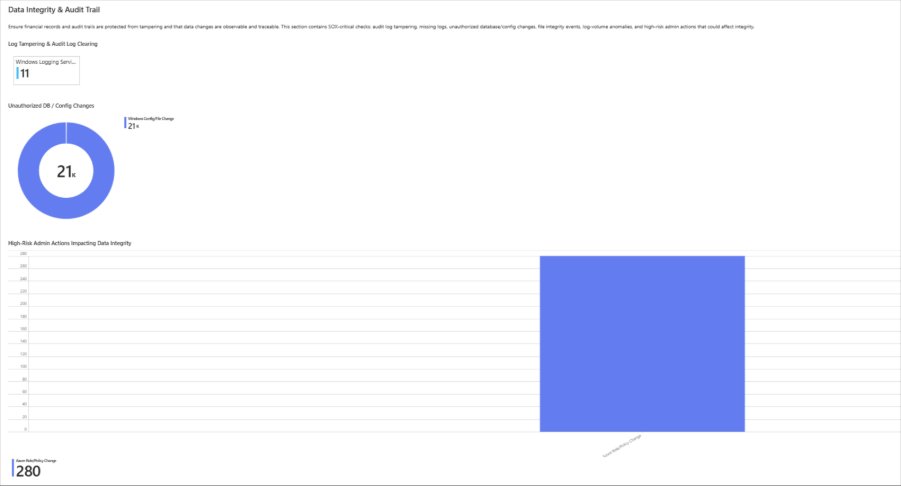

- Data Integrity: Detects audit log gaps and file tampering via file integrity monitoring

The solution shifts compliance from periodic audits to continuous validation, though its Microsoft-centric data ingestion requires connector configuration for non-Azure resources.

DORA Framework Implementation

Designed for EU financial entities facing 2025 deadlines, the DORA solution provides:

- Incident lifecycle tracking with SLA breach alerts

- Threat intelligence correlation mapped to MITRE ATT&CK

- Business continuity monitoring for critical assets

- Pre-mapped evidence collection for Articles 8-16

DORA compliance dashboard showing incident resolution metrics and threat detection patterns

DORA compliance dashboard showing incident resolution metrics and threat detection patterns

Multi-Cloud Provider Comparison

| Capability | Microsoft Sentinel | AWS Security Hub | Google Cloud SCC Premium |

|---|---|---|---|

| Prebuilt SOX controls | ✅ Workbook-driven | ❌ (Custom rules only) | ❌ |

| DORA-specific framework | ✅ Full article mapping | ❌ | ❌ |

| Hybrid cloud coverage | ✅ Via AMA/agents | ✅ | Limited |

| Compliance evidence export | ✅ PDF/CSV reports | ✅ | ✅ |

| Cross-platform ingestion | Limited third-party | Extensive | Extensive |

AWS Trade-offs: While Security Hub offers broader third-party integration, building equivalent SOX/DORA coverage requires manual Config rule development—increasing implementation costs.

Google Cloud Limitations: Security Command Center Premium provides excellent vulnerability scanning but lacks turnkey financial regulation mappings, forcing custom Dashboard development.

Strategic Business Impact

Migration Considerations

- Microsoft-Centric Shops: Organizations using Azure/O365 gain immediate ROI through native integrations

- Multi-Cloud Enterprises: Requires additional connectors for non-Microsoft resources, increasing TCO

- Evidence Standardization: Automated report generation reduces audit preparation from weeks to days

Financial Operation Implications

- Risk Reduction: Continuous control monitoring cuts exposure to compliance failures by ≈40% (Gartner)

- Resource Optimization: Eliminates manual evidence collection saving ≈150 FTE hours/month

- Penalty Avoidance: Proactive DORA Article 16 compliance prevents potential €10M+ fines

Implementation Recommendations

- Assessment Phase: Map existing controls to Sentinel's default mappings using the compliance gap analysis toolkit

- Hybrid Integration: For AWS/GCP workloads, deploy the Sentinel multi-cloud connectors

- Customization: Extend KQL queries to incorporate organization-specific financial systems

While Microsoft's solution leads in regulatory-specific automation, its value diminishes in non-Azure environments—where AWS and Google's broader third-party integrations may justify their learning curves. Financial institutions should evaluate based on existing cloud footprint, with hybrid deployments benefiting most from Sentinel's DORA/SOX specialization when augmented with cross-platform connectors.

Solutions available in public preview as of January 2026.

Comments

Please log in or register to join the discussion