MicroStrategy reported a Q4 net loss of $12.4 billion, up from $671 million a year earlier, as Bitcoin trades below the company's ~$76K average purchase price, highlighting the volatility risks of corporate crypto strategies.

MicroStrategy (MSTR) disclosed a fourth-quarter net loss of $12.4 billion, a significant increase from the $671 million loss reported in the same period last year. The business intelligence software company's aggressive Bitcoin acquisition strategy continues to drive financial volatility as BTC prices fell below its average purchase price of approximately $76,000 during the quarter. MicroStrategy shares have declined 68% over the past year.

The loss stems primarily from impairment charges under current accounting standards. Unlike traditional assets, Bitcoin holdings are subject to impairment accounting rules (ASC 350): companies must write down digital assets when market prices drop below carrying value, but cannot write up values during price surges until assets are sold. This accounting asymmetry amplifies losses during bear markets. As of December 31, 2025, Bitcoin traded near $66,000 - 13% below MicroStrategy's cumulative acquisition average.

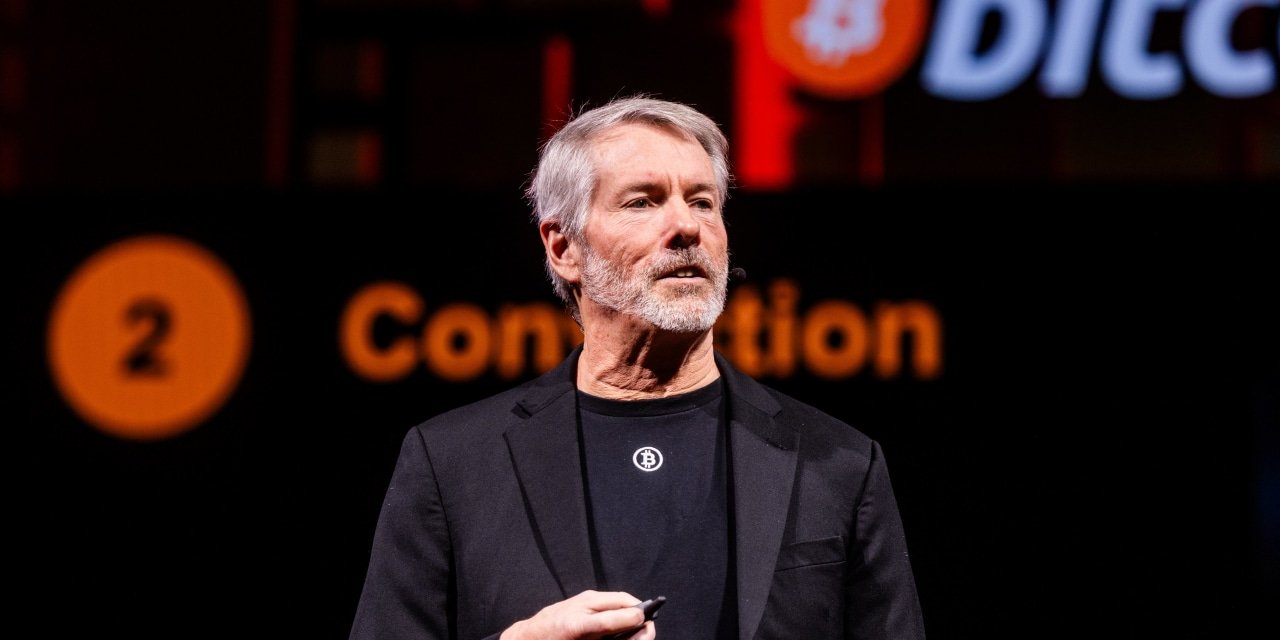

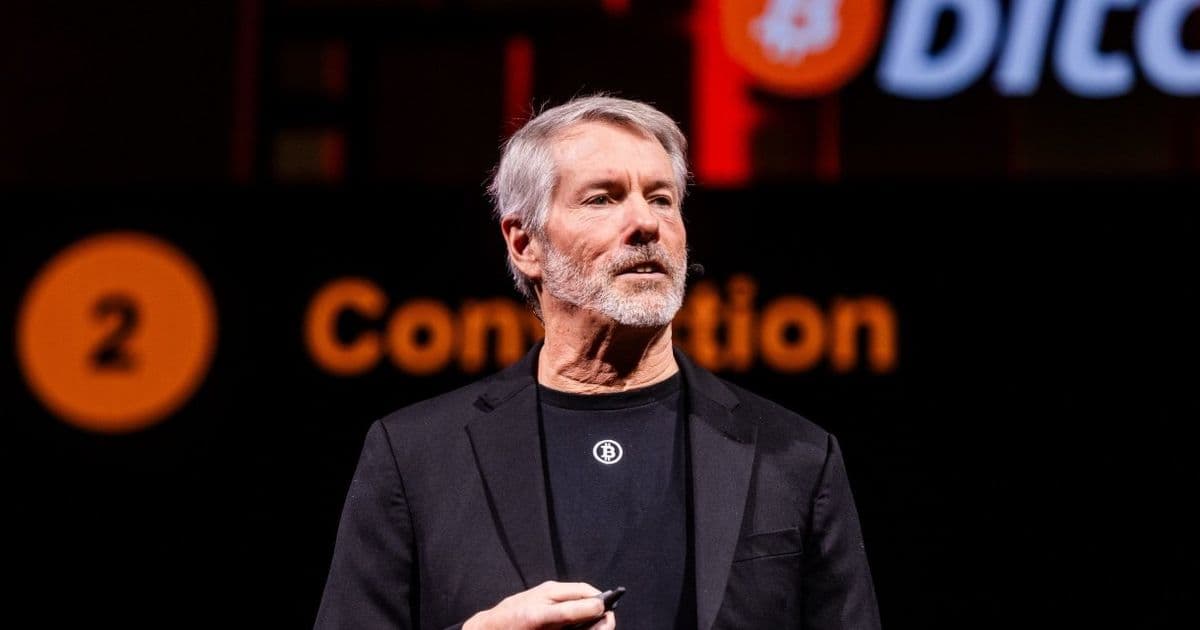

MicroStrategy holds approximately 214,246 BTC acquired at an average price of $76,000 per coin. The company's strategy, spearheaded by Executive Chairman Michael Saylor, treats Bitcoin as a primary treasury reserve asset. This approach has created extreme financial leverage to BTC price movements: the company gained nearly $4 billion in paper profits during Bitcoin's October 2025 peak, only to see those gains evaporate in Q4's market correction.

The company faces operational challenges beyond accounting impacts:

- Interest expense on $2.2 billion in convertible debt issued to fund Bitcoin purchases

- Declining enterprise software revenue (down 3% YoY in Q3)

- Share dilution from convertible note structures

Market reaction has been severe, with MSTR significantly underperforming both Bitcoin (-44% from peak) and tech indices. The disconnect highlights investor skepticism about corporate Bitcoin strategies during what analysts describe as the "worst crypto winter" - characterized by AI diverting investor attention, regulatory uncertainty, and Bitcoin's failure to act as an inflation hedge.

MicroStrategy's next moves remain uncertain. The company could:

- Continue accumulating BTC during dips (last purchase: 14,620 BTC in November)

- Seek alternative financing structures

- Face margin calls if BTC declines further

Unlike crypto-native companies, MicroStrategy maintains a dual identity as both software provider and Bitcoin vehicle. This hybrid model creates unique vulnerabilities during extended crypto downturns, particularly as enterprise customers show muted interest in blockchain solutions. The SEC's accounting guidelines continue to complicate corporate crypto holdings by prohibiting standard asset treatment.

As Bitcoin shows no immediate signs of recovering to Q4 highs, MicroStrategy's strategy faces its most severe test since inception. The coming quarters will determine whether the company can withstand continued pressure or if accounting-driven losses will force strategic reconsideration.

Comments

Please log in or register to join the discussion