Nvidia CEO Jensen Huang confirmed the company has surpassed Apple as TSMC's largest customer, driven by unprecedented demand for AI processors, while supply chain sources indicate TSMC may be raising prices for Apple due to foundry capacity constraints.

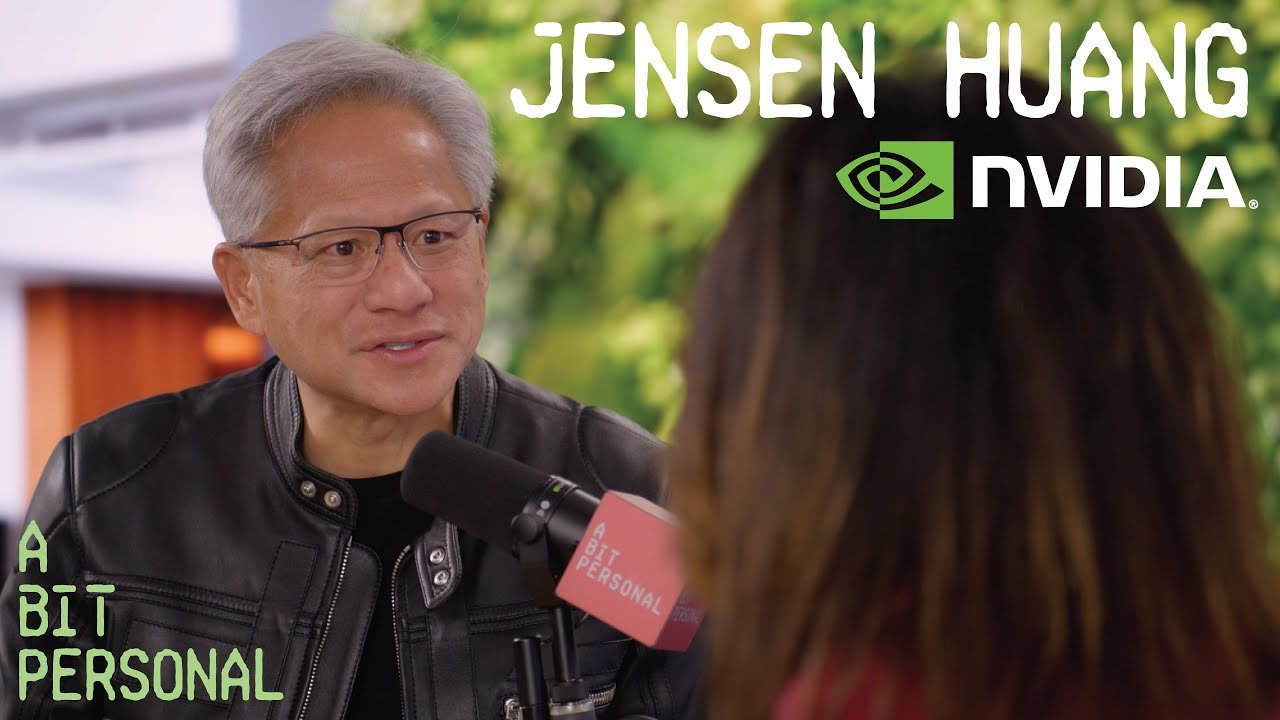

Nvidia CEO Jensen Huang publicly confirmed during the 'A Bit Personal with Jodi Shelton' podcast that his company has displaced Apple as Taiwan Semiconductor Manufacturing Company's (TSMC) primary customer. This shift marks a significant power realignment in semiconductor manufacturing priorities, reflecting the overwhelming market demand for artificial intelligence accelerators versus consumer electronics.

Jensen Huang discussing Nvidia's position during podcast interview

Jensen Huang discussing Nvidia's position during podcast interview

Historical production patterns show Nvidia previously held TSMC's top customer position in the early 2000s before Apple secured the spot in the 2010s. Apple's dominance coincided with TSMC manufacturing A-series and M-series processors for iPhones, iPads, and Macs after Intel failed to secure Apple's foundry business. At its peak, Apple accounted for over 25% of TSMC's advanced node capacity (5nm and below), with iPhone production alone exceeding 200 million units annually.

The reversal stems from divergent demand patterns: While Apple moves approximately 50 million smartphone chips quarterly, Nvidia shipped over 3.76 million data center GPUs in 2023 according to industry analysts. Crucially, Nvidia's H100 and upcoming Blackwell architecture GPUs command significantly higher ASPs (averaging $25,000-$40,000 per unit) compared to Apple's smartphone SoCs (estimated at $110-$170 per chip). This pricing differential, combined with enterprise customers ordering GPUs in thousand-unit increments for AI clusters, propelled Nvidia's revenue contribution to TSMC.

TSMC's advanced node manufacturing enables both companies' flagship products

TSMC's advanced node manufacturing enables both companies' flagship products

Supply chain analysts note that TSMC's 3nm and 5nm production lines are operating at near-maximum utilization, with AI-related orders consuming approximately 35-40% of advanced node capacity. Multiple industry sources, including Apple supply chain monitor Fixed Focus Digital, indicate TSMC is negotiating price increases of 8-12% for Apple's future 2nm chip orders. This would mark a reversal of Apple's traditional preferential pricing arrangements, though neither company has publicly confirmed adjustments.

The capacity rebalancing reflects fundamental market forces: Consumer electronics face natural demand elasticity with clear price ceilings, while hyperscalers like Microsoft, Google and Meta continue expanding AI infrastructure with seemingly unlimited capital expenditure. Nvidia's data center revenue reached $47.5 billion in FY2024 - a 217% year-over-year increase - compared to Apple's entire product division growing 2% during the same period.

Should AI investment plateau, Apple could regain its position given its consistent high-volume orders across smartphones, tablets, and computers. However, with TSMC projecting 20% annual growth in AI-related revenue through 2028 and Nvidia commanding over 90% of the AI accelerator market, current dynamics favor sustained GPU production priority. Foundry pricing adjustments would likely impact Apple's gross margins minimally (estimated 20-40 basis points) given their pricing power and vertical integration advantages.

This customer shift underscores how specialized AI hardware is reshaping semiconductor manufacturing hierarchies, prioritizing high-margin, low-volume enterprise components over high-volume consumer silicon for the first time in a decade.

Comments

Please log in or register to join the discussion