Platforms like Kalshi and Polymarket are attracting billions in trades on everything from elections to celebrity gossip, operating in a regulatory gray zone between financial markets and gambling. As the CFTC struggles to apply decades-old derivatives rules to these retail-focused prediction markets, critical questions about market manipulation, consumer protection, and election integrity remain unanswered.

The Wild West of Wagering: How Prediction Markets Are Outpacing Regulators

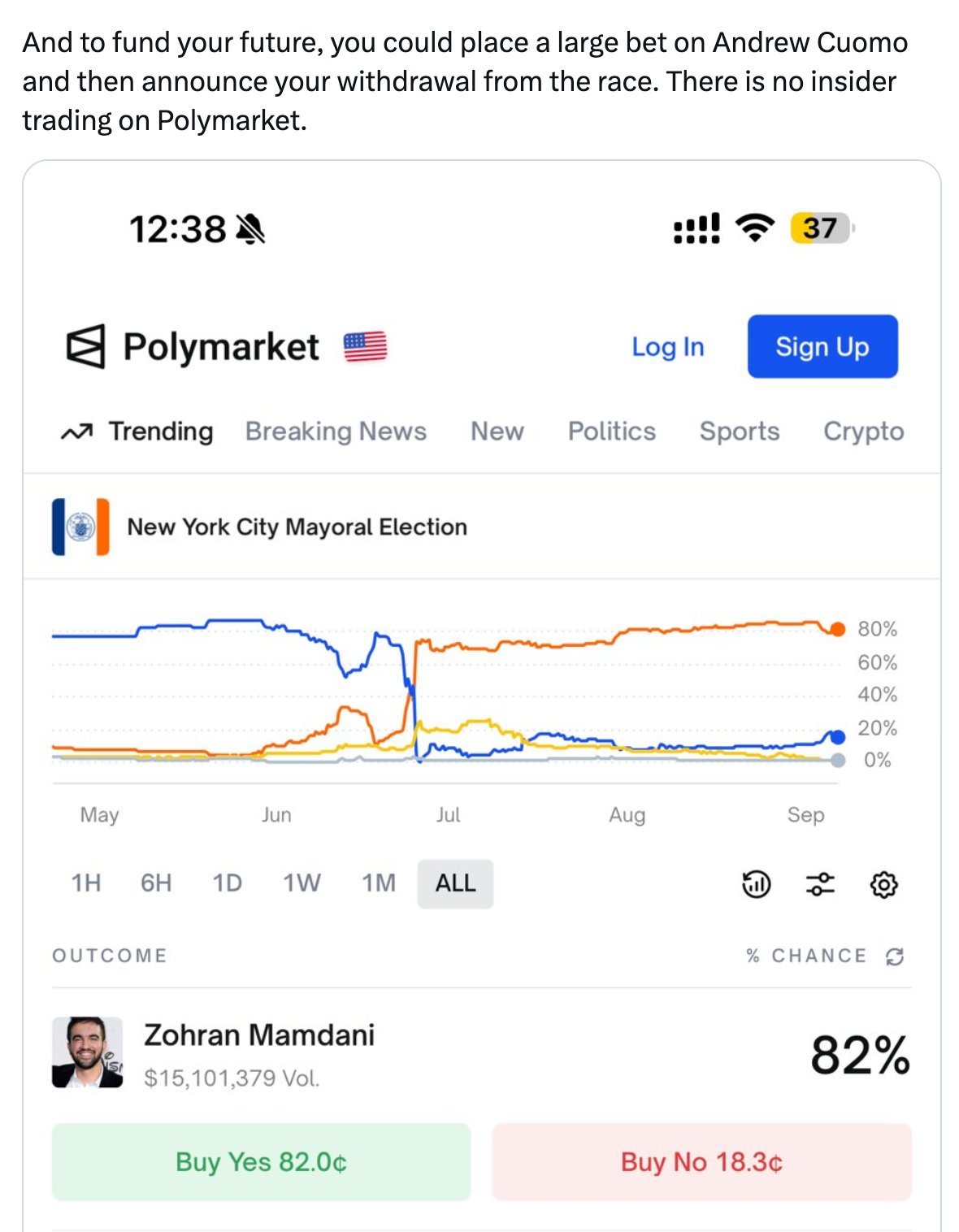

When billionaire investor Bill Ackman suggested on Twitter that NYC Mayor Eric Adams could "place a large [Polymarket] bet on Andrew Cuomo and then announce [his] withdrawal" from the mayoral race, he highlighted prediction markets' dangerous regulatory vacuum. Ackman's chilling addendum—"There is no insider trading on Polymarket"—wasn't a statement of integrity, but an acknowledgment of unenforceability.

Regulatory Whack-a-Mole: CFTC vs. An Evolving Industry

Prediction markets operate under the Commodity Futures Trading Commission (CFTC), not the SEC, placing them in a fundamentally different regulatory universe:

- Jurisdictional Quirks: Unlike securities markets with strict insider trading rules, the CFTC historically allowed commercial hedgers (like farmers or airlines) to use non-public operational data. This framework is ill-suited for anonymous crypto traders betting on Taylor Swift's bridesmaids.

- No-Action Rollercoaster: Academic platforms like PredictIt initially operated under CFTC no-action letters. Kalshi later became the first fully regulated US prediction market in 2021, only to face a 2022 crackdown where the CFTC revoked PredictIt's status and fined Polymarket $1.4 million for unregistered contracts.

- Aggressive Legal Onslaught: After court victories by Kalshi (2024) and PredictIt (2025), and a deregulatory shift under the Trump administration, the CFTC retreated. Polymarket acquired a regulated exchange and re-entered the US market with agency approval.

Gambling vs. Trading: A Legitimacy Crisis

Platforms maintain they offer "legitimate hedging," but their marketing tells a different story. Kalshi ads explicitly invite users to "bet" on NFL games  , while defending their status in court:

, while defending their status in court:

"'Sporting events such as the Super Bowl... were precisely what Congress had in mind as ‘gaming’ contracts,'" Kalshi argued in 2024 filings—before launching those exact markets.

Gaming law expert Andrew Kim notes the hypocrisy: "Retail individuals trading on these platforms are not thinking of it as not gambling... There are exchange wagering outlets generally covered by state gambling law."

The Enforcement Gap: Who Polices the Predictors?

The CFTC's mandate focuses on market integrity, not consumer protection—a critical mismatch:

- No Suitability Checks: Unlike broker-dealers, prediction markets don't assess if trades align with a user's financial situation.

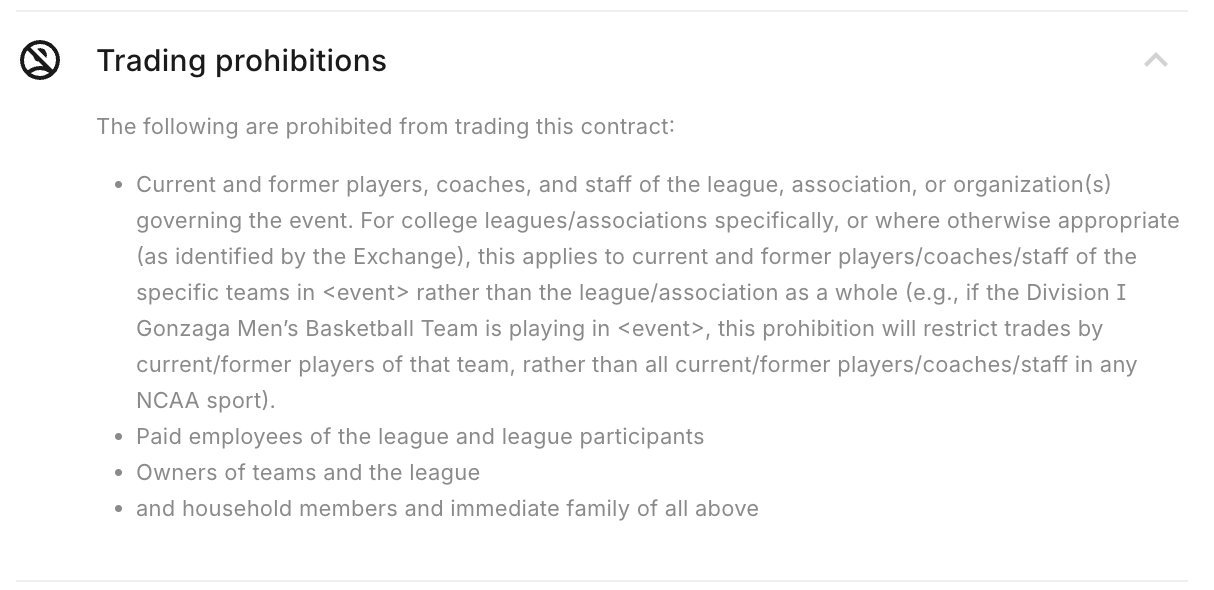

- Inconsistent Insider Bars: While Kalshi blocks athletes from sports bets

and some political figures from election markets, most contracts (including politician self-betting scenarios) lack prohibitions. Polymarket operates with near-total anonymity.

and some political figures from election markets, most contracts (including politician self-betting scenarios) lack prohibitions. Polymarket operates with near-total anonymity. - Addiction Safeguards Missing: State gambling commissions require age verification (often 21+), deposit limits, and compulsive gambling interventions. Kalshi offers only voluntary self-exclusion; Polymarket publicly mocked a user who lost $40,000.

High-Stakes Implications: Elections, Integrity, and Democracy

Election markets pose existential questions:

- Manipulation Risks: The CFTC initially banned Kalshi's congressional control markets, with then-Chair Rostin Behnam warning the agency lacked resources to be an "election cop." Better Markets cited evidence of potential market manipulation favoring specific candidates.

- Perverse Incentives: As Public Citizen's Lisa Gilbert warned, "layering in gambling on our elections will take our democracy in the wrong direction." Yet ethics experts admit Ackman's proposed candidate self-bet scenario likely isn't illegal.

A Regulatory Crossroads

With platforms reporting billion-dollar monthly volumes and giants like Robinhood entering the space, regulators face urgent choices:

- Consumer Protection: Should the CFTC adopt gambling-style safeguards, or cede oversight to state agencies?

- Market Scope: Can contracts like "Will Trump say 'pizza' in September?" satisfy the Commodity Exchange Act's requirement for "legitimate economic purpose"?

- Election Firewalls: Must prediction markets implement sportsbook-level integrity monitoring for political events?

As CFTC-regulated lawyer Laurian Cristea concedes, "Maybe there does need to be some sort of retail protection." But without swift action, prediction markets risk mirroring crypto's trajectory: explosive growth followed by devastating consumer harm—all while eroding trust in financial and democratic systems.

Source: Citation Needed

Comments

Please log in or register to join the discussion