Recent announcements from Google and other quantum computing firms drove significant stock market gains in 2025, but technical analysis reveals these 'breakthroughs' represent incremental progress rather than revolutionary leaps.

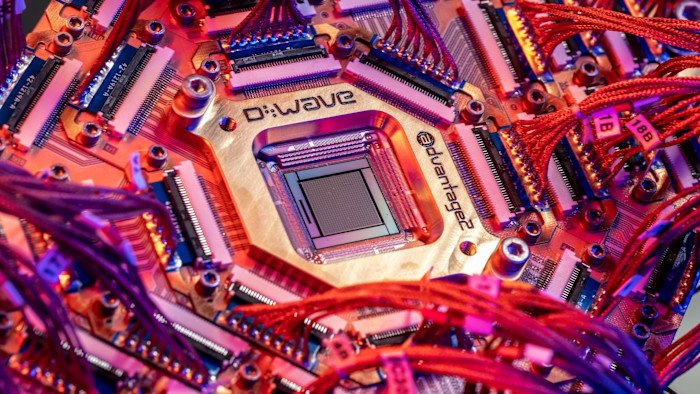

The quantum computing sector experienced a significant stock rally in late 2025 following a series of announcements from Google and competitors claiming hardware and algorithmic breakthroughs. While these claims fueled investor enthusiasm—with stocks like IonQ, Rigetti, and D-Wave seeing 30-50% gains—a closer examination of the technical substance reveals a more nuanced reality.

Google's much-publicized 'quantum supremacy 2.0' demonstration involved a 72-qubit processor reportedly solving a sampling problem 100 trillion times faster than classical supercomputers. Meanwhile, European quantum startup Quantinira announced error-correction thresholds approaching practical utility, and academic researchers from ETH Zurich published results claiming algorithmic improvements reducing qubit requirements for certain optimization problems by 40%.

What these announcements actually represent:

- Hardware scaling: Google's demonstration used improved calibration techniques on existing superconducting architecture rather than novel qubit technology

- Error correction: Quantinira's results applied specifically to their proprietary photonic qubits under laboratory conditions, not general fault tolerance

- Algorithmic gains: The Zurich research optimized specific problem formulations but didn't overcome fundamental complexity barriers

The limitations remain significant:

- Coherence times remain orders of magnitude too short for practical applications

- Error rates still require excessive qubit overhead for meaningful computation

- Algorithm mapping challenges persist when translating real-world problems to quantum architectures

Financial analysts note the stock surge reflects pent-up enthusiasm after years of slow progress rather than fundamental valuation shifts. 'Investors are desperate for validation that quantum computing isn't just theoretical,' notes quantum financial analyst Dr. Mei Chen. 'But we're still in the engineering phase where each 10% error reduction requires years of materials science work.'

The practical implications remain narrow: quantum systems currently outperform classical computers only on carefully constructed benchmark problems with no commercial application. Genuine commercial viability likely remains 5-7 years away for optimization problems in pharmaceuticals and materials science, with broader adoption requiring fundamental physics breakthroughs.

As Richard Waters noted in the Financial Times, the disconnect between marketing claims and technical reality highlights the field's challenge: 'Quantum computing must navigate the valley between physics breakthroughs and investor expectations without succumbing to the hype cycle that doomed earlier emerging technologies.' For now, the recent stock gains appear more a reflection of speculative momentum than substantive technological shift.

Comments

Please log in or register to join the discussion