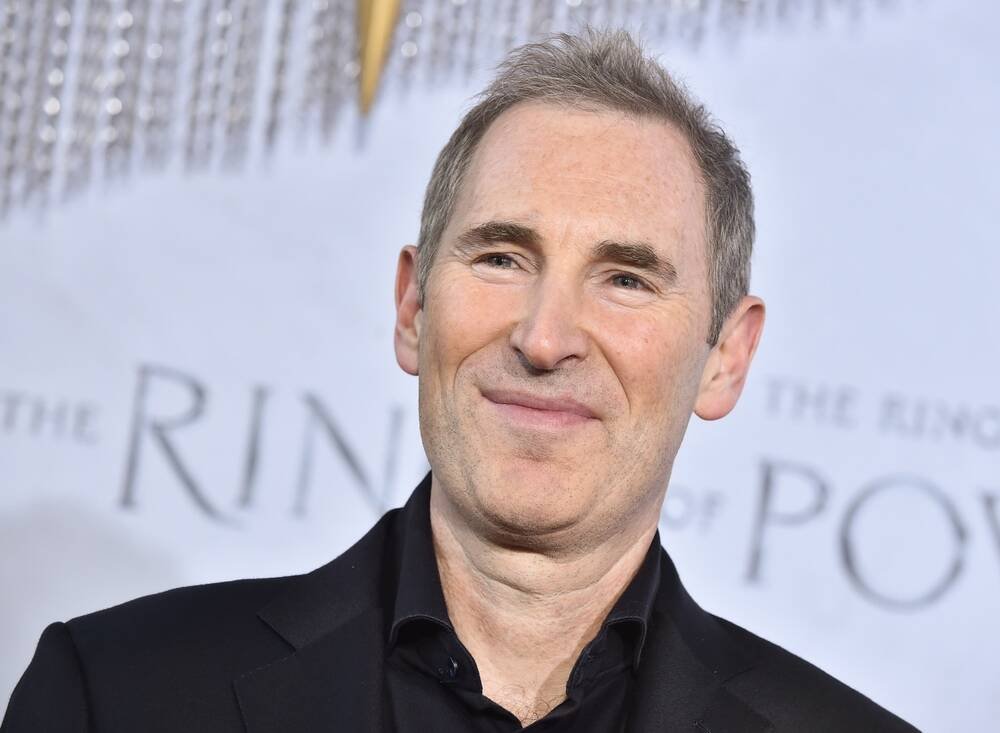

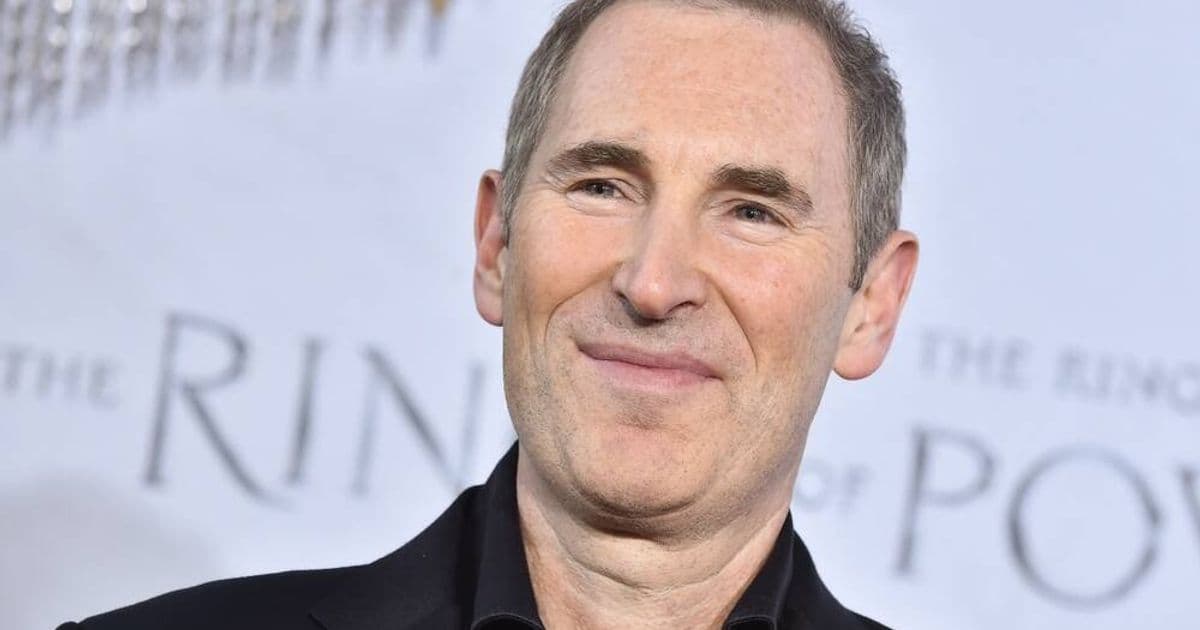

Amazon CEO Andy Jassy's comments on circular AI investments and infrastructure sustainability signal emerging compliance risks requiring proactive governance frameworks.

Recent statements by Amazon CEO Andy Jassy at the World Economic Forum in Davos have underscored critical compliance considerations surrounding artificial intelligence investments. While not explicit regulatory action, Jassy's acknowledgment of circular deal structures and infrastructure constraints illuminates governance gaps that may soon attract formal oversight. Regulators globally are scrutinizing AI's financial ecosystems, making Jassy's insights a timely framework for compliance planning.

Circular Investment Structures Require Transparency

Jassy confirmed that AI model developers and cloud providers engage in reciprocal funding arrangements where "companies have opportunities to invest in companies" to fund compute resources. This creates circular valuation chains lacking independent price discovery. For compliance officers, this demands:

- Disclosure Protocols: Documenting all reciprocal investments in quarterly filings per SEC Regulation S-K Item 303

- Valuation Audits: Third-party validation of AI asset valuations under FASB ASC 820 fair value measurements

- Conflict Policies: Implementing SEC Rule 10b5-1 compliant plans to prevent insider trading in interconnected deals

These measures align with emerging Financial Stability Board guidance on AI market transparency expected in Q3 2026.

Infrastructure Sustainability Demands Risk Assessment

Jassy highlighted a "power shortage" threatening AI's compute growth, noting some infrastructure deals are "hard to make sense of." This triggers environmental compliance obligations:

- Energy Reporting: Disclose power sourcing under EPA GHG Protocol Scope 2 requirements

- Capacity Planning: Model compute demand against regional grid capacity using NERC reliability standards

- Alternative Energy Compliance: Document nuclear investments per NRC Part 50 licensing frameworks

Amazon's nuclear project investments exemplify proactive mitigation, though materialization timelines remain uncertain.

Workforce Transformation Needs Ethical Guardrails

Jassy predicted AI will impact "coding, customer service, research and analytics" roles. Workforce transitions require:

- WARN Act Compliance: 60-day notice for mass layoffs

- Retraining Documentation: Evidence of upskilling programs per Department of Labor guidelines

- Algorithmic Bias Audits: Annual assessments of HR AI systems under EEOC guidance

Implementation Timeline

| Phase | Deadline | Key Actions |

|---|---|---|

| Risk Assessment | Q1 2026 | Map circular investments; audit power contracts |

| Disclosure Enhancement | Q2 2026 | Update 10-Q/K filings; establish valuation committees |

| Operational Alignment | Q4 2026 | Implement energy monitoring; deploy retraining programs |

While Jassy maintains Amazon's commitment to AI through projects like Trainium chips and Anthropic's Project Rainier, his cautionary tone signals that compliance teams must prepare for three converging pressures: financial regulators targeting valuation opacity, environmental agencies scrutinizing energy consumption, and labor departments monitoring workforce displacement. Proactive governance isn't optional—it's the firewall against the bubble's burst.

Compliance officers should monitor SEC AI disclosure proposals, EPA power reporting rules, and DOL retraining mandates through 2026.

Comments

Please log in or register to join the discussion