The FTC reports a record $700 million lost by Americans aged 60+ to online scams in 2024, a sixfold increase from 2020 driven by tech-based impersonation and social engineering. Scammers exploited trust gaps and digital illiteracy, devastating life savings through fake crises and fraudulent calls. This underscores a critical cybersecurity crisis demanding urgent industry and educational reforms.

Senior Scam Epidemic: $700M Lost as Tech Exploitation Surges in 2024

In a stark revelation that highlights the dark intersection of technology and human vulnerability, the Federal Trade Commission (FTC) has reported that Americans aged 60 and older lost a staggering $700 million to online scams in 2024. This represents a sixfold increase from 2020's $121 million and a 30% surge over 2023, signaling an alarming escalation in fraud targeting seniors. The losses, detailed in the FTC's Consumer Protection Data Spotlight, reveal not just financial devastation but a systemic failure in protecting the digitally disenfranchised. As one FTC official starkly noted: "Scammers have weaponized technology to prey on trust, leaving victims stripped of their life savings—and the real FTC would never demand money transfers or Bitcoin deposits."

The Soaring Cost of Deception

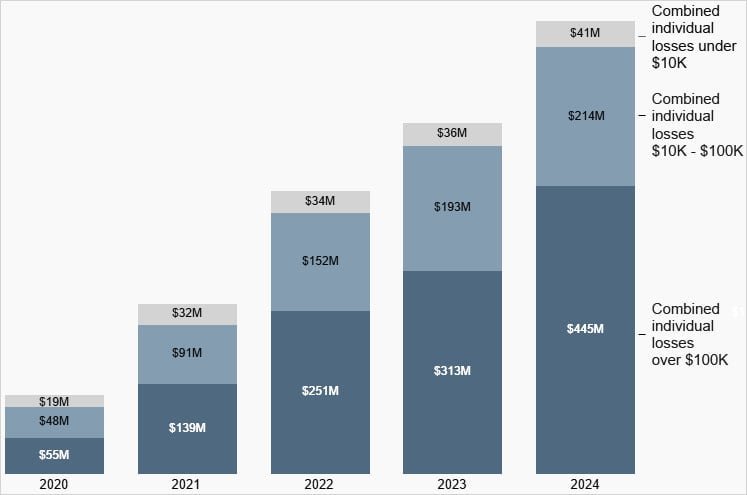

The breakdown of losses paints a grim picture of how scammers escalate their attacks:

- Losses above $100,000: $445 million (an eightfold jump from 2020)

- Losses between $10,000 and $100,000: $214 million

- Losses under $10,000: $41 million

Annual losses to scams from individuals aged 60+, showing a relentless upward trajectory. Source: FTC

Annual losses to scams from individuals aged 60+, showing a relentless upward trajectory. Source: FTC

This data isn't just numbers—it reflects a broader trend where high-value heists are becoming the norm. Scammers increasingly target seniors due to their substantial financial reserves, such as 401(k)s, and a perceived respect for authority that makes them susceptible to manipulation.

Tactics of Tech-Enabled Exploitation

Impersonation and fabricated urgency were the cornerstones of these scams. Attackers posed as trusted entities like the FTC, Microsoft, or Amazon, using phone calls and online messages to spin tales of fabricated crises:

"In another layer of irony, these scammers often pretend to be the FTC, the nation's consumer protection agency, sometimes impersonating real staff," the FTC report states. "They told people to transfer money, deposit cash into Bitcoin ATMs, or hand off cash to couriers—all while isolating victims emotionally."

Key methods included:

- Fake security alerts: Claims of hacked computers, compromised Social Security numbers, or suspicious bank activity to induce panic.

- Hybrid approaches: Starting online (e.g., phishing emails) and escalating to voice calls for real-time pressure, exploiting seniors' limited tech fluency.

- Cryptocurrency demands: Instructions to use Bitcoin ATMs, demonstrating how scammers leverage emerging tech for untraceable theft.

For developers and cybersecurity professionals, this is a red flag: social engineering attacks are evolving to exploit API-driven services and communication platforms, underscoring the need for more robust identity verification in digital systems.

Why Seniors? The Perfect Storm of Trust and Tech Gaps

Older adults are disproportionately targeted not due to naivety, but because of a convergence of factors:

- Substantial savings: Access to retirement funds makes them high-value targets.

- Authority bias: A tendency to trust government or corporate impersonators.

- Digital literacy gaps: Difficulty discerning legitimate tech support from fraud, especially with sophisticated spoofing tools.

The fallout is catastrophic—many victims lose everything, facing not just financial ruin but deep emotional trauma. As the FTC emphasizes, recovery is rare, turning these scams into life-altering events.

Protecting the Vulnerable: A Call to Action

To combat this, the FTC advises never sharing financial details with unsolicited contacts and verifying claims through official channels. But the responsibility extends beyond individuals:

- Tech industry role: Companies like Microsoft and Amazon must enhance fraud detection in customer interactions and educate users on red flags.

- Developer imperatives: Build apps with simpler security UX for seniors, like one-touch verification, and integrate behavioral analytics to flag social engineering.

- Broader context: This $700M loss is part of a $12.5B overall fraud surge in 2024, per the FTC—a 25% annual rise that reflects escalating cyber threats. As highlighted in reports like the

Picus Red Report 2025, which details how malware tactics like password store targeting have tripled, the fight against fraud requires industry-wide collaboration. Only through better tech safeguards and proactive education can we shield society's most vulnerable from these digitally orchestrated heists.

Picus Red Report 2025, which details how malware tactics like password store targeting have tripled, the fight against fraud requires industry-wide collaboration. Only through better tech safeguards and proactive education can we shield society's most vulnerable from these digitally orchestrated heists.

Source: FTC Data Spotlight and original reporting from BleepingComputer

Comments

Please log in or register to join the discussion