SK Hynix’s latest forecast warns that commodity DRAM—DDR5, DDR4, GDDR6/7, and LPDDR5x/6—will remain scarce until 2028, potentially driving up prices for gamers and consumer devices. The company’s focus on expanding HBM and SOCAMM capacity with Low‑NA EUV tools highlights a strategic shift that could widen the gap between high‑performance and mainstream memory markets.

A Long‑Term Bottleneck on the Horizon

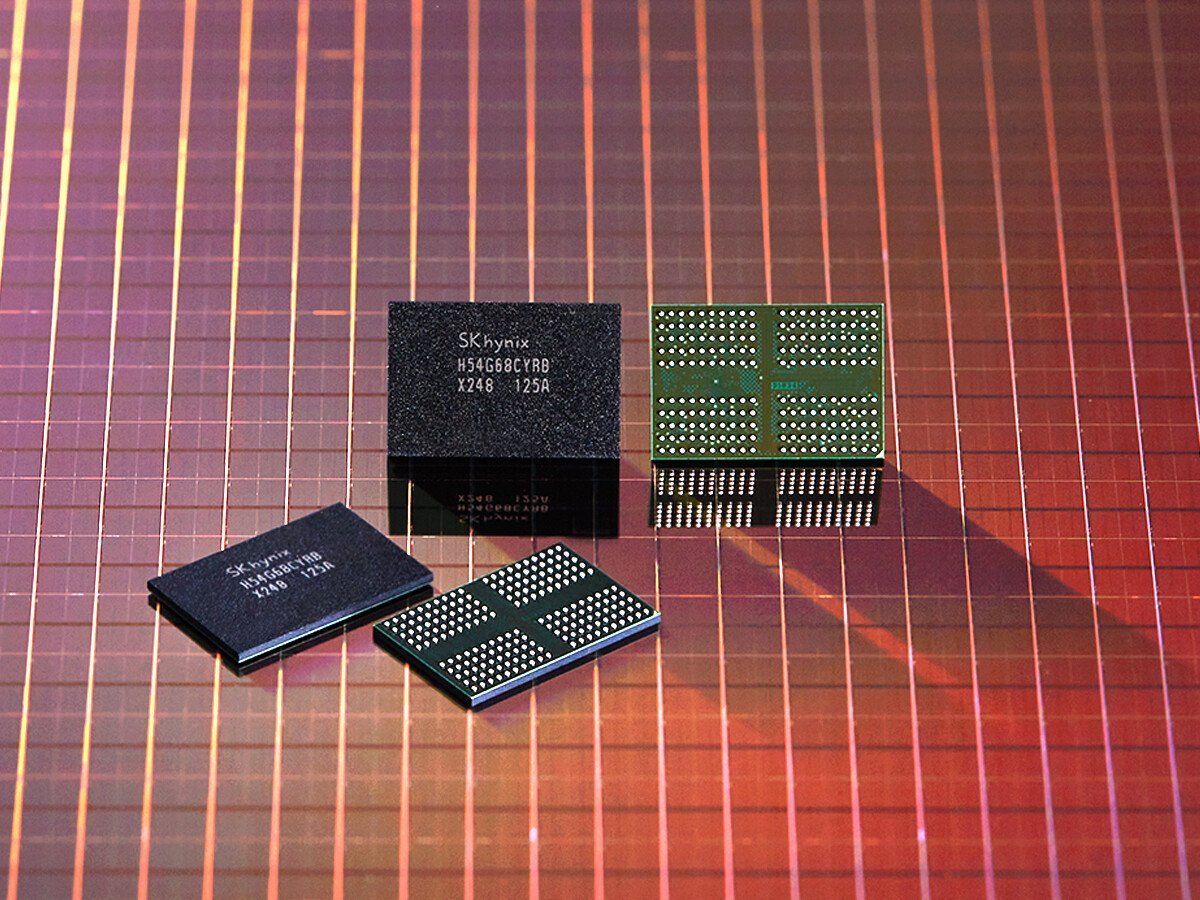

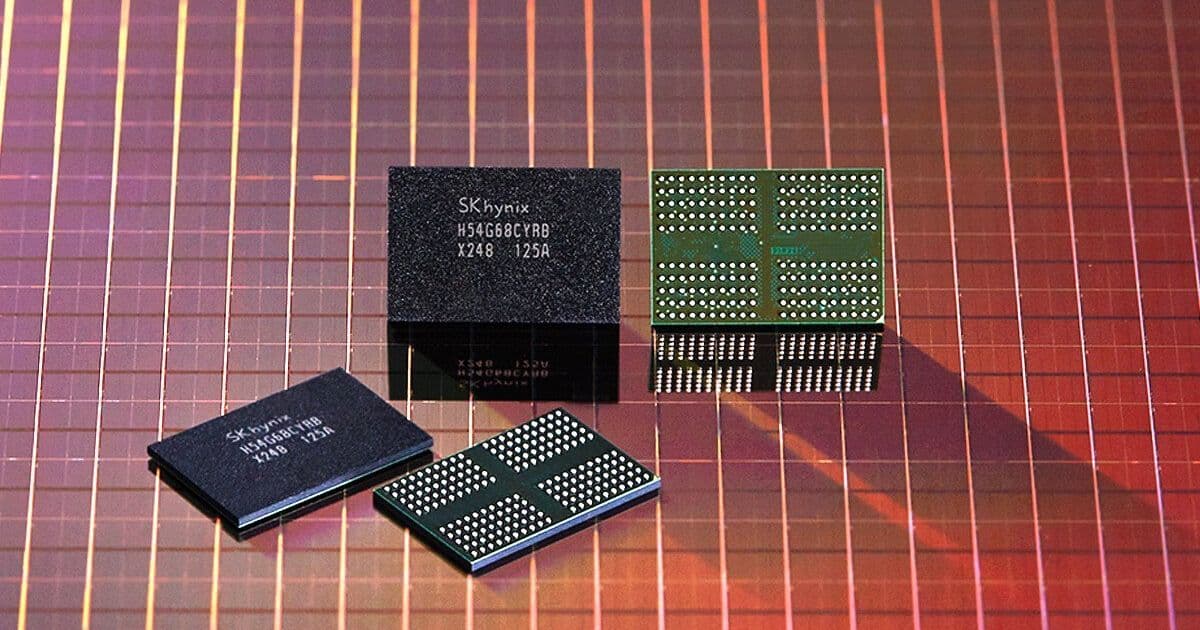

SK Hynix, one of the world’s leading DRAM suppliers, has announced that its internal forecasts predict a tight supply of commodity DRAM lasting until 2028. The forecast covers the full spectrum of memory used in PCs, consoles, and mobile devices:

- DDR5 / DDR4 – the backbone of desktop and laptop RAM

- GDDR6 / GDDR7 – the high‑bandwidth memory powering modern GPUs

- LPDDR5x / LPDDR6 – the low‑power variants found in smartphones and tablets

“All the aforementioned DRAM variants are essential for PC and console components, making millions of gamers at risk of absorbing a massive price increase as a result.” – TechPowerUp

Unlike past cycles where manufacturers ramped up capacity to meet surging demand, SK Hynix has chosen to keep production flat, citing a shift in strategic priorities.

Why the Supply Won’t Expand

The company’s decision stems from a combination of market dynamics and capital allocation:

- AI‑Driven Demand Concentration – HBM and SOCAMM, the high‑bandwidth memory used in AI accelerators and server GPUs, are experiencing a boom. SK Hynix plans to install 20 Low‑NA EUV machines over the next two years, exclusively for HBM and advanced storage solutions. This investment will not benefit commodity DRAM.

- Capacity Reallocation by Competitors – While SK Hynix focuses on HBM, Samsung is reportedly reallocating some of its HBM production capacity to regular DRAM to alleviate shortages, indicating a fragmented industry response.

- Cost of Expansion vs. Market Risk – Expanding commodity DRAM capacity requires multi‑year, multi‑billion‑dollar investments. Executives fear that a sudden drop in AI demand could leave them with excess inventory and erode margins.

"The planned DRAM expansion capacity will not benefit the commodity DRAM group, as all new capacity from SK Hynix will serve its data center customers." – TechPowerUp

Ripple Effects Across the Ecosystem

The projected shortage has a cascading impact:

- Gaming PCs and Consoles – Higher memory prices could push OEMs to raise component costs or reduce feature sets. Valve’s recent claim that its Steam Machine outperforms 70 % of current gaming PCs may become harder to sustain.

- Mobile Devices – Smartphone manufacturers may face higher LPDDR costs, potentially leading to slimmer devices or higher retail prices.

- Enterprise and Cloud – Data centers that rely on commodity DRAM for virtualization and edge computing could see increased capital expenditures.

Industry analysts warn that the effect may be uneven: while high‑performance segments (AI, servers) could thrive, mainstream consumer markets risk stagnation.

What’s Next for SK Hynix and the Market?

The company’s strategy signals a broader industry trend: a bifurcation between high‑bandwidth memory for AI workloads and commodity memory for consumer devices. If the AI bubble does not burst, the demand for HBM will keep driving SK Hynix’s investment in EUV tools, potentially widening the supply gap.

Meanwhile, competitors like Samsung are taking a more balanced approach, expanding 1 cm² DRAM wafer output while maintaining a mix of HBM and commodity production. Micron’s position remains unclear, but the market will likely see a continued push for price‑sensitive consumers to seek alternative solutions, such as hybrid memory architectures or larger RAM capacities per board.

In the coming months, stakeholders should monitor:

- EUV Tool Deployment – How quickly SK Hynix brings its Low‑NA EUV lines online.

- Competitive Capacity Moves – Samsung’s reported 200k‑wafer per month expansion and Micron’s investment plans.

- Price Trajectories – Whether commodity DRAM prices continue to climb or stabilize as the market adjusts.

The next few years will test the resilience of the DRAM supply chain and its ability to balance the divergent demands of AI, gaming, and mobile markets.

Source: TechPowerUp – “SK Hynix Forecasts Tight Memory Supply Lasting Through 2028”

Comments

Please log in or register to join the discussion