While streaming dominates TV viewership, TiVo's latest report reveals a surprising counter-trend: nearly a third of cord-cutters are returning to traditional cable, driven by frustration with rising streaming costs, fragmented content, and a yearning for simplicity. This 'cord reviving' phenomenon underscores the growing dissatisfaction with the very services that disrupted the legacy TV model.

Streaming's reign as the primary TV viewing platform is undeniable, having decisively surpassed broadcast and cable combined. Yet, amid the relentless narrative of cord-cutting, a smaller, counterintuitive movement is emerging: cord reviving. This trend sees individuals who previously abandoned traditional pay-TV services (cable, satellite, managed IPTV) for streaming actually returning to those legacy platforms.

According to TiVo's Q2 2025 Video Trends Report: North America, based on a survey of 4,510 adults in the US and Canada, 31.9% of respondents who had cut the cord later resubscribed to a traditional TV service – a figure representing an increase of about 10%. This finding echoes earlier data from CouponCabin, which found 22% of cord-cutters had already returned to cable, with another 6% considering it.

"A mixture of reasons, with internet bundle costs, familiarity of use, and local content (sports, news, etc.) being the primary drivers," a TiVo spokesperson explained via email, noting that these returning subscribers are likely maintaining a hybrid approach, using traditional TV alongside some streaming subscriptions.

TiVo, whose parent company Xperi has ties to the pay-TV industry, isn't a disinterested observer. However, the reported drivers align with widespread consumer complaints about the streaming landscape. The convenience of streaming is increasingly overshadowed by:

- Skyrocketing Costs: The cumulative cost of multiple SVOD subscriptions rivals or exceeds traditional cable bills.

- Content Fragmentation: Finding desired content requires navigating an ever-growing number of walled-garden services.

- Ad Intrusion: Once-promised ad-free experiences are vanishing, replaced by tiers laden with commercials.

- Discovery Fatigue & Churn: Users often subscribe for a single show and cancel when it ends, leading to high volatility. TiVo's own report found 25.4% canceled an SVOD service in the last six months, driven primarily by content ending or cost concerns.

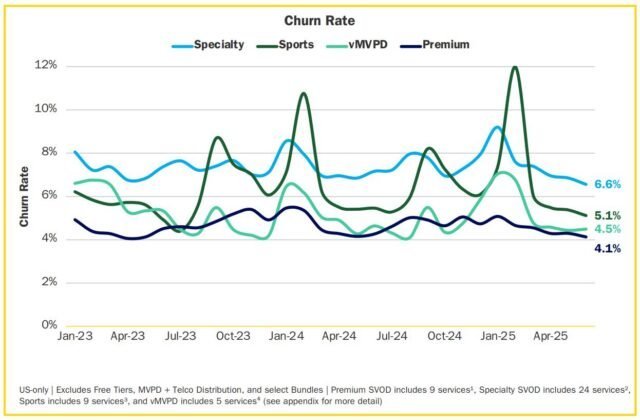

Antenna's Q3 2025 State of the Subscriptions report visually reinforces this instability, showing consistently high SVOD churn rates since early 2023.

Events like the wave of Disney+ cancellations following the temporary preemption of Jimmy Kimmel Live! further illustrate the fragility of streaming subscriber loyalty. While some express a form of 'cable nostalgia' – reminiscing about the simplicity of channel surfing and bundled live content – frustrated streamers are more likely seeking alternatives within the streaming realm rather than a full cable comeback.

This includes a significant shift towards:

- Free Ad-Supported Streaming TV (FAST) services like Pluto TV, offering linear channel experiences.

- Specialty & Niche Streaming Services catering to specific interests.

- Virtual Multichannel Video Programming Distributors (vMVPDs) like YouTube TV or Hulu Live, which mimic traditional cable bundles over the internet.

Antenna reports usage of these alternative services (specialty, sports, vMVPDs) grew 20% to 177 million users between Q2 2023 and Q2 2025.

The rise of cord reviving, however small, is less a prediction of cable's resurgence and more a stark indicator of the growing pains within the streaming ecosystem. It signals that the initial promise of streaming – lower cost, less friction, more control – is eroding for a segment of users. As fragmentation intensifies and prices climb, the industry faces pressure to innovate beyond simply replicating the cable bundle's flaws in a digital wrapper. The true legacy of cord reviving may be its role as a canary in the coal mine, highlighting the urgent need for streaming services to address user frustration before seeking further growth.

Comments

Please log in or register to join the discussion