Speaker Mike Johnson's ability to pass legislation is deteriorating as the 2024 midterm elections approach, with Republican defections and narrow majorities creating a governance crisis that could impact tech policy and regulatory agendas.

The 2024 midterm elections are already reshaping the political calculus in the House of Representatives, creating a governance crisis for Speaker Mike Johnson that threatens to stall key tech and regulatory legislation. Johnson's grip on House votes has weakened significantly in recent weeks, with Republican defections becoming more frequent and his majority shrinking to its narrowest point since taking the gavel.

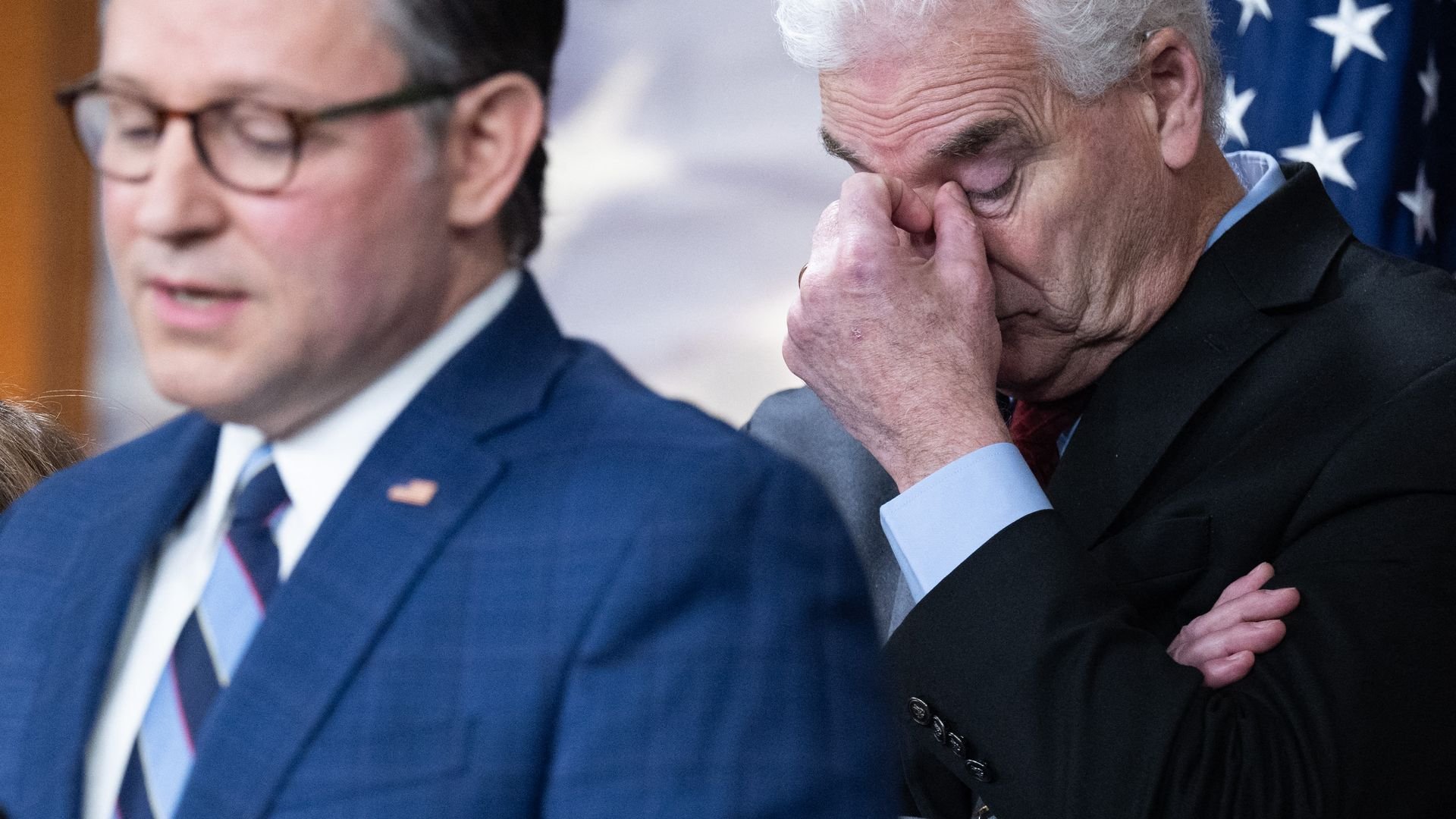

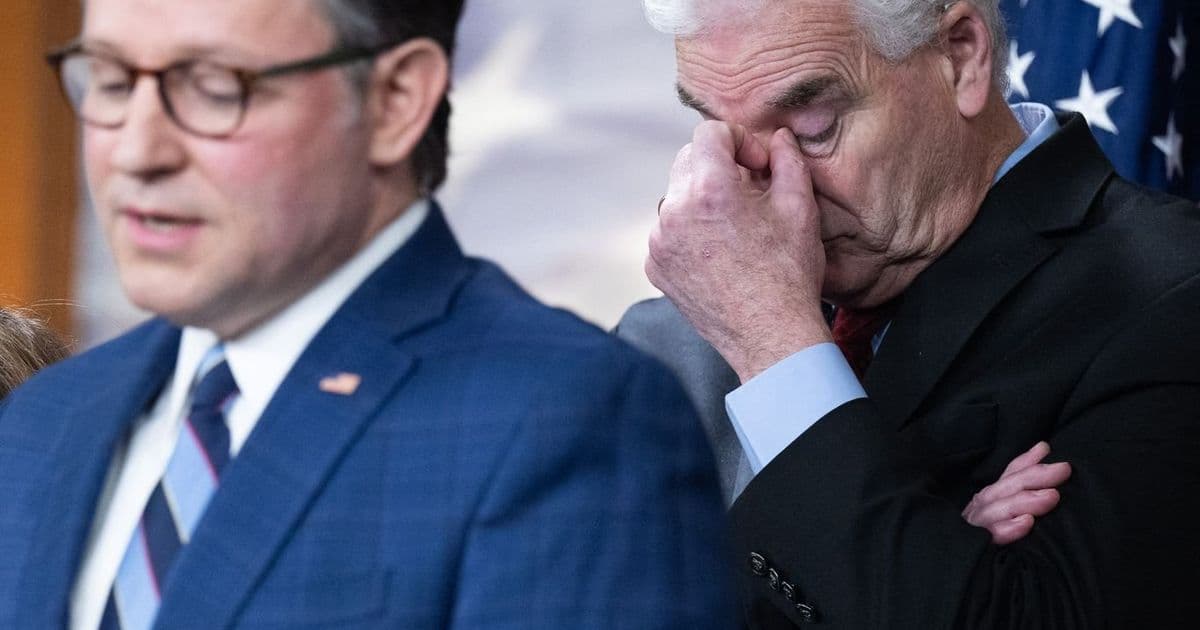

Whip Tom Emmer, stands alongside Speaker Mike Johnson as he speaks during a press conference on Jan. 21. Photo: SAUL LOEB / AFP via Getty Images

The Numbers Tell the Story

Johnson's effective majority has shrunk to just three votes after recent Republican resignations and absences. This means he can afford only two defections on party-line votes—a margin that evaporates when considering the growing faction of conservative hardliners who regularly break ranks on procedural votes and spending bills. The situation has forced Johnson to rely on Democratic votes for routine legislation, a strategy that alienates his right flank and creates unpredictable outcomes for tech-related bills.

The fiscal year 2025 budget process has already exposed these vulnerabilities. Johnson needed Democratic support to pass a continuing resolution in September, a move that prompted three Republican members to vote against the measure. This pattern—Johnson securing Democratic votes while losing Republicans—has become his new normal, fundamentally altering how legislation moves through the House.

Why This Matters for Tech Policy

The legislative paralysis has direct implications for the technology sector. Several high-profile tech bills have stalled in committee or failed to advance due to Johnson's inability to maintain party discipline:

- The Kids Online Safety Act (KOSA), which had bipartisan momentum, now faces an uncertain path as Johnson balances conservative demands for stronger parental control provisions against Democratic concerns about privacy and free speech.

- AI regulation legislation remains fragmented, with competing bills from different committees struggling to find a unified approach that can survive the narrow vote margins.

- Antitrust measures targeting Big Tech have lost priority as Johnson focuses on must-pass spending bills and avoiding government shutdowns.

The uncertainty extends to regulatory appointments. Key positions at the Federal Communications Commission (FCC) and the Department of Commerce remain vacant or filled with acting officials, limiting the administration's ability to implement tech policy. Johnson's weakened position makes it harder to schedule confirmation votes without risking embarrassing defeats.

The Midterm Pressure Cooker

With the 2024 midterms just over a year away, every vote becomes a political calculation. Republican members in competitive districts are increasingly voting against party leadership to demonstrate independence from Washington. This dynamic is particularly pronounced on tech issues, where members face pressure from both constituents and donors.

The fundraising numbers reflect this shift. Republican members in swing districts are raising money at a faster pace than their safe-seat colleagues, suggesting they're preparing for competitive races where tech policy positions could become campaign issues. Johnson's inability to deliver on tech priorities weakens his value to these vulnerable members, reducing his leverage in whip counts.

What Comes Next

The House schedule for the remainder of 2024 will be dominated by spending battles and must-pass legislation, leaving little room for the comprehensive tech bills that industry advocates have been pushing. Johnson's team is reportedly considering a strategy of "minimum viable legislation"—small, targeted bills that can pass with narrow majorities rather than sweeping reforms.

This approach could mean progress on specific issues like semiconductor subsidies or cybersecurity standards, but it abandons broader regulatory frameworks that tech companies have been lobbying for. The alternative—relying on Democratic votes—creates its own problems, as it requires concessions that alienate the conservative base.

The Speaker's office has not commented publicly on these challenges, but internal discussions suggest a recognition that the current trajectory is unsustainable. Some members are already floating the idea of a leadership change if Johnson cannot regain control of the floor, though such a move would require a formal challenge that has not yet materialized.

For the technology sector, the message is clear: Washington's ability to address tech policy through legislation is diminishing as the election cycle intensifies. Companies will need to adjust their strategies, focusing more on regulatory agencies and state-level initiatives where action remains possible. The window for comprehensive federal tech legislation appears to be closing, at least until the new Congress convenes in 2025.

Comments

Please log in or register to join the discussion