Former President Donald Trump stated that Apple and Nvidia invested in Intel after the US government took a 10% stake, though no official confirmation exists and experts question whether he meant equity investment or chip manufacturing contracts.

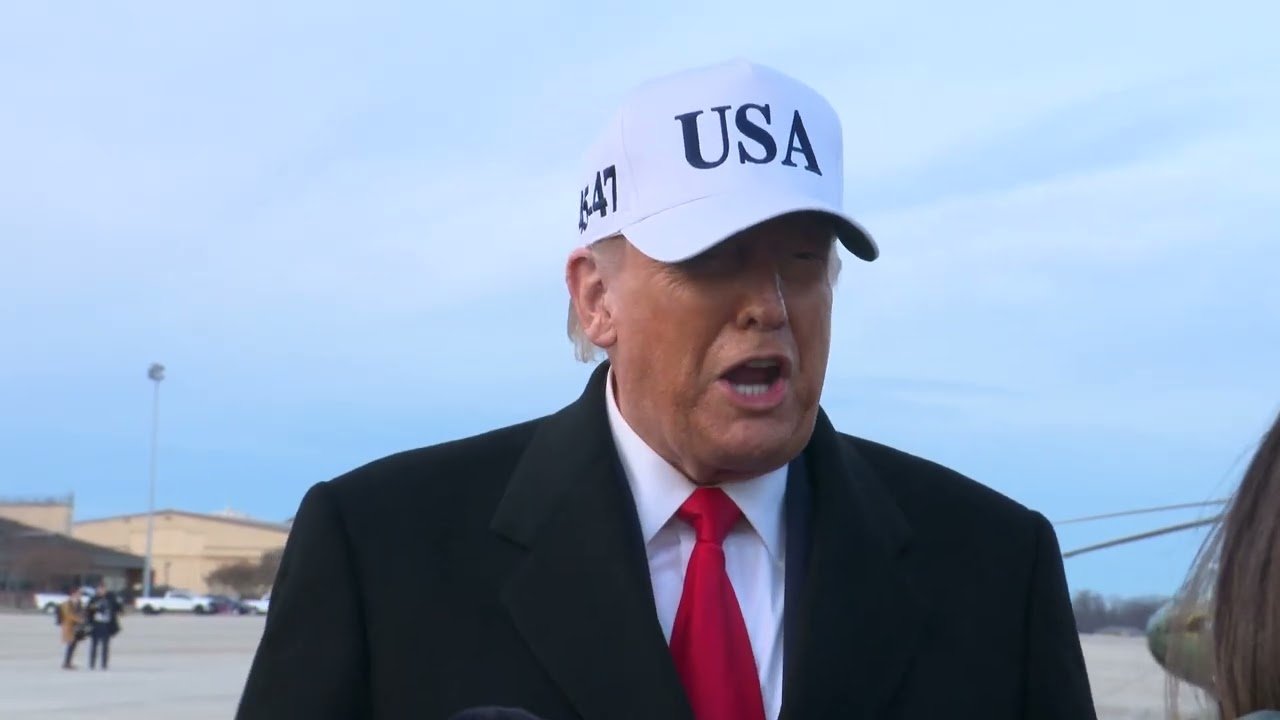

Former President Donald Trump claimed that Apple and Nvidia have invested in Intel, suggesting the companies followed the US government's lead after it acquired a 10% stake in the struggling chipmaker. The remarks, made during a press gaggle at Joint Base Andrews on January 13, 2026, have sparked confusion among industry analysts since neither Apple nor Intel has announced such an investment.

"As soon as we went in, Apple went in, Nvidia went in, a lot of smart people went in — they followed us," Trump told reporters when asked about Intel's stock performance following the government investment. The statement came in response to a question about whether he would invest more in Intel, to which he replied, "I like it, you know? Well, I don’t know about Intel, but I’ll invest more in other things."

What Trump Actually Meant

The ambiguity in Trump's comments leaves several possibilities open. The most straightforward interpretation—that Apple and Nvidia purchased Intel stock—faces immediate scrutiny because publicly traded companies must disclose major equity purchases in SEC filings. Intel would be required to notify shareholders if it sold a significant portion of its stock to Apple or Nvidia, and no such disclosure has emerged.

A more plausible explanation is that Trump was referring to manufacturing agreements rather than equity investments. Apple has been exploring Intel's advanced packaging technologies, specifically EMIB (Embedded Multi-die Interconnect Bridge), according to job listings from both Apple and Broadcom seeking experts in Intel's packaging tech. Additionally, reports indicate Apple acquired Intel's 18A process design kit for potential use in entry-level M-series chips.

If Apple were to sign a major manufacturing contract with Intel for 15-20 million chip units, this would represent a significant shift in Apple's supply chain strategy. The company currently relies exclusively on TSMC for its custom silicon, but diversifying to Intel 18A or the upcoming 14A process could provide supply chain resilience and better cost control.

Recent Intel Investment Context

The US government's 10% stake in Intel came after the company struggled to compete with TSMC in advanced manufacturing. Intel has been seeking strategic partners and investors to fund its ambitious foundry expansion plans. In August 2025, SoftBank Group announced it would purchase $2 billion of Intel shares, providing another major vote of confidence.

Intel's 18A process, which Apple is reportedly evaluating, represents the company's most advanced manufacturing node. The process features RibbonFET transistors and PowerVia backside power delivery, technologies that Intel hopes will help it regain process leadership by 2025. The company is currently sampling 18A test chips to potential customers, with production slated for 2025.

Supply Chain Implications

If Apple has indeed committed to using Intel's foundry services, this would mark a major realignment in the semiconductor supply chain. Apple currently accounts for approximately 25% of TSMC's revenue, making any diversification away from the Taiwanese foundry significant for both companies.

For Intel, landing Apple as a customer would validate its foundry business model and provide the high-volume production needed to achieve economies of scale. The company has invested over $100 billion in its foundry operations, but has struggled to attract leading-edge customers willing to commit to its manufacturing processes.

Analyst Skepticism

Industry experts remain cautious about interpreting Trump's comments as confirmation of an actual deal. The lack of official statements from either Apple or Intel, combined with the requirement for public disclosure of material agreements, suggests the remarks may have been imprecise or referred to preliminary discussions rather than finalized contracts.

The possibility that Trump confused Apple with SoftBank also exists, given that the Japanese conglomerate's $2 billion investment was announced around the same time as the government's stake. However, the specificity of naming both Apple and Nvidia makes simple confusion less likely.

What to Watch For

Intel's upcoming quarterly filings, due within weeks, may provide clarity. Any major manufacturing agreement or equity investment would need to be disclosed. Additionally, job postings from Apple seeking Intel packaging expertise suggest at least some level of technical evaluation is underway, even if no final agreement exists.

The semiconductor industry will be watching closely for official announcements from either company. If Apple has indeed committed to Intel's foundry, it would represent one of the most significant supply chain shifts in recent years and could reshape competitive dynamics across the industry.

For now, Trump's comments remain unverified speculation. Neither Apple nor Intel has responded to requests for comment, and the lack of corroborating evidence means investors and analysts must wait for official disclosures to determine whether this represents a genuine strategic shift or simply ambiguous remarks from a former president.

The situation highlights the intersection of politics and semiconductor manufacturing, where government involvement can influence private sector decisions. Whether Apple and Nvidia truly "went in" to Intel remains to be seen, but the comments have certainly drawn attention to Intel's ongoing efforts to rebuild its manufacturing leadership and attract marquee customers to its foundry business.

Comments

Please log in or register to join the discussion