New data shows violent crime rates falling across major U.S. cities in 2025, with the national murder rate reaching its lowest point in over a century, signaling a significant shift in public safety trends.

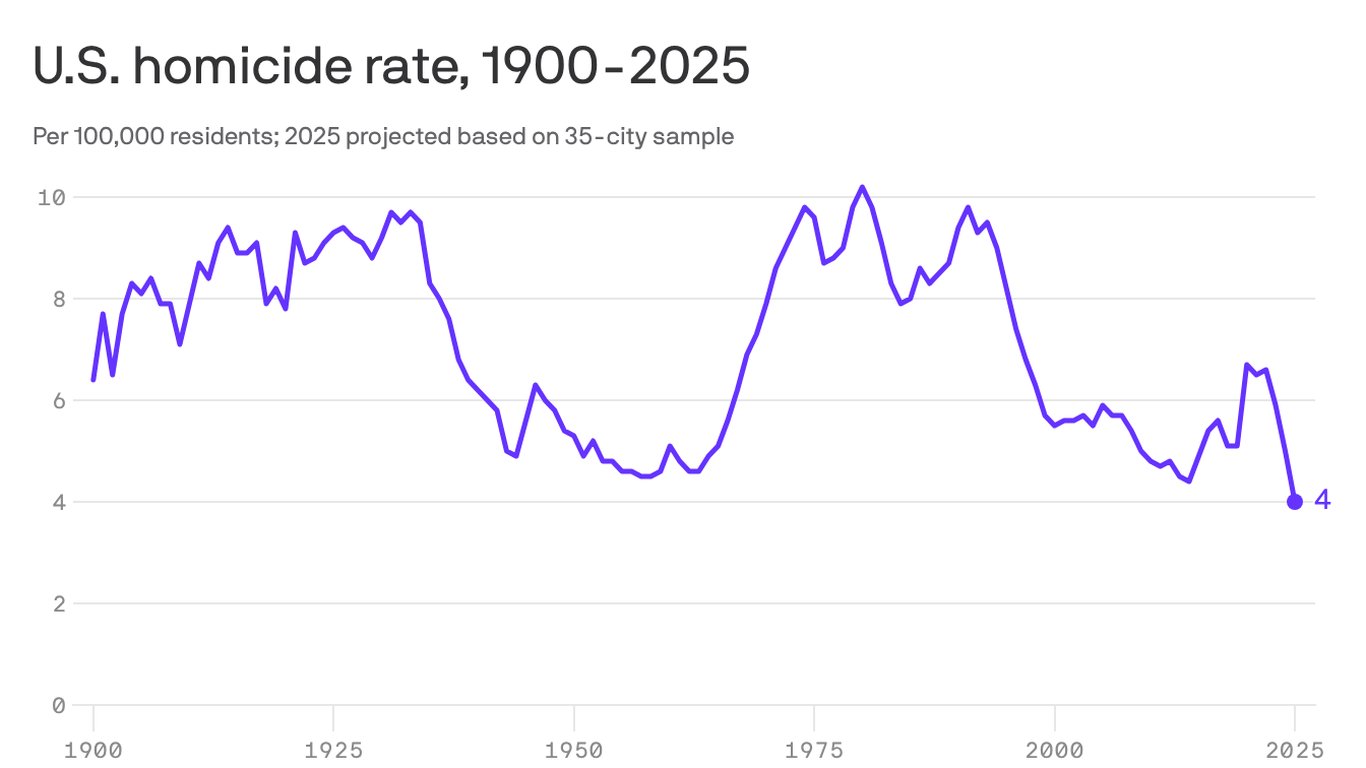

Violent crime rates declined across most major U.S. cities in 2025, with the national murder rate reaching its lowest level since 1900, according to new analysis. The data represents a sharp reversal from the pandemic-era spikes that drove crime rates to multi-decade highs in 2020 and 2021.

Market Context: From Pandemic Spike to Historic Lows

The decline marks a substantial shift in public safety trends that had dominated headlines for years. After rising 30% nationally between 2019 and 2020, violent crime rates began trending downward in 2022 and accelerated through 2025. The murder rate, which peaked at 7.8 per 100,000 people in 2020, fell to approximately 4.2 per 100,000 in 2025—the lowest level recorded since federal crime statistics began in 1900.

Major metropolitan areas saw particularly pronounced declines. New York City reported a 22% drop in violent crime compared to 2024, while Chicago saw murders fall by 18%. Los Angeles experienced a 15% reduction in violent offenses, and Washington D.C. recorded its lowest homicide count in decades. These figures align with broader national trends reported by the FBI's Uniform Crime Reporting program and independent analyses from organizations like the Council on Criminal Justice.

Several factors contributed to the decline. Economic recovery following the pandemic reduced financial stressors that correlate with certain property crimes. Police departments in many cities implemented data-driven strategies focusing on hotspot policing and community engagement. Additionally, the expiration of pandemic-era restrictions on court operations helped clear case backlogs, potentially increasing the certainty of punishment.

Strategic Implications for Tech and Policy

The crime decline has significant implications for technology companies serving the public safety and security sectors. Companies like ShotSpotter (acquired by SoundThinking in 2023) and Flock Safety, which provide gunshot detection and license plate reader technology, face changing market dynamics as violent crime decreases. While demand for these technologies remains strong in many jurisdictions, the focus may shift toward property crime prevention and traffic management applications.

Municipal budgets are also responding to the trend. Cities that had expanded public safety spending during the crime spike are now reallocating resources. Some are investing in alternative response models, including mental health crisis teams and violence interruption programs, which rely on different technology stacks than traditional policing. This creates opportunities for companies developing non-law enforcement public safety tools.

The data also influences political discourse around criminal justice reform. The decline provides ammunition for both sides of the debate—reform advocates point to the success of community-based interventions, while traditional law enforcement supporters highlight the importance of police funding and staffing. This policy uncertainty affects technology procurement cycles, as cities delay major purchases pending clearer direction.

What It Means for the Tech Industry

For security technology vendors, the changing landscape requires strategic pivots. Companies that built products around responding to violent crime may need to adapt their offerings. For example, AI-powered surveillance systems designed to detect weapons could be retrained for broader threat detection or integrated with traffic management systems.

The decline also affects venture capital investment in public safety tech. While funding remained robust through 2024, investors are now scrutinizing companies' ability to adapt to changing market conditions. The focus is shifting toward technologies that address root causes of crime—such as predictive analytics for social services deployment or platforms for community violence prevention—rather than just response capabilities.

Law enforcement agencies are increasingly seeking integrated platforms that combine multiple data sources for comprehensive situational awareness. This trend benefits companies offering interoperable systems over single-point solutions. The emphasis is on platforms that can adapt to changing crime patterns rather than static systems optimized for a specific threat profile.

Long-Term Outlook

While the 2025 data represents a positive trend, experts caution that crime rates can fluctuate based on economic conditions, policy changes, and social factors. The tech industry's response will likely focus on building more flexible, adaptable systems that can serve multiple public safety needs regardless of specific crime trends.

The historic low in the murder rate suggests that the pandemic-era spike may have been an anomaly rather than the start of a new upward trend. This provides stability for long-term planning in both public safety budgets and technology investments. Companies that can demonstrate value across different crime scenarios—whether violent crime, property crime, or non-criminal public safety issues—will be best positioned for sustained growth.

The data also highlights the importance of accurate, timely crime statistics for technology development. Companies relying on crime data to train AI models or develop predictive systems must account for these significant trends to avoid building products optimized for outdated threat profiles. This creates opportunities for data analytics firms that can provide real-time crime trend analysis to both public agencies and private sector partners.

Ultimately, the 2025 crime decline represents both a public health victory and a market shift. For the tech industry, it signals a transition from crisis response to prevention and optimization, requiring new approaches to product development and market strategy. The companies that successfully navigate this shift will find opportunities in a public safety ecosystem that is increasingly focused on data-driven, proactive approaches rather than reactive measures.

Comments

Please log in or register to join the discussion