Western Digital's CEO disclosed full utilization of HDD manufacturing capacity due to long-term AI infrastructure agreements, signaling potential price increases across the storage market.

Western Digital has reached maximum hard disk drive production capacity according to CEO David Goeckeler, who cited "massive long-term agreements" (LTAs) with artificial intelligence infrastructure providers as the primary driver. This disclosure signals impending supply constraints across the global storage market, with industry analysts projecting price increases of 15-30% for high-capacity HDDs in the coming quarters.

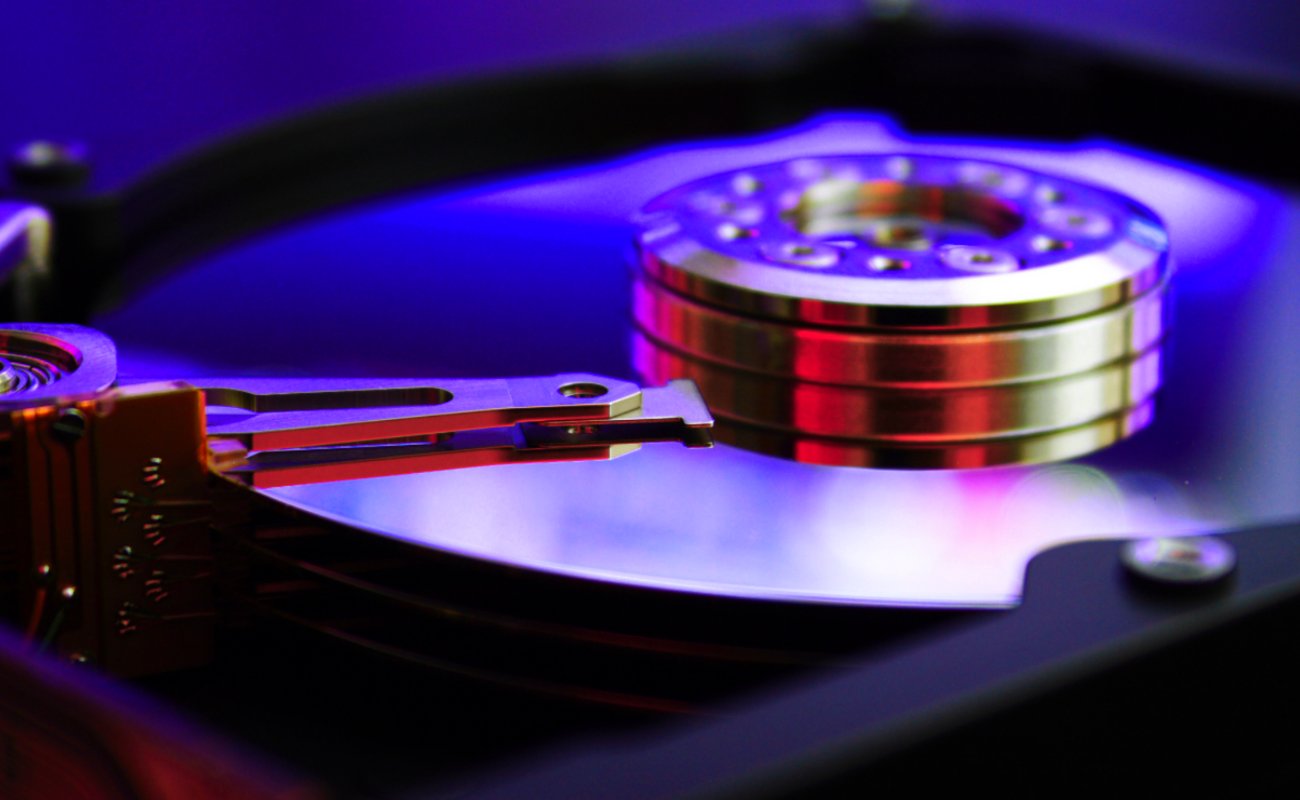

The capacity crunch emerges from unprecedented demand for bulk storage in AI training environments. While NAND flash dominates low-latency applications, hyperscalers continue relying on high-capacity HDDs for cost-effective storage of massive datasets. A single modern AI training cluster can require over 100PB of storage for raw training data alone, with Western Digital's 22TB Ultrastar DC HC570 and upcoming 30TB heat-assisted magnetic recording (HAMR) drives being particularly sought after. Unlike GPUs which face cyclical demand fluctuations, storage requirements scale linearly with model complexity - the Llama 3 400B parameter model reportedly consumed 1.2 exabytes of training data.

What distinguishes this shortage from previous supply chain disruptions is its structural nature. The LTAs referenced by Goeckeler typically span 3-5 years with minimum purchase commitments, locking production capacity for AI infrastructure buildouts. Industry sources indicate similar capacity constraints at Seagate, though with more flexible allocation. This contrasts sharply with pandemic-era shortages driven by component scarcity; current constraints stem from deliberate capacity allocation decisions rather than material shortages.

Market dynamics reveal concerning limitations. HDD manufacturing requires specialized facilities with vibration-dampened clean rooms and substrate treatment systems, creating a 12-18 month lead time for new production lines. While Western Digital's HAMR technology enables higher areal density, yield rates reportedly remain below 70% for 30TB+ drives. The situation exacerbates existing NAND flash shortages, creating a cascading effect throughout the storage hierarchy. Enterprise SSD prices have already increased 18% QoQ according to TrendForce, with HDDs likely following suit.

Practical implications extend beyond pricing. Data center operators face difficult trade-offs between storage tiering strategies, with some considering colder storage tiers using shingled magnetic recording (SMR) technology despite its 30-50% slower write performance. Smaller AI firms may encounter 60+ day lead times for multi-petabyte orders, potentially delaying research timelines. The Open Compute Project has accelerated development of computational storage architectures that reduce data movement as a mitigation strategy.

This capacity exhaustion underscores a broader industry trend: AI's infrastructure demands are testing physical manufacturing limits in unexpected domains. While GPU shortages capture headlines, storage constraints may prove more persistent due to longer lead times for capacity expansion. Market watchers should monitor Q2 earnings from Seagate and Toshiba for confirmation of industry-wide patterns, while enterprises would be prudent to audit storage procurement strategies against projected AI roadmap requirements.

Comments

Please log in or register to join the discussion