AMD captured 29.2% of total x86 CPU shipments and 35.4% of revenue in Q4 2025, setting new records as Intel faces supply constraints and competitive pressure across all segments.

AMD closed 2025 with historic gains across the CPU market, achieving its highest-ever unit and revenue shares in the x86 processor segment according to Mercury Research data. The company secured 29.2% of total x86 CPU shipments by volume during Q4 2025, representing a 3.8% quarter-over-quarter increase and 4.6% year-over-year growth. More significantly, AMD captured 35.4% of total x86 processor revenue, highlighting its success in higher-margin segments.

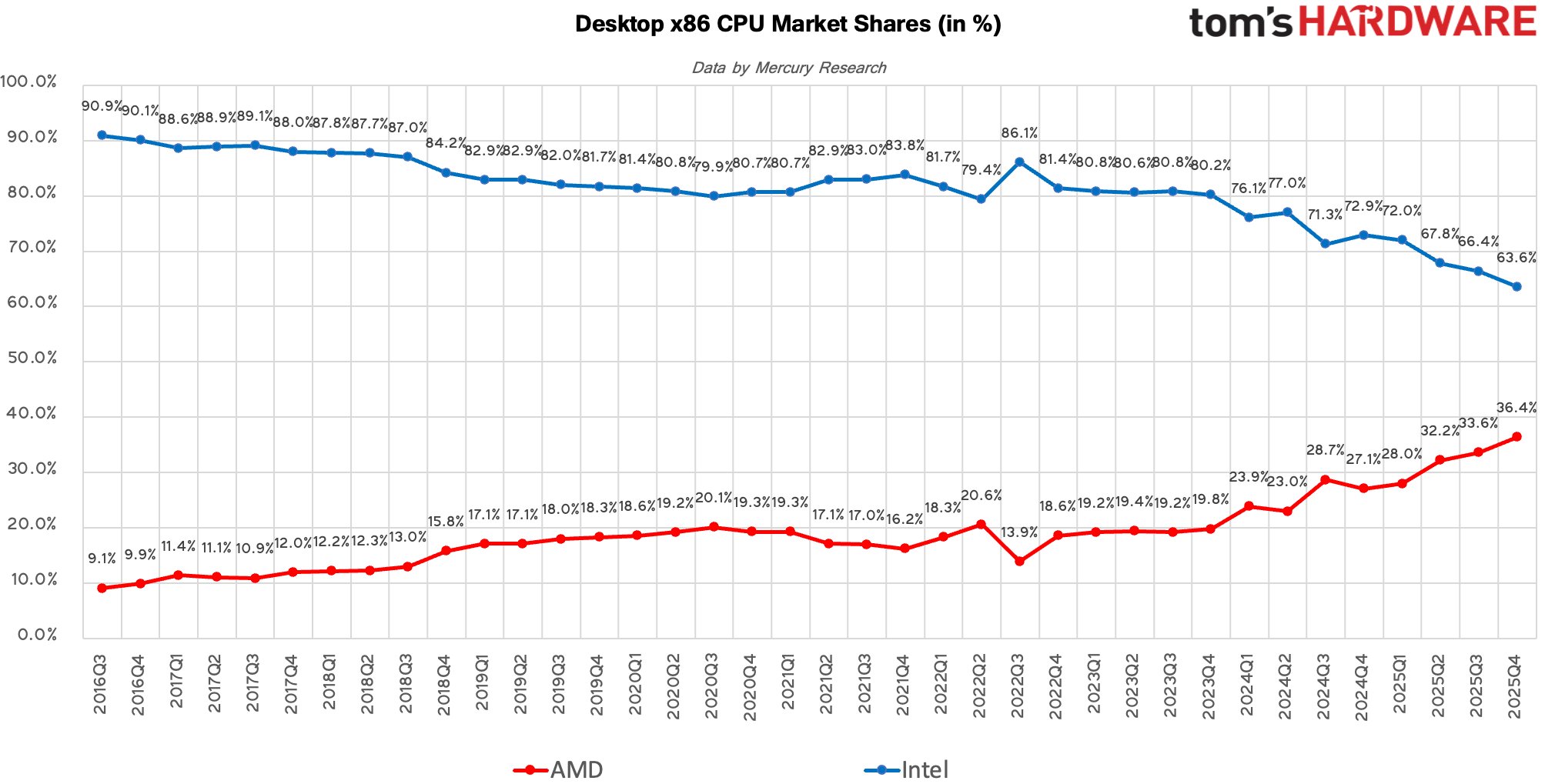

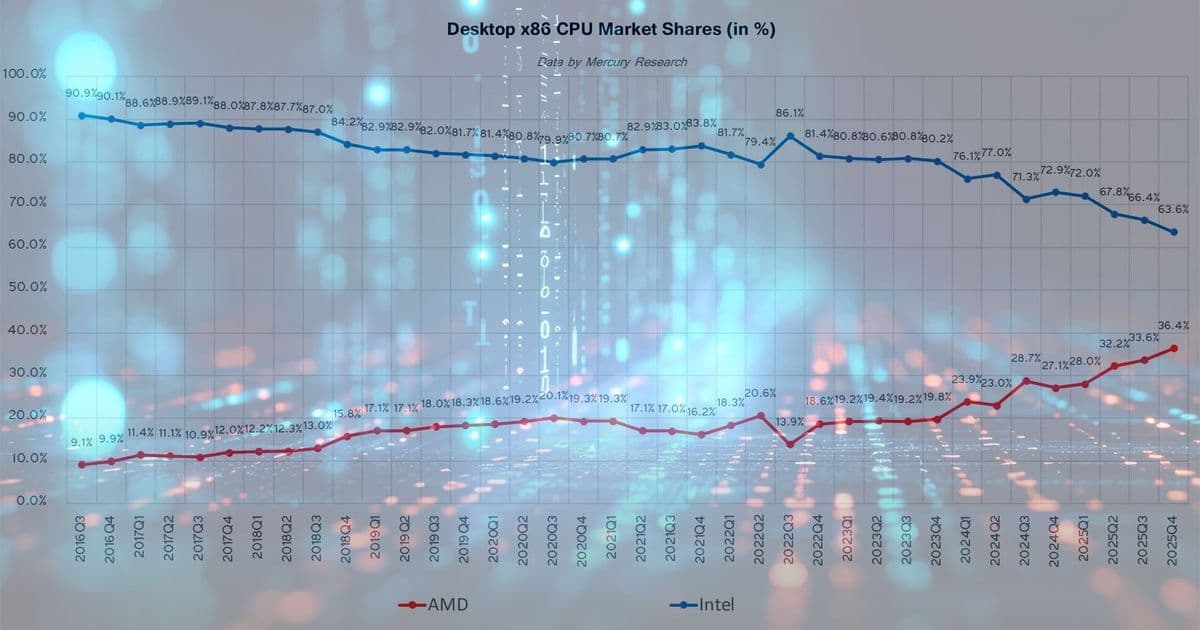

This momentum stems from simultaneous advances in three critical segments. In desktop processors, AMD reached 36.4% unit share driven by strong Ryzen 9000 series adoption among enthusiasts and system builders. The revenue impact was even more substantial at 42.6%, reflecting premium pricing for chips like the Ryzen 7 9850X3D that outperform Intel's 14th Gen Core offerings. Intel maintained a 63.6% desktop unit share but suffered a 9.5% year-over-year decline.

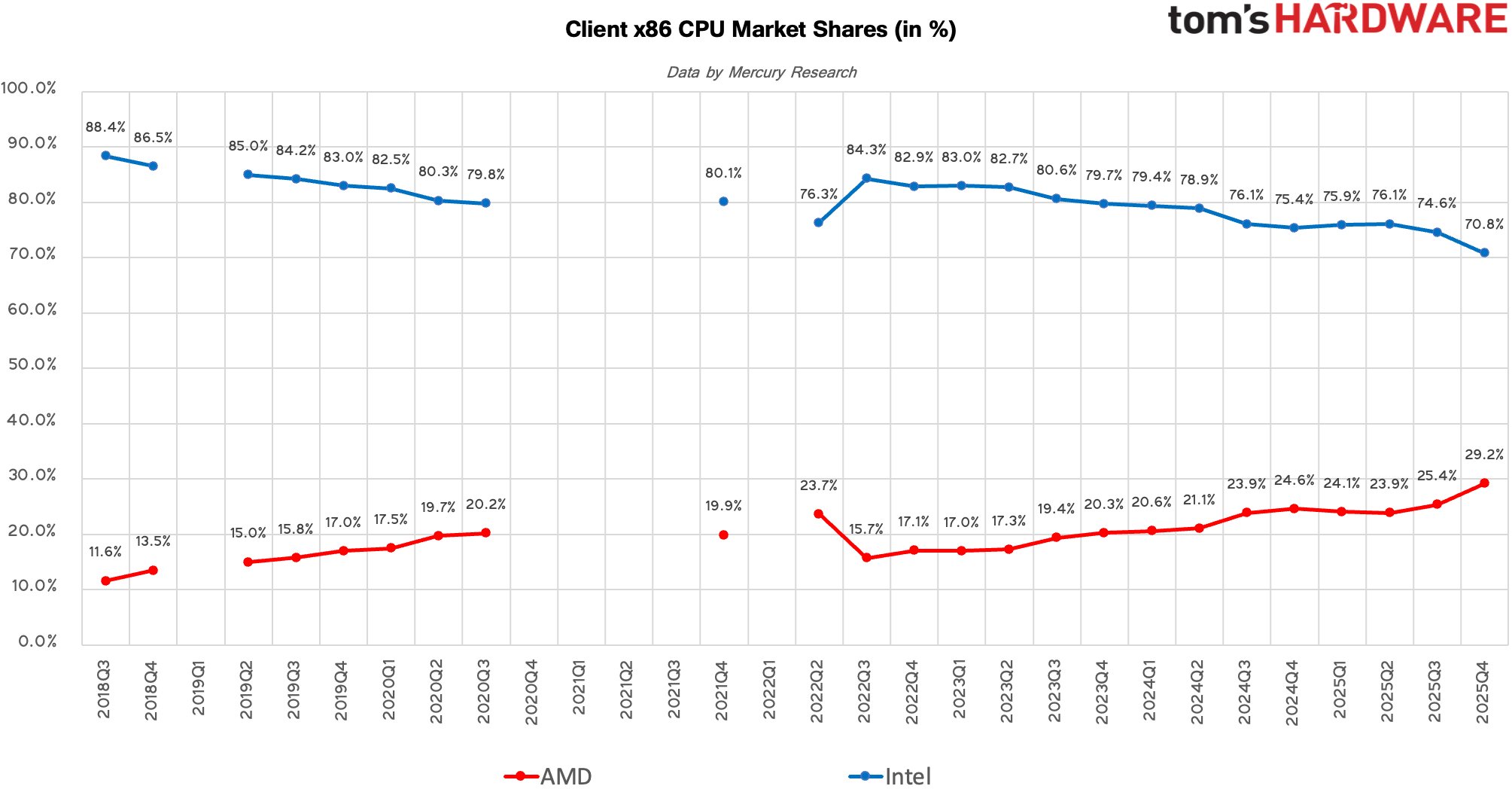

AMD's mobile breakthrough proved equally noteworthy, with unit share jumping to 26% - a 4.1% quarterly increase that sets a new record for the company in notebooks. Revenue share reached 24.9% as AMD's expanded Ryzen mobile portfolio gained traction across premium ultrathin and gaming laptop categories. While Intel retains 74% of mobile unit volume, AMD's 3.3% year-over-year revenue gain indicates erosion in Intel's high-margin mobile segments.

The server market showed AMD's most consistent expansion, with unit share climbing to 28.8% (up 1% quarterly) and revenue share reaching 41.3% as EPYC processors continue gaining adoption in cloud and AI infrastructure. This 3.1% annual unit growth demonstrates steady displacement of Intel Xeon in data centers despite the segment's inherent conservatism. Intel maintains 71.2% server unit share but faces margin compression with only 58.7% of revenue.

Technical execution underpins AMD's gains. The company's chiplet architecture allows cost-effective scaling across segments while TSMC's 5nm and 4nm nodes deliver power/performance advantages. Intel's simultaneous struggles with internal 20A node ramp and external foundry allocation at TSMC created supply gaps, particularly in entry-level client CPUs. AMD's average selling prices rose 11% year-over-year versus Intel's 3% decline, reflecting divergent product competitiveness.

Market implications point to sustained momentum. AMD now holds over 25% share in all major CPU categories simultaneously for the first time, with desktop at 36.4%, mobile at 26%, and servers nearing 30%. Intel acknowledges competitive gaps won't close before late 2026 with Panther Lake CPUs, giving AMD clear runway for continued expansion. The revenue share divergence - AMD gaining 7.4% annually versus Intel's equivalent loss - suggests structural margin advantages that could fund future R&D. With TSMC CoWoS packaging capacity expanding and Zen 5 architecture launching, AMD appears positioned to continue its share trajectory through 2026.

Processor segment performance:

- Desktop: AMD 36.4% units / 42.6% revenue

- Mobile: AMD 26% units / 24.9% revenue

- Server: AMD 28.8% units / 41.3% revenue

- Total x86: AMD 29.2% units / 35.4% revenue

Comments

Please log in or register to join the discussion