Apple is struggling to secure advanced chip production capacity at TSMC as Nvidia's AI-driven demand surges, potentially displacing Apple as TSMC's top client. TSMC reports record 62.3% gross margins while planning a 32% capex increase to $56B, highlighting the massive resource shift toward AI processors.

For over a decade, Apple's partnership with TSMC propelled both companies to dominance in consumer electronics. That era is ending abruptly as Nvidia's explosive demand for AI chips forces Apple into an unfamiliar position: fighting for factory space at the world's most advanced foundry.

When TSMC CEO C.C. Wei visited Cupertino last August, he delivered two harsh realities: Apple would face its largest price hike in years, and more critically, its chip orders no longer guaranteed priority placement in TSMC's production schedule. This shift stems from simple arithmetic. Each Nvidia H100 GPU occupies nearly three times the wafer area of an Apple A-series processor, while Nvidia's projected 62% revenue growth for FY2026 dwarfs Apple's estimated 3.6% hardware expansion.

TSMC quarterly revenue growth by segment (Source: Company Reports)

TSMC quarterly revenue growth by segment (Source: Company Reports)

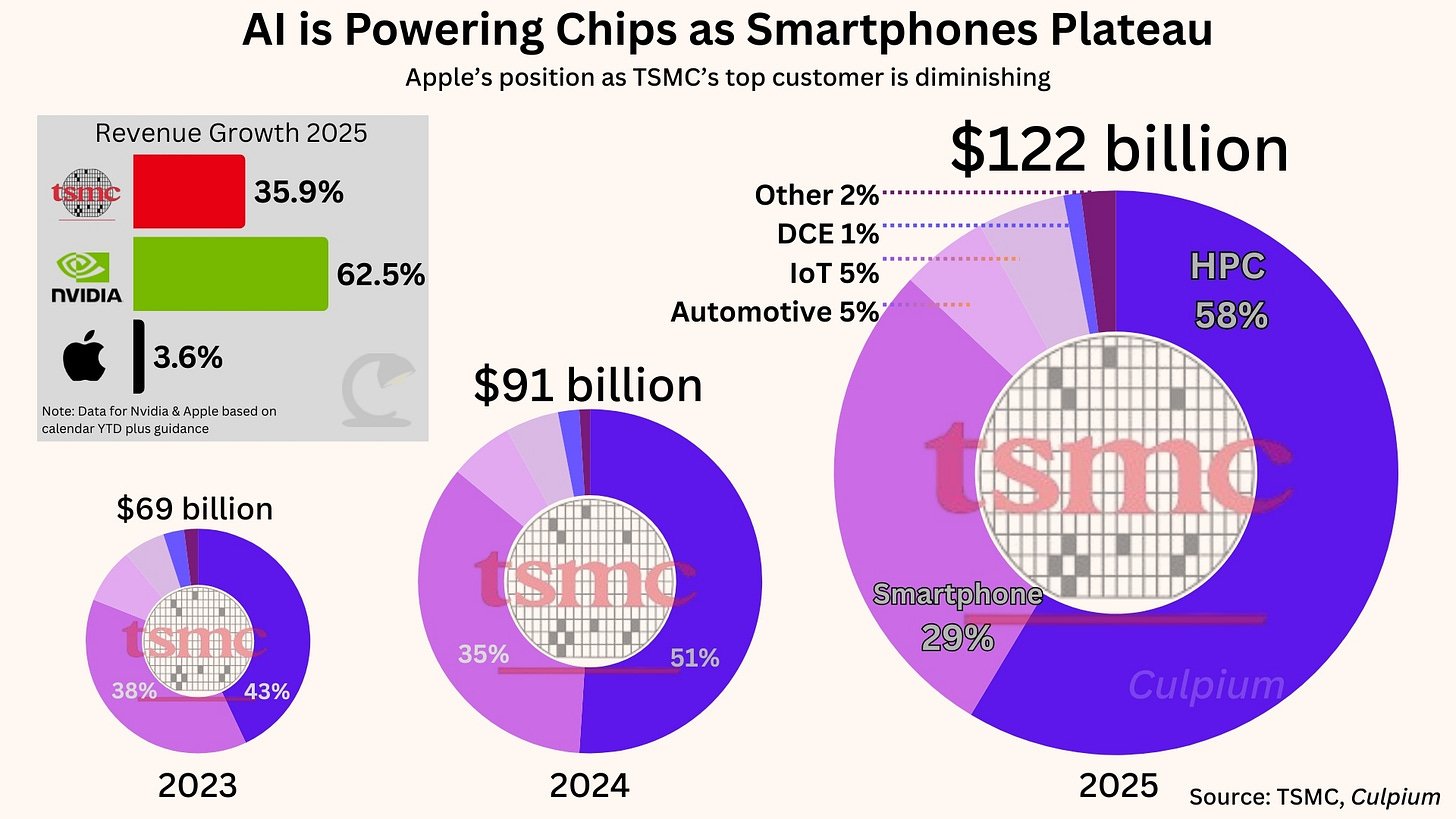

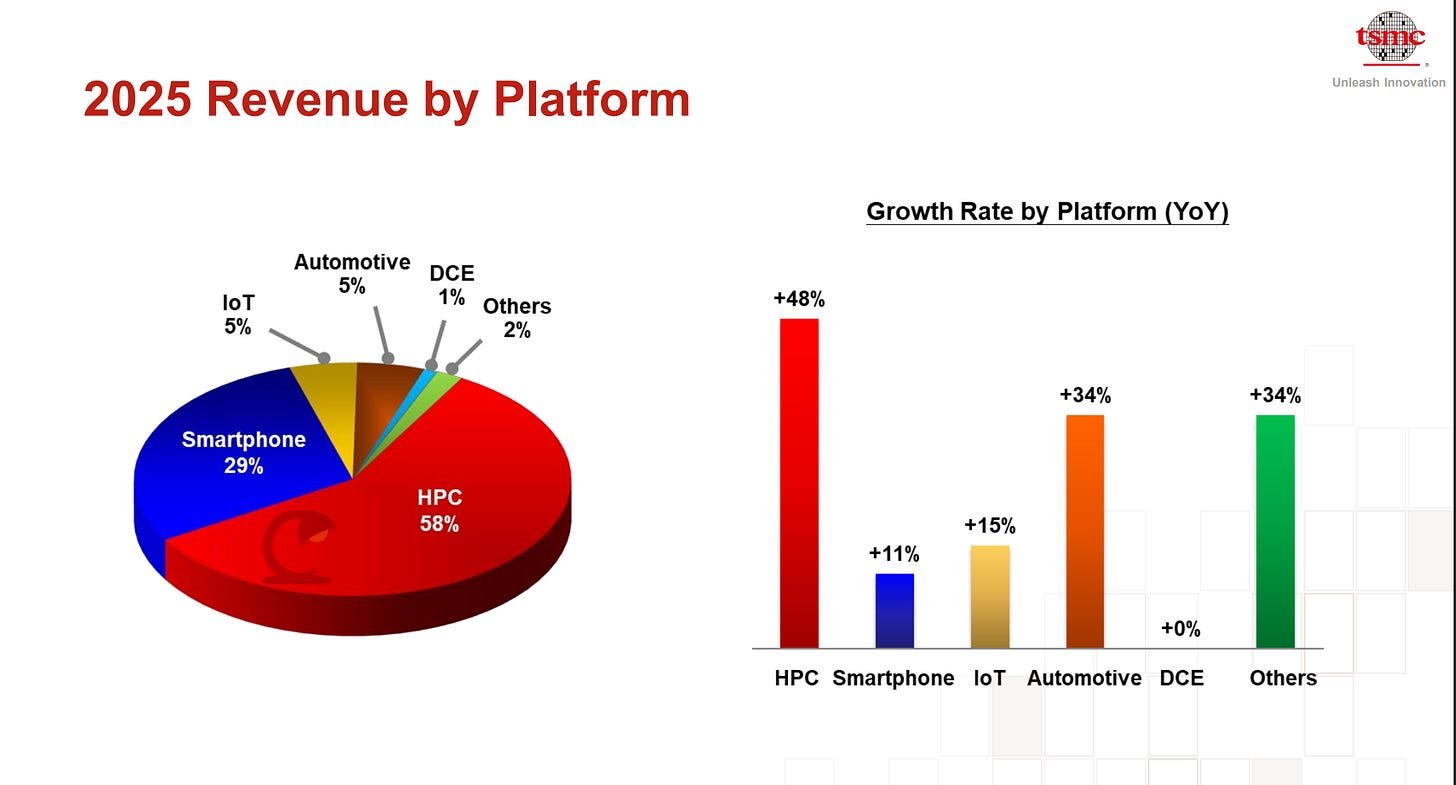

The Numbers Behind the Power Shift TSMC's latest earnings reveal the magnitude of this transformation:

- Overall 2025 revenue surged 36% to $122B

- High-Performance Computing (HPC) segment revenue jumped 48% YoY, accelerating from 2024's 58% growth

- Smartphone-related revenue grew just 11%, down from 23% in 2024

- Q4 gross margins hit 62.3% - nearing software company levels

- 2026 capex will leap 32% to $52-56B to accommodate AI demand

Crucially, Culpium analysis indicates Nvidia likely surpassed Apple as TSMC's largest customer in at least one quarter of 2025. While TSMC CFO Wendell Huang declined to confirm client rankings, the trajectory is undeniable. If Nvidia hasn't overtaken Apple already, it almost certainly will in 2026.

Technical Drivers of the Capacity Crunch Three semiconductor realities disadvantage Apple:

- Node Allocation: Nvidia's GPUs monopolize TSMC's cutting-edge CoWoS packaging capacity required for AI accelerators

- Wafer Economics: A single Nvidia H100 yields ~25-30 chips per 300mm wafer versus ~600 for Apple's A17 Pro

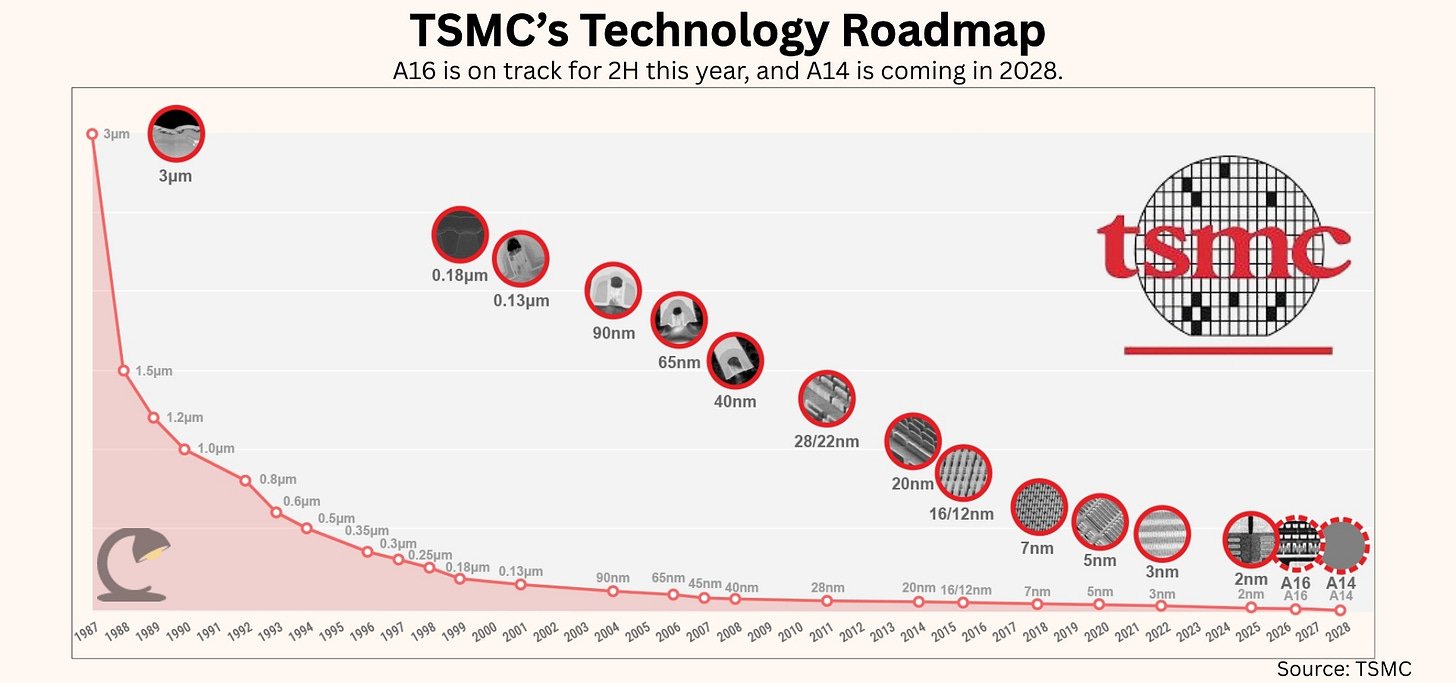

- Process Specialization: TSMC's new A16 node (entering production late 2026) specifically optimizes HPC designs with Super Power Rail technology - a backside power delivery system that benefits large dies

TSMC's technology roadmap through 2028 (Source: Company Presentations)

TSMC's technology roadmap through 2028 (Source: Company Presentations)

Apple's diversified chip portfolio - spanning iPhone processors (N4P node), Mac silicon (N3E), and accessory controllers (older nodes) - once provided stability. Now, that breadth works against them as Nvidia's concentrated demand for leading-edge wafers generates more revenue per square millimeter.

The Strategic Dilemma TSMC faces unprecedented capital allocation challenges. Building a new fab takes 2-3 years with equipment costs hitting $20B for advanced nodes. As Wei noted: "Even if we spend $52 to $56 billion this year, the contribution this year is none." This lag creates enormous risk - TSMC's 33% capital intensity and 45% depreciation-to-COGS ratio far exceed Nvidia's 2.5% capex burden.

TSMC's global manufacturing footprint expansion (Source: Company Filings)

TSMC's global manufacturing footprint expansion (Source: Company Filings)

Contrary to critics claiming TSMC should expand faster, the foundry must balance explosive AI demand against inevitable cyclical downturns. As Wei admitted: "I am very nervous... If we didn't do it carefully, it would be a big disaster." This caution stems from bitter experience - TSMC's Arizona and Japan fabs currently operate at lower margins due to higher costs, dragging overall profitability down.

Long-Term Implications The AI boom won't last forever, and Apple's broad manufacturing footprint across 12+ fabs ensures its enduring importance. TSMC's A14 node (2028) will rebalance priorities by optimizing equally for mobile and HPC. But for now, the calculus is clear: Nvidia's concentrated demand for premium-priced AI wafers commands TSMC's attention, while Apple learns what it means to be just another customer in the queue.

As one industry insider summarized: "Jensen Huang now wields more influence in Hsinchu than Tim Cook - and neither has to worry about the $20 billion price tag of building the fabs they're fighting over."

Comments

Please log in or register to join the discussion