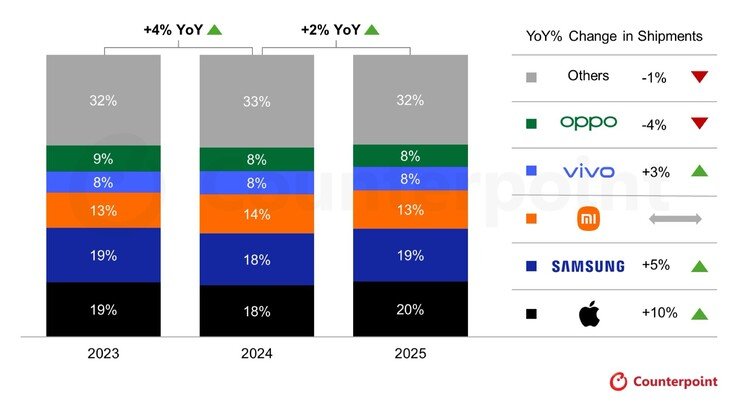

Apple captured 20% of global smartphone shipments in 2025, surpassing Samsung for the top spot amid 2% industry growth driven by premium devices. Nothing and Google posted explosive shipment increases exceeding 25%, while Samsung's budget-focused Galaxy A series maintained competitiveness.

The global smartphone market grew by 2% in 2025 with premium devices driving most gains, according to Counterpoint Research data. Apple emerged as the clear leader, shipping 10% more iPhones than in 2024 to capture 20% market share – dethroning Samsung for the first time in over a decade. Samsung retained second place with 19% share on 5% growth, largely sustained by budget models like the Galaxy A16, currently the world's best-selling Android phone at approximately $125.

Apple's momentum accelerated dramatically in Q4 2025, achieving 25% market share versus Samsung's 17% during the holiday quarter. This gap underscores Apple's dominance in the premium segment where customers increasingly prioritize performance and ecosystem integration over price sensitivity. Despite Samsung's broader device portfolio spanning all price tiers, its premium Galaxy S and foldable lines couldn't match iPhone's sales velocity.

Counterpoint Research's 2025 smartphone market share chart

Xiaomi maintained third position with 13% share, while Oppo and Vivo tied at 8% each. The most explosive growth came from challenger brands: Nothing increased shipments by 31% year-over-year following strategic pricing adjustments and distinctive design language in its Phone (2) series. Google saw 25% growth with Pixel devices, leveraging AI photography features and tighter Android integration to attract users seeking premium alternatives.

The outlook for 2026 appears less optimistic. Counterpoint forecasts a 3% market contraction due primarily to rising DRAM costs, which may force manufacturers to increase prices or reduce component quality. This could disproportionately impact budget segments where Samsung's Galaxy A series currently dominates. Buyers prioritizing longevity should consider devices with ample RAM headroom before potential price hikes, while premium shoppers remain relatively insulated from these fluctuations.

For consumers, these trends highlight two viable paths: budget-focused buyers get exceptional value from Samsung's A-series, while premium seekers benefit from Apple's ecosystem advantages and Google's AI-driven software. Nothing's growth signals strong demand for differentiated designs below flagship pricing, making its upcoming models worth watching. As component costs rise, 2026 may favor manufacturers with tighter hardware-software integration to maintain performance at stable price points.

Comments

Please log in or register to join the discussion