A new Counterpoint Research report reveals Apple captured the top spot in China's smartphone market during Q4 2025, with iPhone shipments jumping 28% year-over-year despite an overall market decline. The success is attributed to the iPhone 17 series, particularly the Pro models and base variants offering double storage at the same price point, though the iPhone Air struggled with a delayed launch and design trade-offs.

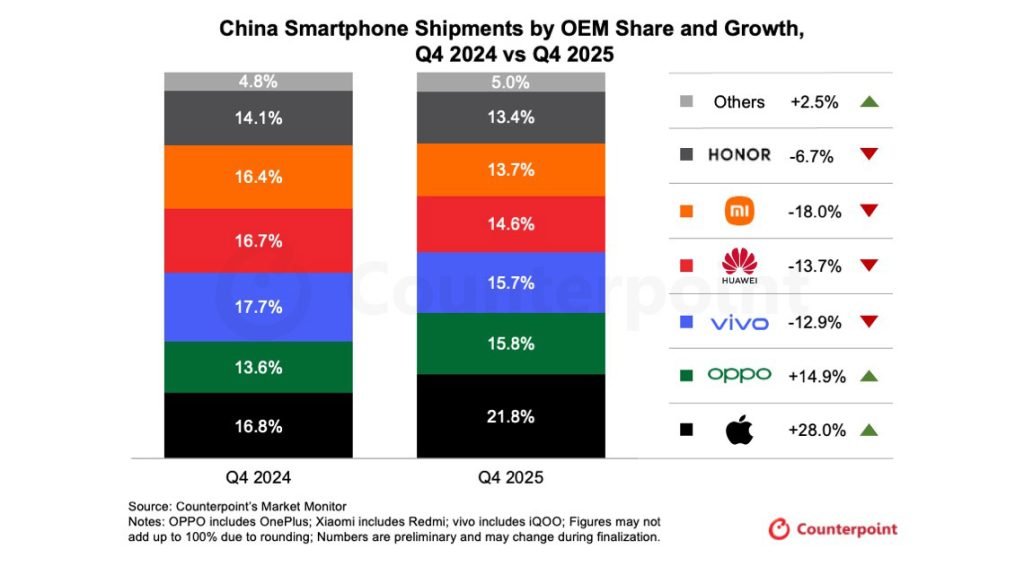

Apple has successfully reversed its multi-year sales slump in China, capturing the top smartphone market share in the final quarter of 2025. According to a new report from Counterpoint Research, iPhone shipments surged 28% year-over-year in Q4 2025, allowing Apple to lead the Chinese market with a 21.8% share. This performance came as the broader Chinese smartphone market contracted by 1.6% during the same period.

The report highlights the iPhone 17 series as the primary driver of this growth. "Apple led China’s smartphone market in Q4 with a 22% share, driven by strong traction for the iPhone 17 series and an accelerated supply ramp," the analysis states. The Pro models, featuring Apple's distinctive new camera design, and the base variants, which doubled storage compared to the previous generation while maintaining the same price point, both saw strong market response.

This marks a significant shift from Q4 2024, when Apple held a 16.8% market share and placed second behind Chinese manufacturer vivo. The 28% shipment increase represents a dramatic turnaround that allowed Apple to outperform the overall market decline.

The iPhone Air's Struggle with Design Trade-offs

Not all news in the report was positive for Apple's portfolio. The iPhone Air, which experienced a delayed launch, captured only a "low single-digit" market share. Senior Analyst Ivan Lam explained the challenges: "The late launch and trade-offs between thinness and the feature set resulted in a slow start for the iPhone Air."

Despite its poor sales performance, Lam noted the iPhone Air's strategic importance: "It's a significant product, not only as an exploration into ultra-thin design, but also when considering the longer-term structural implications for the domestic market for eSIM smartphones." This suggests Apple views the Air as a design experiment that could inform future product development, particularly as the industry moves toward eSIM-only devices.

Full-Year 2025 Performance

Looking at the entire year, Apple's 2025 performance in China shows steady growth. Compared to 2024, Apple saw a 7.5% increase in shipments, placing it second overall with a 16.7% market share. Huawei narrowly led the market with 16.9%, while vivo, which ranked second in 2024, fell to third with 16.4%. Xiaomi showed 4.3% growth, securing fourth place.

This full-year context is important because it shows Apple's Q4 surge wasn't an anomaly but part of a broader recovery strategy. The company's ability to outperform the market in key shopping periods like Singles' Day, combined with the iPhone 17's strong reception, demonstrates a successful execution of its China strategy.

Developer and Market Implications

For iOS developers, Apple's strong performance in China has several implications. First, the market's growth means a larger potential user base for apps, particularly those targeting premium users who can afford the Pro models. The iPhone 17's success also validates Apple's design choices, suggesting developers should consider optimizing for the new camera system and display technologies.

The iPhone Air's poor performance, however, highlights the challenges of ultra-thin designs. For developers, this means the Air may represent a smaller segment of the market, potentially requiring different optimization strategies compared to the main iPhone lineup. The focus on eSIM capabilities in the Air also signals Apple's direction toward removing physical SIM trays entirely, which could affect how apps handle carrier-related features.

Supply Chain and Market Dynamics

The report mentions an "accelerated supply ramp" as a factor in Apple's success. This suggests Apple improved its manufacturing and distribution efficiency in China, potentially addressing previous supply constraints that limited sales. For the broader market, Apple's ability to increase shipments while competitors declined indicates strong brand loyalty and product differentiation.

The success of the storage upgrade strategy—doubling storage at the same price point—appears to have resonated with Chinese consumers. This approach addresses a common pain point in the market, where storage limitations have been a frequent complaint about premium smartphones.

Looking Ahead

Apple's Q4 2025 performance in China represents a significant milestone in its recovery in one of the world's largest smartphone markets. The company has successfully leveraged the iPhone 17 series to capture market share even as the overall market contracts. The iPhone Air's struggles, while notable, appear to be viewed as a calculated risk for a design-focused product rather than a core revenue driver.

For developers and industry observers, the key takeaway is that Apple's China strategy is working. The combination of competitive pricing (for the base models), premium features (for the Pro models), and supply chain improvements has created a winning formula. As the industry continues to evolve toward eSIM and ultra-thin designs, Apple's experimentation with the iPhone Air could provide valuable insights for future product development.

The full report from Counterpoint Research provides additional data points on regional performance and competitive dynamics, but the headline remains clear: Apple has returned to the top of China's smartphone market, driven by the iPhone 17 series' strong performance across multiple price points and configurations.

Comments

Please log in or register to join the discussion