CFTC Chair Mike Selig announces plans to file friend-of-the-court briefs defending the commission's exclusive authority over prediction markets as states challenge federal jurisdiction.

The Commodity Futures Trading Commission is preparing to escalate its defense of regulatory authority over prediction markets, with Chair Mike Selig announcing plans to file friend-of-the-court briefs in ongoing state-level legal challenges.

In a significant move that underscores the growing tension between federal and state oversight of prediction markets, Selig told Axios that the CFTC will actively intervene in lawsuits questioning the commission's exclusive jurisdiction. This represents a more aggressive stance from the federal regulator as prediction markets gain mainstream attention and states seek to assert their own regulatory frameworks.

The timing is particularly noteworthy given the recent surge in prediction market activity and the increasing political stakes involved. As these platforms become more prominent in forecasting election outcomes and other high-profile events, the regulatory framework governing them has become a flashpoint for jurisdictional disputes.

What's Actually New The CFTC's decision to file amicus briefs marks a departure from its previous approach of primarily defending its authority through direct enforcement actions. By entering ongoing litigation as a third-party advocate, the commission is signaling that it views state challenges to its jurisdiction as a systemic threat requiring coordinated legal response.

This strategy allows the CFTC to influence multiple cases simultaneously while avoiding the resource drain of becoming a direct party to numerous lawsuits. The briefs will likely focus on statutory interpretation of the Commodity Exchange Act and precedents establishing federal preemption in similar regulatory domains.

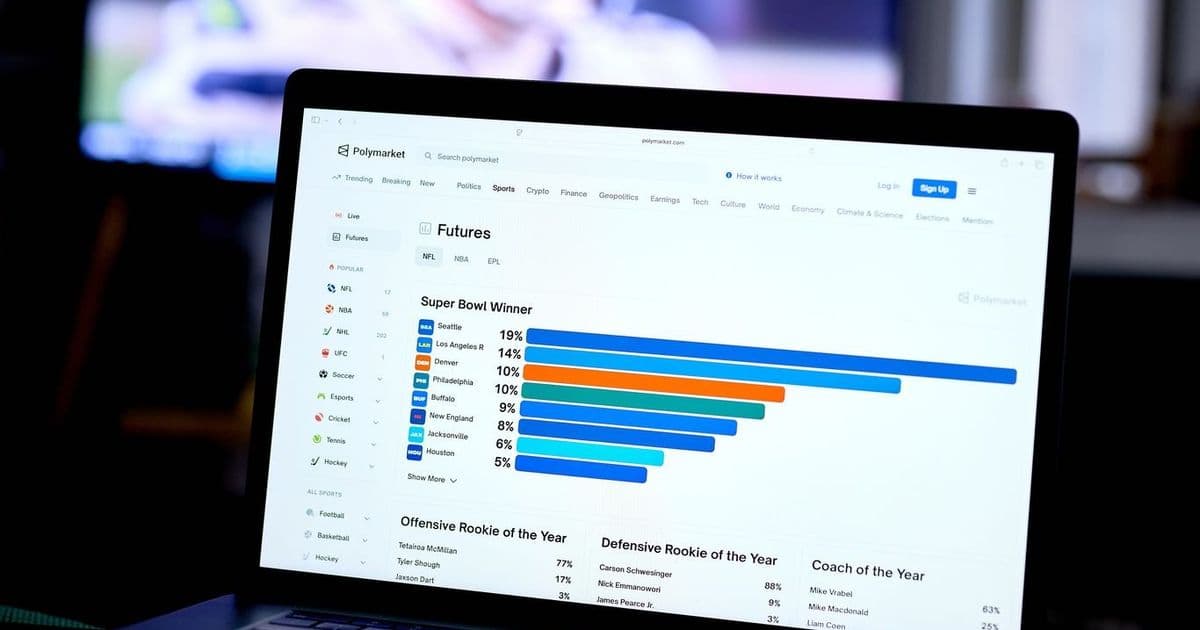

The Broader Context Prediction markets have evolved from niche academic tools to platforms with significant real-world impact. Companies like Kalshi and Polymarket have attracted substantial investment and user bases, while traditional financial institutions have begun exploring prediction market mechanisms for risk management and forecasting.

The regulatory uncertainty has created a complex landscape where platforms must navigate overlapping federal and state requirements. Some states have moved to explicitly ban or restrict prediction markets, while others have proposed frameworks for licensing and oversight.

Limitations and Challenges Despite the CFTC's assertive stance, several factors could limit the effectiveness of this legal strategy:

- Judicial deference: Courts may be reluctant to fully endorse exclusive federal jurisdiction over emerging technologies without clear congressional mandate

- State sovereignty: States retain significant authority over gambling and gaming activities, which prediction markets often resemble

- Political pressure: Growing public interest in prediction markets could influence judicial interpretation of regulatory boundaries

The outcome of these legal battles will likely shape the future of prediction markets in the United States, determining whether they develop under a unified federal framework or face a patchwork of state regulations.

Industry Implications For prediction market operators, the CFTC's legal campaign provides some clarity but also introduces new uncertainty. Companies must now prepare for potentially lengthy litigation while continuing to operate under existing regulatory frameworks.

The dispute also highlights the broader challenge of regulating innovative financial technologies within existing statutory structures. As prediction markets blur the lines between gambling, securities trading, and information markets, regulators face difficult questions about appropriate oversight mechanisms.

Looking Ahead The CFTC's decision to file friend-of-the-court briefs represents just the opening salvo in what could be a protracted legal battle over prediction market jurisdiction. The outcome will have implications far beyond the immediate parties to the lawsuits, potentially determining the regulatory landscape for an entire industry.

As states continue to assert their authority and the CFTC defends its turf, prediction market operators find themselves caught in the middle, forced to navigate an increasingly complex regulatory environment while trying to build sustainable businesses.

The resolution of these jurisdictional disputes will likely require either judicial clarification or congressional action to establish clear regulatory boundaries for prediction markets in the digital age.

Comments

Please log in or register to join the discussion