A Reuters report citing three sources claims Chinese customs agents have been instructed to block imports of Nvidia's H200 AI chips, effectively banning the advanced processor from the Chinese market. This development contradicts recent reports that Beijing might allow limited imports under special circumstances and represents a significant escalation in the ongoing semiconductor trade tensions between the U.S. and China.

Chinese customs agents have been instructed not to allow imports of Nvidia's H200 AI chips into China, according to a Reuters report citing three people briefed on the matter. The directive, if confirmed, would effectively serve as a ban on the advanced AI processors, though it remains unclear whether this represents a temporary condition or a permanent policy shift.

This development marks a sharp reversal from recent reports suggesting Beijing might permit limited imports of the H200 under "special circumstances." The Trump Administration approved H200 exports to China last month, with Chinese tech giants like Alibaba and ByteDance reportedly preparing to purchase 200,000 units each, pending Beijing's approval. However, the Chinese government has remained silent on whether it will grant these purchase requests.

Technical Context and Market Implications

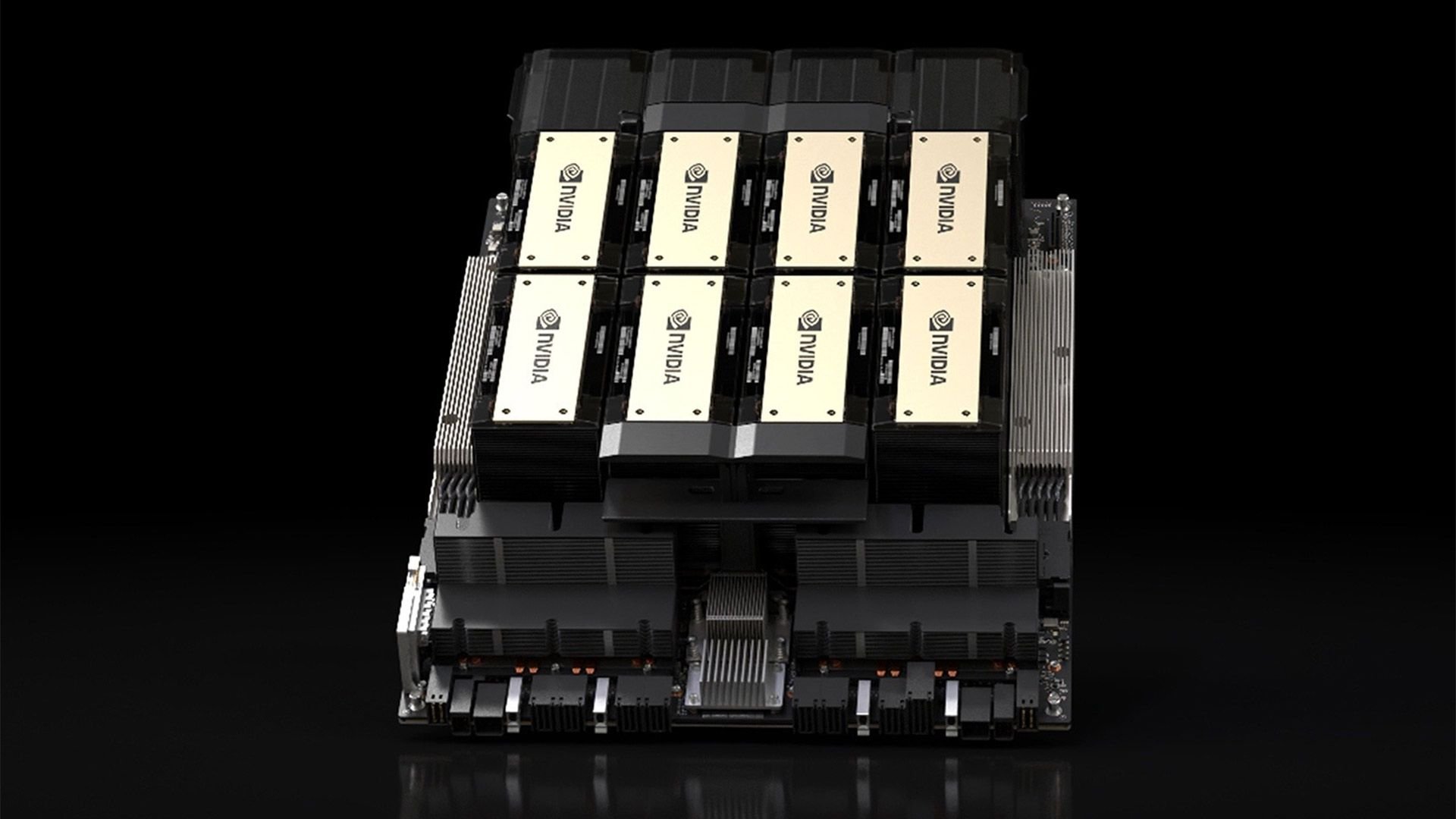

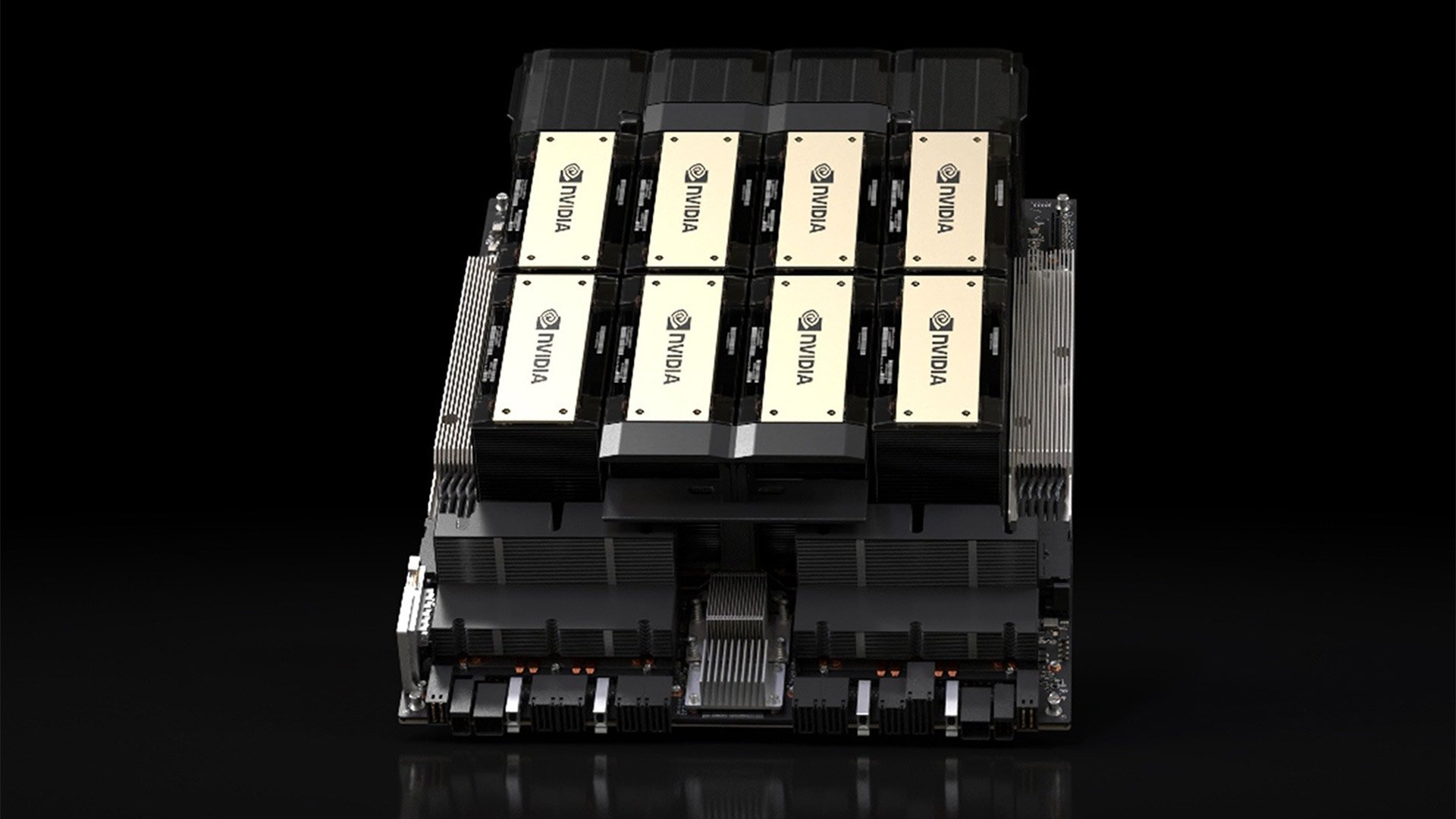

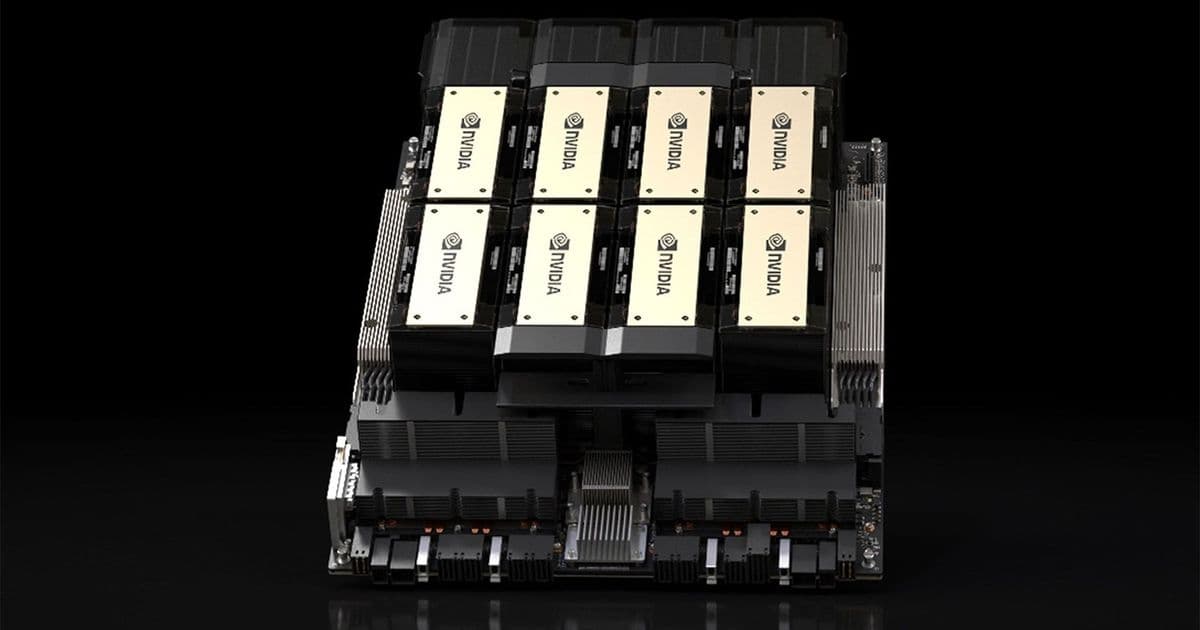

The H200 represents a significant advancement in AI computing capability. Based on Nvidia's Hopper architecture, the H200 features 141GB of HBM3e memory with 4.8 TB/s bandwidth, delivering substantially improved performance for large language model training and inference compared to previous generations. For Chinese AI companies, access to these chips is critical for developing competitive models, particularly as the global AI race intensifies.

The potential ban creates a complex dilemma for Beijing. On one hand, Chinese AI firms require cutting-edge hardware to train state-of-the-art models and maintain competitiveness with Western counterparts. On the other hand, the Chinese government has prioritized semiconductor sovereignty, pushing domestic alternatives like Huawei's Ascend processors and Biren's GPUs. The H200 ban would accelerate this domestic substitution strategy but at the cost of immediate performance gaps.

Geopolitical Calculations

The timing of this directive appears strategically significant. Beijing has reportedly been conducting meetings since Washington approved H200 exports to assess domestic demand and determine appropriate policy responses. The Chinese government allegedly instructed its companies to pause purchase deliberations while terms are being finalized.

This situation mirrors previous semiconductor trade dynamics. In April 2025, the Trump administration banned exports of China-specific AI GPUs during the height of trade tensions, only to reverse course three months later. Beijing subsequently restricted domestic companies from acquiring these chips, citing improved performance of homegrown alternatives. Some analysts viewed this as leverage during U.S.-China trade negotiations.

The current H200 situation may follow a similar pattern. With President Trump scheduled to visit Beijing in April, the customs directive could serve as bargaining leverage in upcoming negotiations. China might be positioning itself to extract concessions from the U.S. regarding technology transfers or trade terms, using the H200 ban as a pressure point.

Supply Chain and Market Impact

For Nvidia, a complete ban on H200 imports into China would represent a substantial revenue loss. China has historically accounted for 20-25% of Nvidia's data center revenue, though this has declined due to previous export restrictions. The H200 ban would further cement this trend, forcing Nvidia to rely more heavily on markets in North America, Europe, and other regions.

The directive would also impact the broader semiconductor ecosystem. Companies like TSMC, which manufactures Nvidia's GPUs, and memory suppliers like SK Hynix and Micron, which provide HBM3e chips, would see reduced orders from Chinese customers. This could affect their production planning and financial forecasts.

Domestic Alternatives and Long-Term Strategy

China's semiconductor industry has made significant strides in developing domestic alternatives. Huawei's Ascend 910B processor, manufactured by SMIC using 7nm technology, has shown competitive performance for certain AI workloads. Biren's BR100 GPU, though facing manufacturing challenges, represents another homegrown option.

However, these alternatives still lag behind Nvidia's latest offerings in terms of performance, software ecosystem, and developer support. The CUDA platform remains the dominant framework for AI development, creating a significant barrier to entry for competitors. Chinese companies developing alternative frameworks face the dual challenge of technical superiority and ecosystem adoption.

The H200 ban would accelerate investment in domestic alternatives but could also create a temporary performance gap that Chinese AI companies must navigate. This might lead to increased focus on algorithmic efficiency and software optimization to compensate for hardware limitations.

Market Uncertainty and Future Outlook

The lack of official confirmation from Beijing creates significant uncertainty for all stakeholders. Chinese AI companies face planning challenges, unable to secure critical hardware or commit to alternative strategies. Nvidia must navigate volatile policy environments while managing investor expectations about China revenue.

The situation also highlights the increasingly fragmented nature of the global semiconductor market. Export controls and import restrictions are creating parallel technology ecosystems, potentially slowing global innovation and increasing costs for all parties involved.

As the April Trump visit approaches, the H200 situation will likely remain fluid. Beijing may adjust its position based on negotiation outcomes, or the customs directive could be clarified or rescinded. For now, the report represents another chapter in the ongoing U.S.-China technology competition, where semiconductors have become both economic assets and geopolitical tools.

The ultimate resolution will depend on broader diplomatic negotiations and each country's assessment of its strategic interests in AI development and semiconductor independence.

Comments

Please log in or register to join the discussion