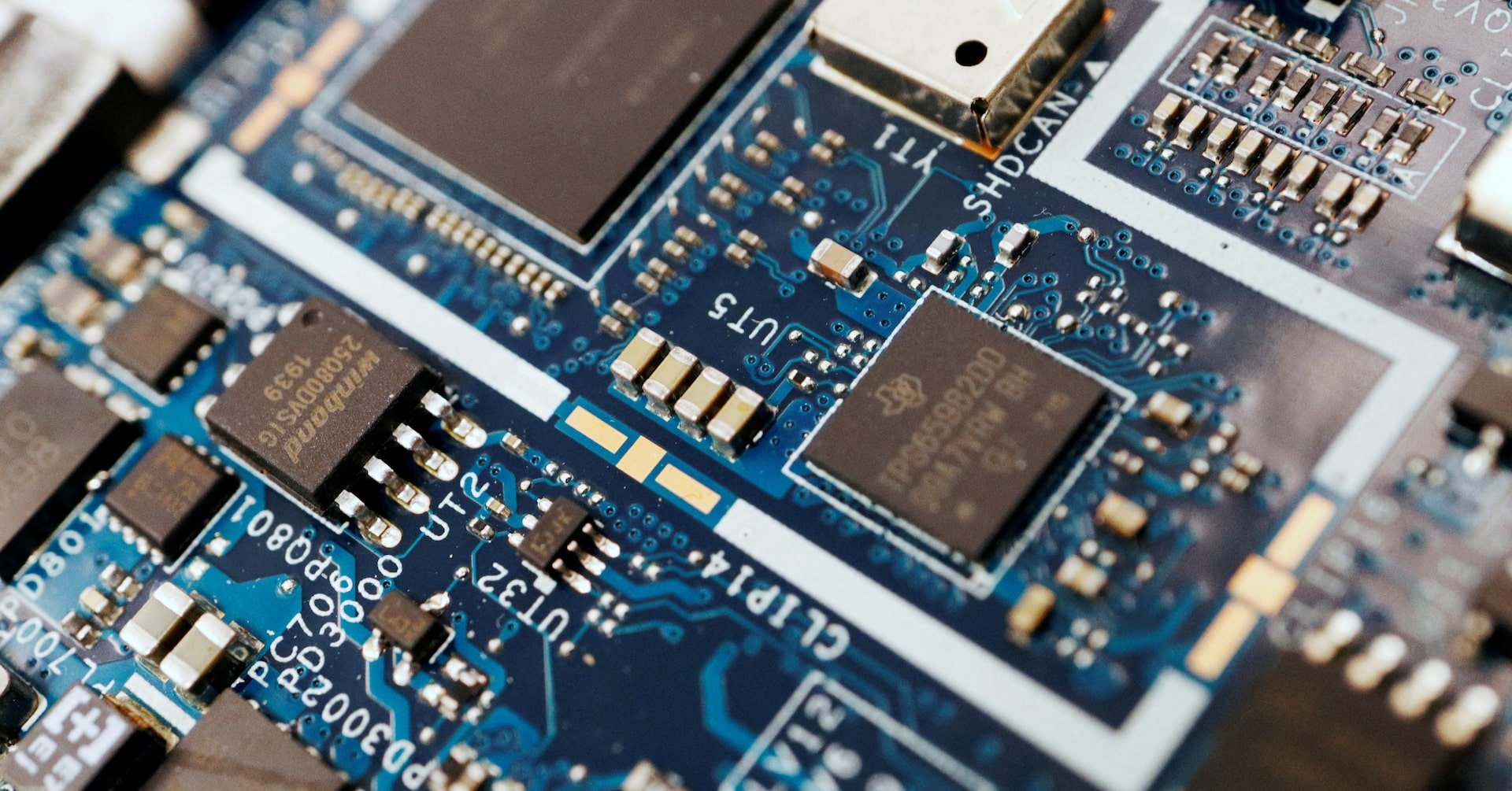

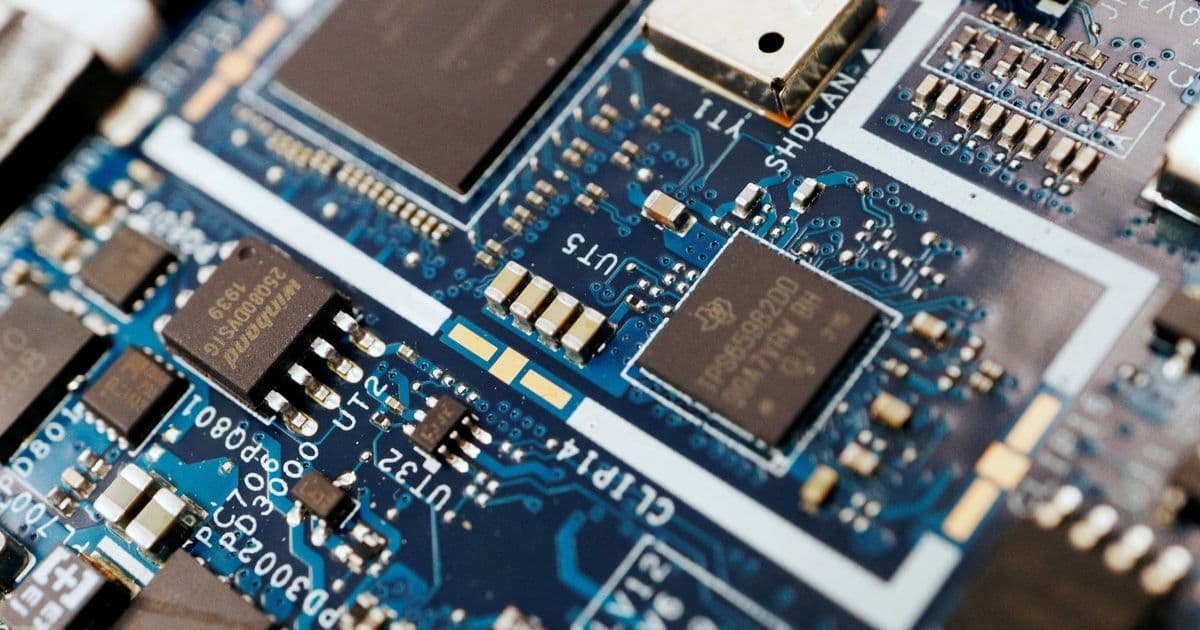

Global semiconductor sales grew 25.6% YoY to $791.7B in 2025, with NVIDIA, AMD and Intel capturing $301.9B of that total. The Semiconductor Industry Association projects $1T in sales for 2026 despite potential supply chain constraints.

The semiconductor industry recorded its second consecutive year of explosive growth, with global sales reaching $791.7 billion in 2025 according to new data from the Semiconductor Industry Association (SIA). This represents a 25.6% year-over-year increase, building on the momentum from 2024's post-slump recovery. The report highlights how NVIDIA, AMD, and Intel collectively captured $301.9 billion in revenue—a 40% annual increase that underscores their dominance in key growth markets.

Driving this expansion is unprecedented demand across multiple sectors: AI infrastructure buildouts continue to consume data center GPUs at record rates, automotive chip demand grew 32% as EVs and advanced driver assistance systems proliferated, and industrial automation deployments accelerated. Notably, the SIA's projection of $1 trillion in sales for 2026 would represent the fastest ascent to that milestone in industry history.

Three factors explain the disproportionate gains by leading players:

- NVIDIA's data center GPU business now accounts for 78% of revenue, with its Blackwell architecture maintaining 95% market share in AI training workloads

- AMD captured 38% of the server CPU market with its Zen 5 EPYC processors while expanding its AI accelerator footprint

- Intel regained process leadership with its Intel 18A node, securing major foundry contracts alongside its core CPU business

However, the industry faces significant challenges. Supply chain reports indicate CPU lead times extending to six months for some customers, reflecting persistent manufacturing constraints despite massive capital expenditure increases. Geopolitical tensions continue to complicate global supply chains, with export controls creating regional inventory imbalances. The SIA's projection also assumes no major economic downturn—a risk factor given recent volatility in tech stocks.

While the $1 trillion projection appears achievable based on design win pipelines and capacity expansion plans, industry analysts note that actual revenue could vary by ±15% depending on AI adoption curves and manufacturing yield improvements. The next 18 months will test whether the industry can maintain this growth trajectory while navigating complex trade policies and supply chain fragility.

- Semiconductor Industry Association Report: https://www.semiconductors.org

- NVIDIA Investor Relations: https://investor.nvidia.com

- AMD Financials: https://ir.amd.com

- Intel Earnings: https://www.intc.com

Comments

Please log in or register to join the discussion