Infineon reportedly plans April 2026 price increases on power switches and ICs, citing AI-driven capacity expansion needs. The hikes could ripple through virtually all electronic devices, from servers to consumer products.

Infineon, one of Europe's largest semiconductor manufacturers, is reportedly preparing to implement significant price increases on its power management chips starting April 1, 2026, according to a leaked letter that has circulated on social media. The alleged notification, claimed to be from Infineon's chief marketing officer Andreas Urschitz, cites the need to expand production capacity to meet surging demand from the artificial intelligence sector and other customers as the primary driver behind the pricing adjustments.

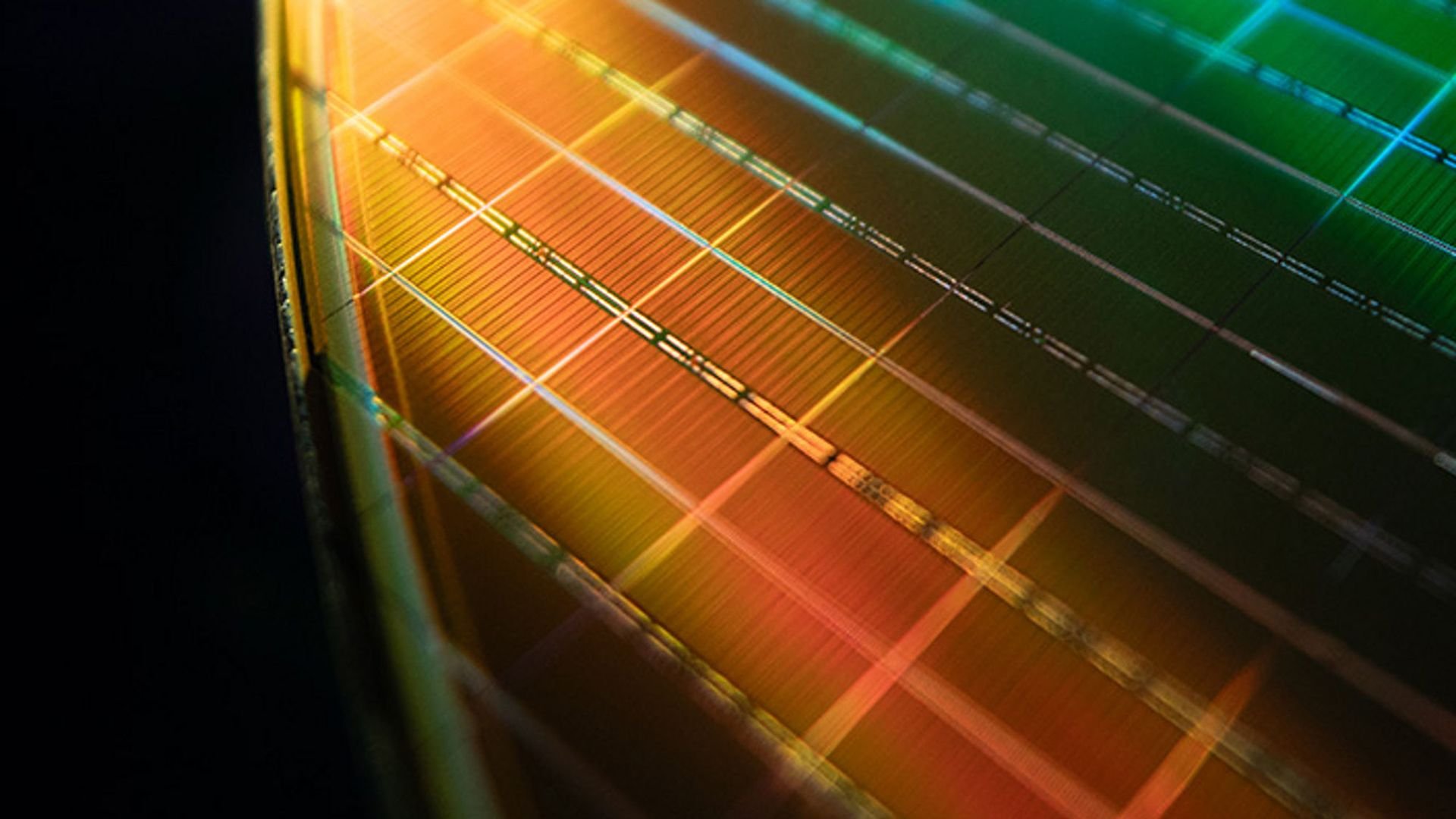

Power management integrated circuits and switches form the backbone of virtually every electronic device in existence today. These components handle the critical function of converting and regulating electrical power before it reaches the actual processing chips, making them indispensable across the entire electronics ecosystem. From the power supplies in desktop computers to the voltage regulator modules on motherboards and graphics cards, from datacenter infrastructure to electric vehicles and renewable energy systems, these chips are ubiquitous.

The timing of these alleged price increases coincides with an unprecedented surge in demand for AI infrastructure. Data centers building out AI training clusters require hundreds of power management chips per server rack, not just for the processors themselves but for the entire supporting infrastructure including cooling systems, power distribution units, and HVAC equipment. This concentrated demand in one sector is creating ripple effects throughout the supply chain.

What makes this situation particularly complex is the interconnected nature of semiconductor manufacturing. Power ICs for various applications are often produced on the same fabrication lines using similar processes. When demand spikes for one category of power chip, it can constrain the production capacity for others. Furthermore, if manufacturers need to accelerate expansion of their production capabilities to meet this demand, the costs associated with that expansion inevitably get passed along to customers.

The leaked letter suggests that Infineon can no longer absorb the increasing costs associated with capacity expansion and must pass them along to clients. This represents a significant shift in the power semiconductor market, where manufacturers have historically operated on relatively thin margins and absorbed cost increases to maintain market share.

Industry analysts note that the impact of these price increases will likely vary significantly across different market segments. Companies producing high-margin AI servers may find it easier to absorb the additional costs, while manufacturers of consumer electronics with tighter profit margins may be forced to either increase retail prices or seek alternative suppliers. Some companies may choose to absorb the cost increases to maintain competitive pricing, while others will likely pass them through to end customers.

The professional tone and structure of the leaked letter, combined with its German-influenced corporate English style, lends credibility to its authenticity. However, Infineon has not publicly confirmed the existence of such a notification or the planned price increases. The company's response to these reports, when and if it comes, will be closely watched by the entire electronics industry.

This situation highlights the growing influence of AI infrastructure development on the broader electronics supply chain. What begins as capacity constraints and pricing pressure in the AI server market can quickly cascade through to affect the cost of everyday consumer electronics. The April 2026 timeline also suggests that these changes have been in planning for some time, indicating that the AI boom's impact on power semiconductor supply is a long-term structural shift rather than a temporary market fluctuation.

For electronics manufacturers, the coming months will likely involve difficult decisions about pricing strategies, supplier relationships, and product designs. Some may accelerate efforts to redesign products with more efficient power management or seek alternative component sources. Others may begin stockpiling inventory ahead of the price increases. The full impact of these changes won't be known until the new pricing takes effect and manufacturers adjust their own pricing strategies accordingly.

The broader implications extend beyond just pricing. If Infineon's capacity expansion plans are indeed driven by AI demand, it suggests a fundamental reshaping of the power semiconductor market where AI infrastructure becomes the primary driver of manufacturing investment and capacity planning. This could lead to longer-term shifts in which types of power chips receive priority in production allocation and how quickly the industry can respond to demand fluctuations in other sectors.

As the electronics industry awaits official confirmation from Infineon, one thing is clear: the AI boom is having far-reaching effects that extend well beyond the data center, potentially touching virtually every electronic device that consumers and businesses rely on daily.

Comments

Please log in or register to join the discussion