Aswath Damodaran's latest country risk premium analysis reveals the complex layers—from political volatility to systemic corruption—that silently dictate tech valuations worldwide. For developers building global SaaS platforms or AI startups, understanding these non-diversifiable risks is critical for resilient financial modeling.

When Aswath Damodaran updates his semiannual country risk premiums—a ritual spanning 30 years—he’s not just tweaking spreadsheets. He’s quantifying the invisible forces that make an Indian SaaS startup riskier than its German counterpart, or a Brazilian cloud infrastructure investment more volatile than one in Canada. For technologists operating in global markets, these premiums aren’t academic exercises; they’re survival metrics.

The Multidimensional Risk Matrix

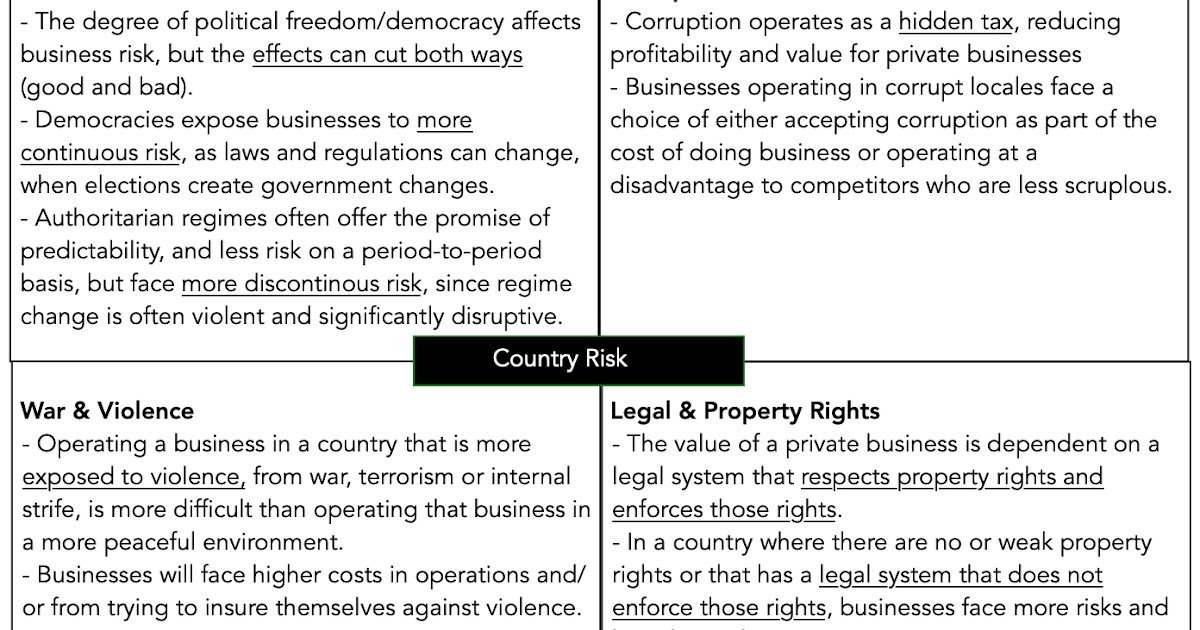

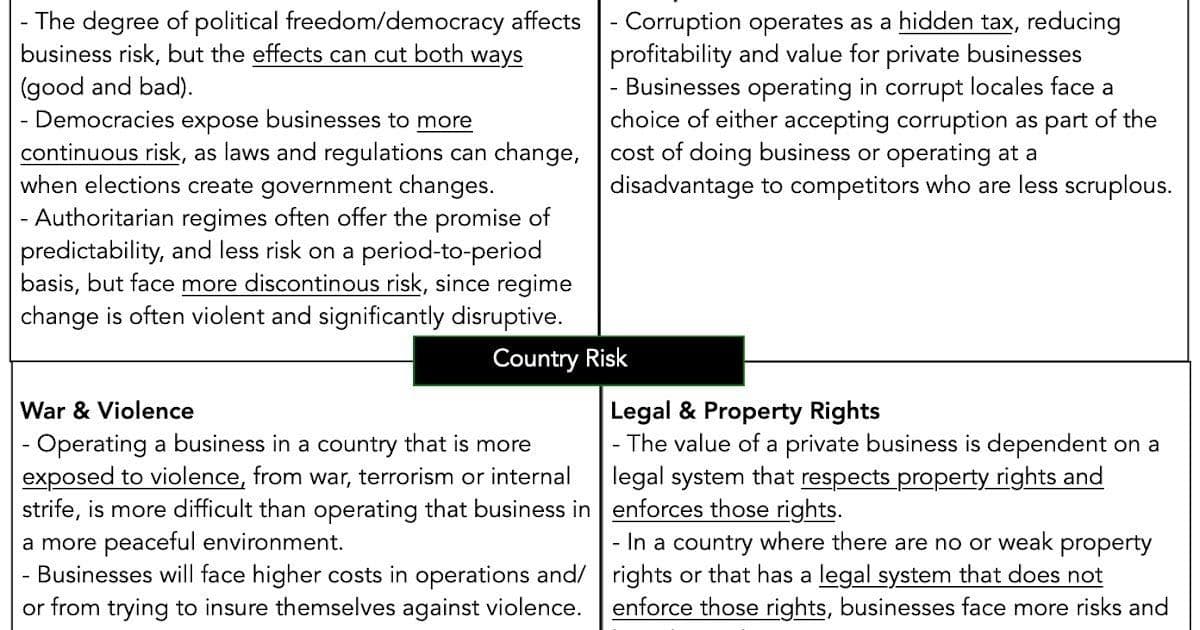

Damodaran identifies four critical dimensions:

- Political Structure: Democracies vs. authoritarian regimes create vastly different risk profiles. The Economist’s Democracy Index shows over 36% of the world now lives under authoritarian rule—a decade-long trend impacting tech talent mobility and IP protection.

- Violence Exposure: Beyond physical threats, violence escalates operational costs (e.g., cybersecurity hardening, employee security details) and insurability. The 2024 Global Peace Index reveals conflict zones add 15-40% overhead to tech deployments.

- Corruption: Acts as an ‘implicit tax,’ distorting market access. In high-corruption regions, cloud providers face unpredictable compliance costs.

- Legal Systems: Weak enforcement of ownership rights jeopardizes AI patents and software licensing.

Why Beta Alone Fails

Many developers rely on simplistic regression-based beta calculations against market indices. Damodaran warns this overlooks critical nuances:

"For diversified investors, only non-diversifiable risks matter. Industry-specific or bottom-up beta calculations—factoring localized operational realities—yield truer risk assessments for global tech projects."

The Currency Trap

Risk premiums tie directly to currency choices. Using volatile local currencies instead of stable alternatives (e.g., USD for Colombian tech ventures) distorts discount rates by 200-500 basis points—potentially derailing ROI projections.

Implications for Tech Builders

- AI/ML Deployment: Training data gathered in high-risk regions may carry hidden compliance liabilities

- Cloud Architecture: Multi-region redundancy isn’t just for latency—it’s risk diversification

- VC Funding: Startups in emerging markets require higher hurdle rates to offset systemic risk

Damodaran’s data underscores a hard truth: Code exists in political contexts. Ignoring the geopolitical layer in financial models is like ignoring technical debt—it compounds silently until systems break. For technologists, the real premium lies in building adaptable systems that withstand not just technical failures, but national ones.

Source: Aswath Damodaran Blog

Comments

Please log in or register to join the discussion