Despite relentless forecasts of their demise, hard disk drives (HDDs) continue to thrive, especially in the enterprise cold storage market. This article explores the surprising economic and technological factors enabling HDDs to maintain a crucial role in data centers worldwide, driven by their unbeatable cost-per-bit advantage for massive, infrequently accessed data.

For over two decades, pundits have predicted the imminent death of the hard disk drive (HDD), declaring it obsolete in the face of faster, more reliable solid-state drives (SSDs). Yet, the venerable spinning disk persists, stubbornly refusing to exit the stage. The reality is stark: HDDs generated over $30 billion in revenue last year, a figure that defies the obituaries. How is this possible in an era dominated by flash memory?

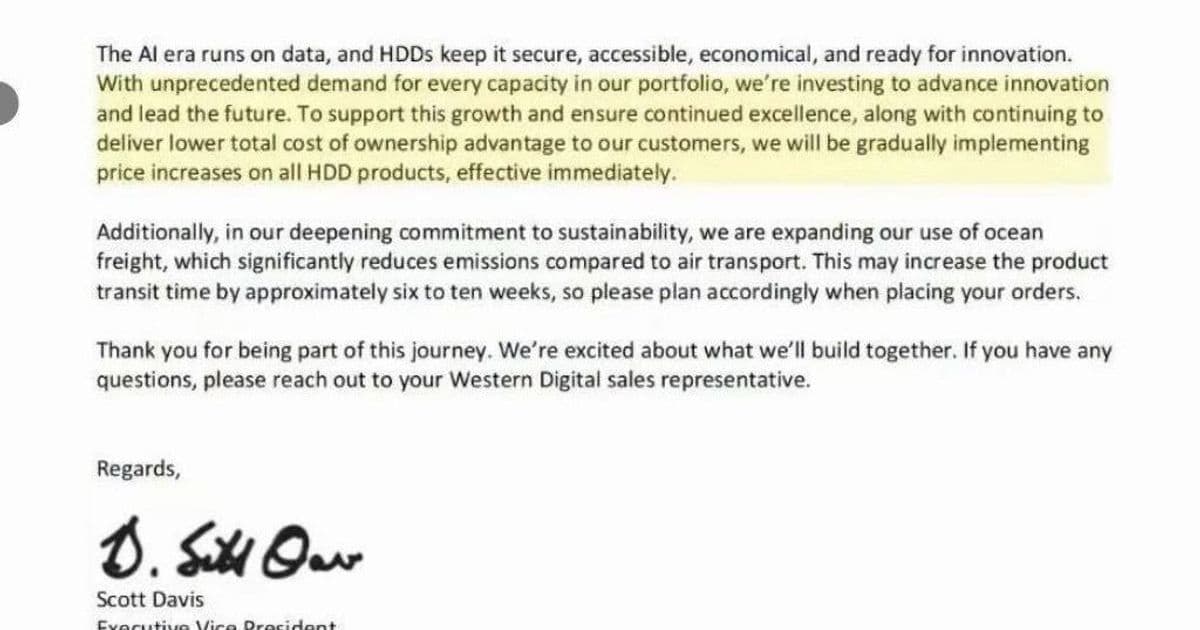

The core driver is simple, brutal economics: Cost-per-bit. While SSDs have plummeted in price, HDDs have maintained a significant cost advantage for storing vast amounts of data. This is particularly crucial in the enterprise and hyperscaler world, where exabytes of 'cold' or 'cool' data – information accessed infrequently but retained for compliance, analytics, or future needs – reside. Storing this data on SSDs remains prohibitively expensive compared to high-capacity HDDs.

"The relentless growth of data, especially unstructured data generated by sensors, logs, video, and backups, creates an insatiable demand for cheap storage," explains a storage industry analyst. "HDDs, particularly high-capacity models (often 20TB+), offer a cost-per-terabyte that flash simply cannot match for bulk storage tiers. The economics dictate their continued existence."

Several key factors reinforce the HDD's cold storage stronghold:

- Technology Evolution: HDD manufacturers haven't stood still. Innovations like HAMR (Heat-Assisted Magnetic Recording) and SMR (Shingled Magnetic Recording) continue to push aerial density limits, enabling larger capacities on fewer drives, further improving cost efficiency and reducing data center footprint and power consumption.

- The Flash Paradox: Ironically, the success of flash memory contributes to HDD longevity. As flash prices drop, it becomes the preferred tier for hot and warm data. This pushes more cold data onto the most cost-effective medium available: HDDs. The storage hierarchy becomes more defined, not less.

- Hyperscaler Demand: Giants like Google, Microsoft (Azure), and Amazon (AWS) operate at scales where marginal cost differences translate to billions. They architect their storage layers meticulously, deploying SSDs for performance-critical workloads and vast arrays of HDDs for archival and backup. Their massive purchasing power sustains the HDD industry.

- Tape's Niche: While magnetic tape offers an even lower cost-per-bit for true archival data, its access latency and sequential nature make it unsuitable for data requiring occasional retrieval or nearline access. HDDs fill this 'cool' storage gap effectively.

Implications for Developers and Architects:

This isn't just a story about hardware vendors. Developers building data-intensive applications and architects designing storage solutions must understand this landscape:

- Tiered Storage is Essential: Designing systems with intelligent data lifecycle management – automatically moving data between SSD (hot), HDD (cool/cold), and potentially tape (archival) – is crucial for optimizing both performance and cost.

- Cost Optimization Reigns: For backend services handling logs, backups, media assets, or historical analytics, HDD-based object storage (like S3 Glacier Deep Archive or Azure Archive Storage) often provides the most economical foundation.

- Performance Assumptions: Don't assume 'disk' means slow SATA drives. High-performance HDDs in large arrays can still deliver significant throughput for sequential workloads common in big data processing, often at a lower cost than equivalent flash capacity.

While SSDs will continue to dominate performance tiers and client devices, the narrative of the HDD's demise is clearly premature. Its resilience highlights a fundamental truth in large-scale infrastructure: raw cost efficiency for bulk storage remains paramount. The spinning disk, leveraging decades of refinement and continuous innovation in density, will likely remain the silent, whirring backbone of the world's cold data for years to come, proving that in the complex calculus of data center economics, sometimes the older, slower technology is precisely the right tool for the job.

(Source: Analysis based on DSH&R blog post 'Hard Disk Unexpectedly Not Dead' and industry trends)

Comments

Please log in or register to join the discussion