Memory costs for ISP routers, gateways, and set-top boxes have jumped sevenfold, potentially ending free installation deals and slowing fiber deployments.

The semiconductor industry's memory crisis has reached a critical juncture, with DRAM price increases now threatening to reshape the economics of home internet infrastructure. Recent analysis from Counterpoint Research reveals that memory costs for ISP-provided equipment have skyrocketed to levels that could fundamentally alter how broadband services are delivered to consumers.

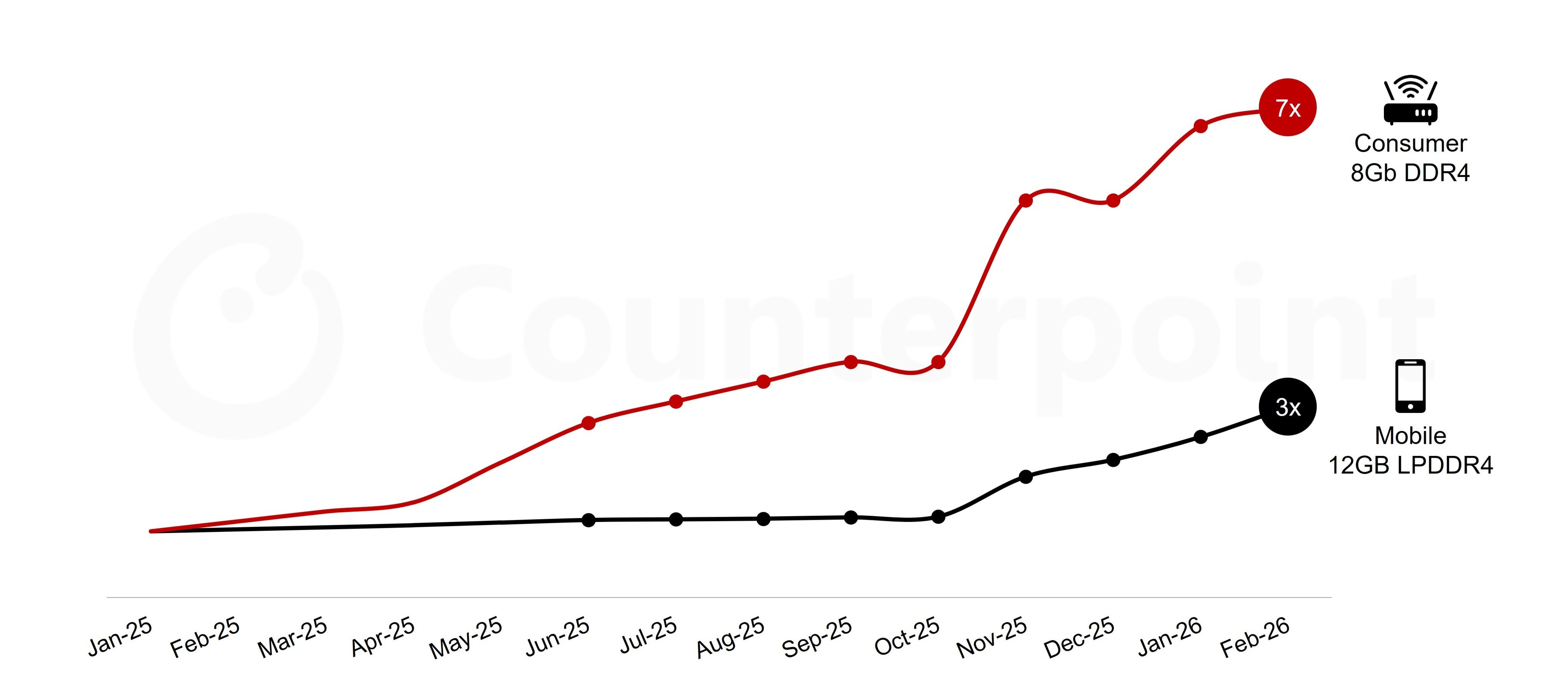

The Sevenfold Price Increase

According to Counterpoint's findings, the memory component that once represented a modest 3% of the bill of materials for routers, gateways, and set-top boxes has ballooned to 20% of total production costs. This dramatic shift represents a sevenfold increase in memory expenses that equipment manufacturers must now absorb or pass along to service providers.

The timing couldn't be worse for the broadband industry, which has long relied on aggressive pricing strategies and promotional offers to attract and retain customers. Free installation deals, complimentary set-top boxes, and other customer acquisition incentives may soon become unsustainable luxuries.

Why Routers Are Hit Hardest

Routers appear to be bearing the brunt of this crisis, primarily because their manufacturers typically lack the negotiating leverage and long-term supply contracts enjoyed by larger industry players. The situation has been exacerbated by several converging factors:

DDR4 Phase-Out Timing: The memory shortage struck just as DDR4 was being phased out of production, creating a perfect storm of supply constraints and surging demand.

AI Feature Creep: The industry's rush to add AI-powered features to networking equipment has dramatically increased memory requirements. Some modern routers and set-top boxes now ship with as much RAM as entry-level personal computers, further straining already tight supply chains.

Mobile vs. Consumer Pricing Gap: The price differential between mobile-optimized LPDDR4 memory and standard DDR4 used in consumer networking gear has widened significantly, as illustrated in Counterpoint's comparative pricing analysis.

Industry-Wide Impact

Major telecommunications equipment manufacturers have begun acknowledging the severity of the situation in their financial disclosures. Nokia's CEO, in the company's Q4 2025 earnings statement, noted that while memory pricing isn't a dominant factor across the entire organization, the company is actively working to secure supply commitments and plans to pass increased costs through to pricing structures.

MediaTek has taken a more direct approach, stating that while it maintains adequate memory supplies for its datacenter products, it will adjust pricing across other segments to reflect rising supply chain costs. The company also indicated it would allocate limited memory supplies based on overall product profitability.

Qualcomm's leadership has been equally candid, identifying the memory shortage and associated price increases as likely defining factors for the handset industry throughout the current fiscal year, with datacenter priorities taking precedence over consumer devices.

Fiber Rollout Implications

The memory crisis threatens to impact more than just individual pieces of equipment. Industry analysts warn that the combined cost increases for networking hardware could slow the pace of ISP fiber rollouts across the industry. When equipment costs that were previously negligible become significant line items, service providers must carefully evaluate the economics of network expansion.

This cost pressure arrives at a particularly challenging moment for the broadband industry. Many providers are simultaneously managing the transition to fiber infrastructure, upgrading existing copper networks, and competing in increasingly saturated markets where customer acquisition costs are already under intense scrutiny.

Consumer Impact

While monthly internet service pricing may remain relatively stable in the short term, consumers should expect to see changes in how equipment is provisioned and priced. The era of "free installation" and complimentary set-top boxes may be drawing to a close as service providers seek to protect their margins in the face of rising hardware costs.

Some potential changes consumers might encounter include:

- Equipment rental fees becoming more prominent in billing statements

- Installation charges that were previously waived

- Equipment purchase options replacing traditional rental models

- Reduced promotional offers that bundle free hardware with service contracts

The Road Ahead

The memory shortage shows no signs of abenuous relief, with Counterpoint researchers projecting the current pricing environment to persist through at least June, with potential for continued escalation depending on supply chain developments.

For the broadband industry, this represents more than a temporary cost increase—it signals a fundamental shift in how networking equipment economics must be approached. Service providers may need to reconsider their hardware strategies, potentially exploring longer equipment lifecycles, alternative memory technologies, or redesigned products that achieve similar functionality with reduced memory footprints.

As the industry navigates these challenges, the ultimate impact on broadband deployment speeds, service pricing, and consumer choice remains to be seen. What's clear is that the memory crisis has evolved from a component supply issue to a strategic challenge that could reshape the economics of internet connectivity for years to come.

Comments

Please log in or register to join the discussion