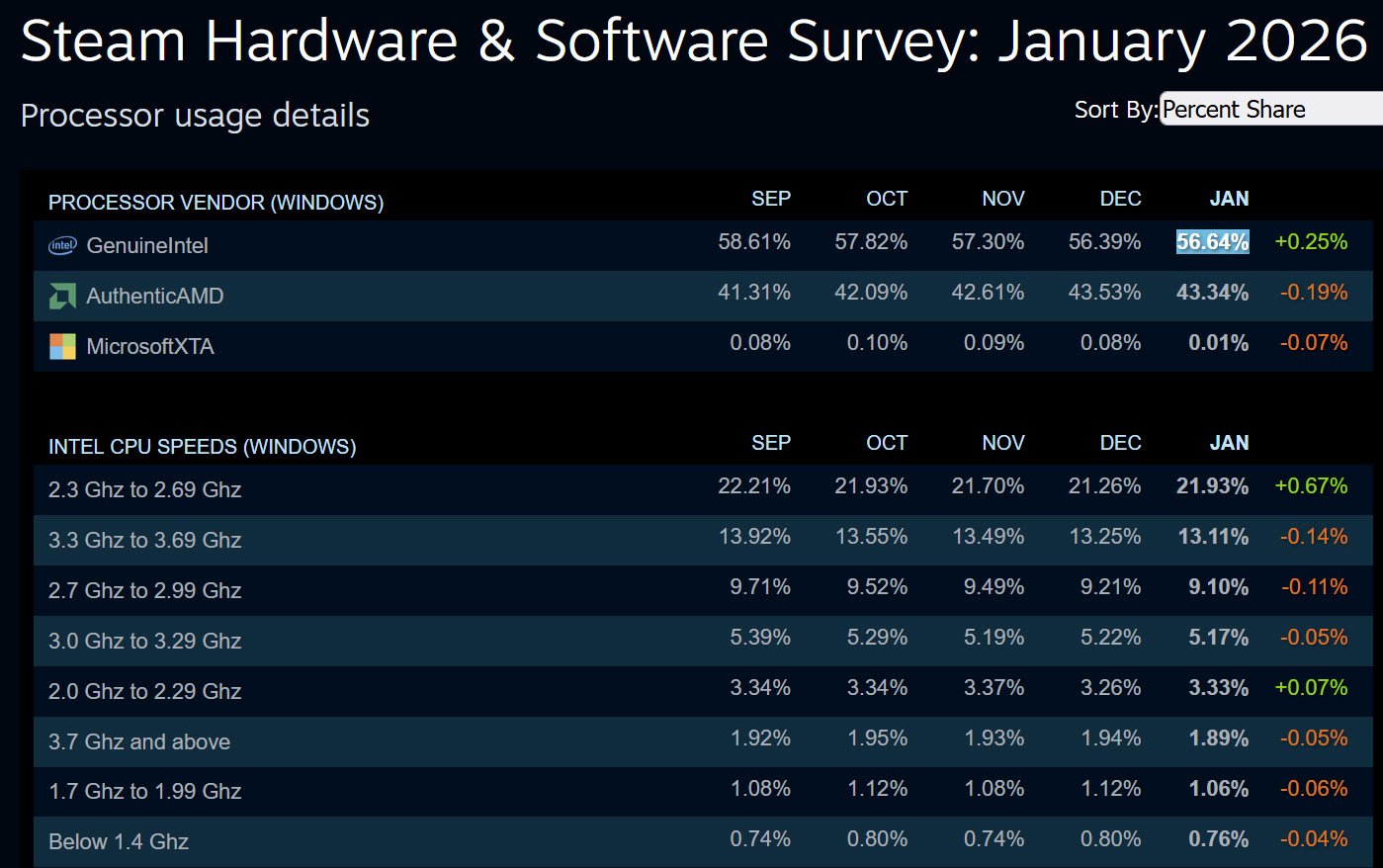

Intel's 0.25% market share gain in the Steam Hardware Survey marks its first growth in months, potentially driven by DDR4 affordability and aggressive pricing as the RAM crisis reshapes PC building priorities.

After months of consistent decline, Intel's consumer CPUs have enjoyed a small but significant spell of market share growth, at least according to the latest Steam Hardware Survey (January 2026 data). The latest statistics raise a couple of key questions. Firstly, could this mark the beginning of an Intel comeback? Secondly, why might Intel platforms be more attractive in the current PC market?

So, the change in share is quite small, at 0.25% up in Intel's favor, in January 2026 data. We know the SHWS hasn't got the strongest reputation for rigorous statistical accuracy, despite the size of the user base. Nevertheless, it is entertaining to ponder whether something larger is happening in the CPU market, and why the balance could be shifting.

An Intel comeback?

Though Intel has broken its downtrend in this latest set of survey statistics, it isn't possible to say whether this is truly a change in fortunes. As Aristotle (probably) said, "one swallow does not a spring make." So, one result doesn't provide a lot of certainty for extrapolations.

We'd need three months of data to confirm a popularity plateau, resistance point, or reversal of fortunes for Intel in the gaming CPU market. That means we are still a long way off the establishment of a reliable trend.

Why might Intel gain market share in 2026?

If we assume that Intel is once again going to consistently grow its consumer CPU market share, it is interesting to look at its current strengths and recent platform announcements.

Ahead of the RAMpocalypse, PC DIY forums and social media generally seemed to steer builders toward AM5 plus DDR5 for creating a potent 'future-proof' PC system. After several months of exploding RAM pricing, this particular path to PC Nirvana has lost its glossy shine.

In the PC DIY space, pricing and availability may have worked in Intel's favor over recent months. The iconic PC chipmaker's 13th and 14th-generation processors appear to have remained in stock, often discounted. They can be used with cheaper DDR4 RAM (that upgraders may already have), with plentiful well-priced DDR4 motherboards (e.g. B760) still at retailers. Moreover, these remain decent platforms for most gamers, who will typically be performance-limited by their GPU choice.

We've also seen some fairly drastic and generous discounts on Intel's current generation processors, with Core Ultra 200 series chips bundled with motherboards, coolers, popular games, or even just slashed in price in the second half of 2025.

A cultural shift from future-proofing to buying the best value $/FPS system today seems to have taken hold in Q4 2025 and persists to this day. At CES 2026, we also noticed more positives for Intel. Its next-gen Panther Lake chips for laptops were far more warmly welcomed than AMD's Ryzen AI 400 series refresh. This won't have started to trickle through to Steam survey results, of course, but Intel traditionally has stronger laptop-maker support, and Panther Lake should ensure that isn't eroded in 2026.

The RAM crisis appears to be reshaping PC building priorities. With DDR5 prices remaining stubbornly high while DDR4 availability remains strong, Intel's platform flexibility offers a compelling alternative. The B760 chipset, in particular, has emerged as a sweet spot for budget-conscious builders, offering many features of higher-end chipsets at lower price points.

This shift toward value-oriented builds could represent a broader market correction. During the pandemic-era component shortages, many enthusiasts prioritized future-proofing and cutting-edge specifications. Now, with economic uncertainty and component inflation affecting purchasing decisions, the calculus has changed.

Intel's aggressive pricing strategy for its 13th and 14th-gen processors has kept these chips competitive even against newer AMD offerings. The company's willingness to bundle processors with motherboards and other components further sweetens the deal for budget builders.

Looking ahead, Intel's ability to maintain this momentum will depend on several factors. The company's upcoming Arrow Lake desktop processors will need to deliver compelling performance improvements to justify their premium pricing. Meanwhile, AMD isn't standing still, with its Ryzen 9000 series and upcoming Strix Point APUs promising to push the performance envelope further.

For now, Intel's modest Steam survey gains suggest that value and availability are winning out over pure performance metrics in the current market environment. Whether this translates to sustained market share growth remains to be seen, but it does indicate that Intel's strategy of offering diverse platform options at various price points is resonating with cost-conscious PC builders.

The Steam Hardware Survey, while not perfectly representative of the broader market, does provide valuable insights into gaming PC trends. If Intel can maintain its pricing advantage and continue offering compelling DDR4 options alongside its DDR5 platforms, the company may well see its market share continue to climb in the coming months.

Comments

Please log in or register to join the discussion