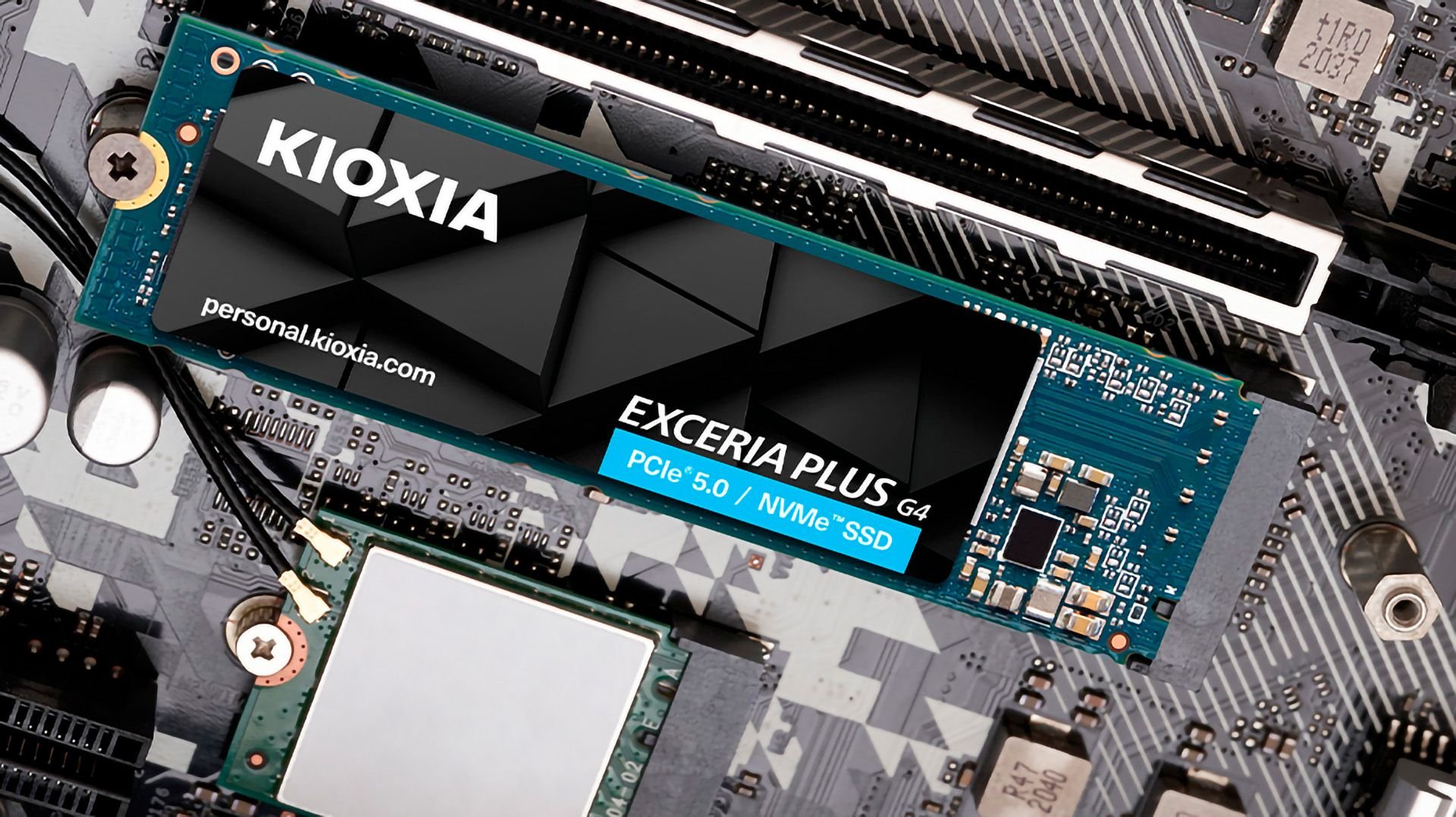

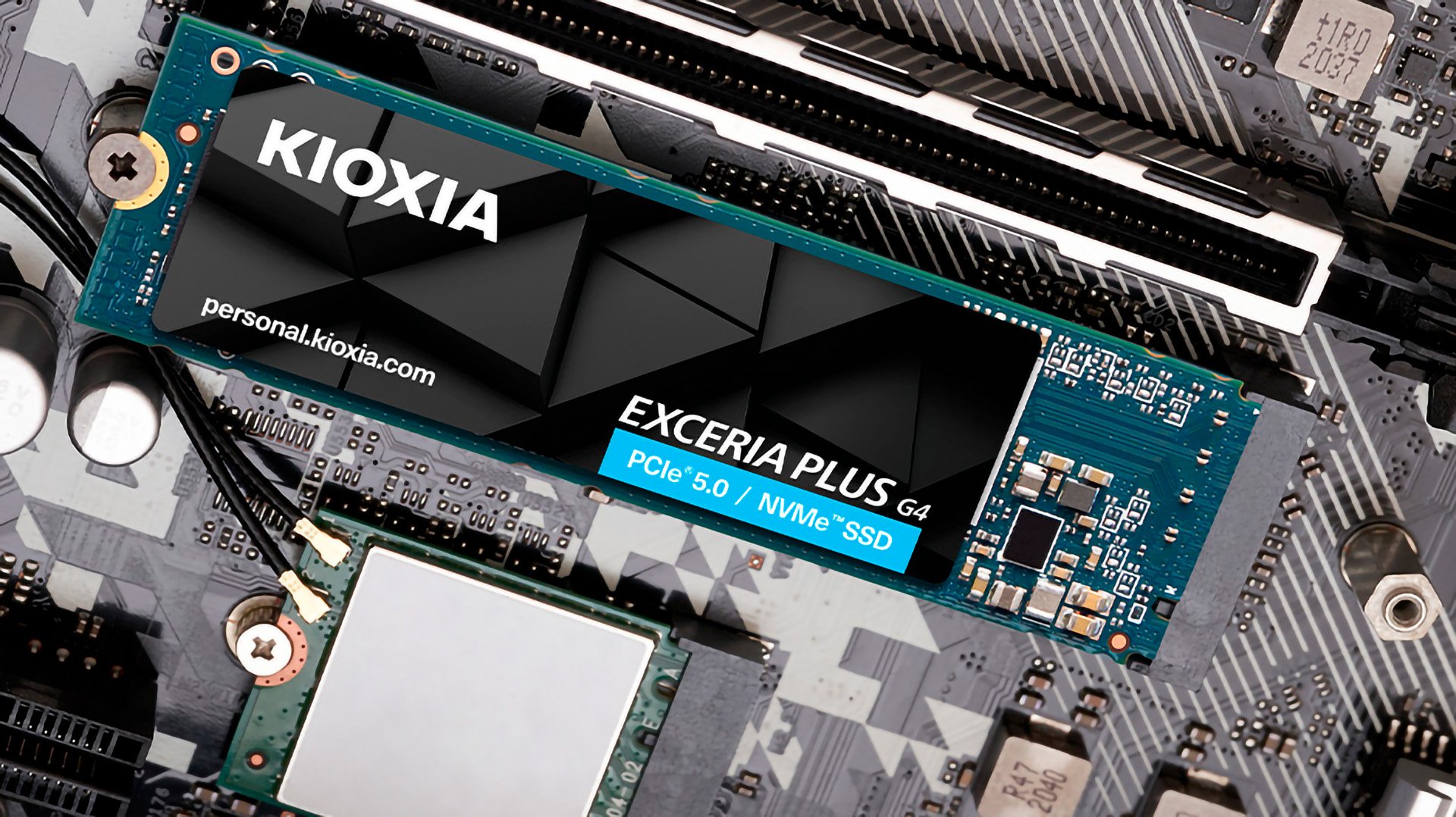

A Kioxia executive has confirmed that the era of sub-$50 1TB SSDs is over, with the company's NAND production capacity sold out for 2026 and likely through 2027. The AI boom has fundamentally reshaped the storage market, driving price increases of over 50% across all SSD categories and creating a supply shortage that manufacturers are addressing through unconventional distribution strategies and advanced fab technologies.

The window for budget-friendly 1TB SSDs has definitively closed. Shunsuke Nakato, Managing Director of Kioxia's Memory Business Unit, stated unequivocally that the days of affordable consumer storage are over, at least until the current AI-driven demand surge subsides. In a meeting held at Seoul's Nine Tree Premier Locus Hotel, Nakato revealed that Kioxia's entire production volume for this year is already sold out, with similar conditions expected to persist through 2026 and likely into 2027.

"To be honest, this year's production volume is already sold out. The days of cheap 1TB SSDs for around 7,000 yen (approximately 60,000 South Korean won or about $45 USD) are over," Nakato explained. This price point represents the threshold that budget-conscious PC builders and system integrators had come to expect during 2023, which marked the golden year for SSD pricing. During that period, 1TB drives routinely sold for under $50, with some entry-level models hitting as low as $35.

The market shift began in 2024 with gradual price increases, but 2025 has seen a dramatic acceleration. Current market data shows that even the most affordable 1TB SATA SSDs now start at approximately $73—a price increase exceeding 50% compared to the 2023 lows. This trend affects the entire SSD spectrum, from legacy SATA interfaces to cutting-edge PCIe 5.0 models.

Technical Price Analysis Across SSD Categories

Examining specific models reveals the extent of the price restructuring:

- PCIe 5.0 Drives: The Corsair MP700 Pro XT 1TB, which launched at $159.99 in October 2024, has increased 38% to $219.99

- High-End PCIe 4.0: Samsung's 990 Pro 1TB jumped from $109.99 to $199.99, an 83% increase

- Mid-Range PCIe 3.0: Western Digital's SN700 1TB experienced the most dramatic shift, rising 132% from $129.99 to $299.99

- SATA Legacy: Even established models like Samsung's 870 Evo 1TB increased 51% from $99.99 to $149.99

These figures represent street prices from major retailers and reflect real market conditions rather than manufacturer suggested retail prices. The consistency of increases across all interface types and performance tiers indicates a fundamental supply constraint rather than a targeted premium strategy.

NAND Supply Dynamics and Manufacturing Response

Kioxia's situation reflects broader industry conditions. The company's Yokkaichi and Kitakami fabrication plants are operating at full capacity, with the former implementing advanced AI and IoT systems that collect approximately 50 terabytes of manufacturing data daily to optimize yield rates. The Kitakami facility is preparing for full-scale production of Kioxia's 8th-generation BiCS (BiCS8) flash memory, which represents the company's latest technological advancement in 3D NAND architecture.

Nakato emphasized that supply constraints are physical rather than logistical. "It's physically impossible to arbitrarily accelerate delivery or increase volume simply because orders are piling up," he stated. This limitation stems from the multi-year timeline required to expand fabrication capacity, which involves billions of dollars in investment and complex construction processes.

Unconventional Distribution Strategy

Kioxia has adopted a "gentleman's agreement" approach to NAND distribution, departing from traditional auction-based or first-come-first-served models. This strategy prioritizes long-term relationships and mutual supply planning with key partners rather than maximizing short-term revenue through competitive bidding.

"Rather than simply prioritizing supply to the highest bidders, we mutually agree on annual supply plans with our long-term partners and distribute them accordingly," Nakato explained. This approach helps maintain supply chain stability for critical customers while ensuring predictable production planning for Kioxia itself.

Market Implications for Consumers and System Builders

The AI boom's impact on storage markets extends beyond simple price increases. Data centers and enterprise customers are consuming NAND capacity at unprecedented rates to support AI model training and inference workloads, which require massive storage arrays for datasets and model checkpoints. This enterprise demand has effectively outbid consumer market demand for available NAND supply.

For PC builders and storage upgraders, the practical implications are significant. The sub-$50 1TB SSD, which became the standard recommendation for budget builds and system upgrades, is now effectively extinct. Current entry-level pricing sits in the $70-80 range, with premium models exceeding $200 for 1TB capacities.

The supply situation suggests that prices will maintain their upward trajectory through 2026, with potential stabilization or correction unlikely until at least 2027. This timeline aligns with industry projections for new fabrication capacity coming online and the eventual maturation of current AI infrastructure investments.

Strategic Recommendations for Consumers

Given the extended shortage timeline, consumers have limited options. Building or upgrading systems in the immediate future requires accepting current price levels. For those with flexibility, delaying purchases until late 2026 or early 2027 may yield better pricing, though this carries the risk of further increases in the interim.

The storage market's transformation represents a fundamental shift from the oversupply conditions that characterized 2023. What was once a buyer's market with aggressive pricing competition has become a seller's market constrained by physical production limits and unprecedented demand from the AI sector.

Kioxia's experience mirrors conditions at other major NAND manufacturers, including Samsung, Micron, and SK Hynix, all of which have reported similar supply constraints and price increases. The industry's collective capacity expansion efforts, while substantial, require years to materialize, leaving consumers to navigate a permanently altered storage landscape for the foreseeable future.

Comments

Please log in or register to join the discussion