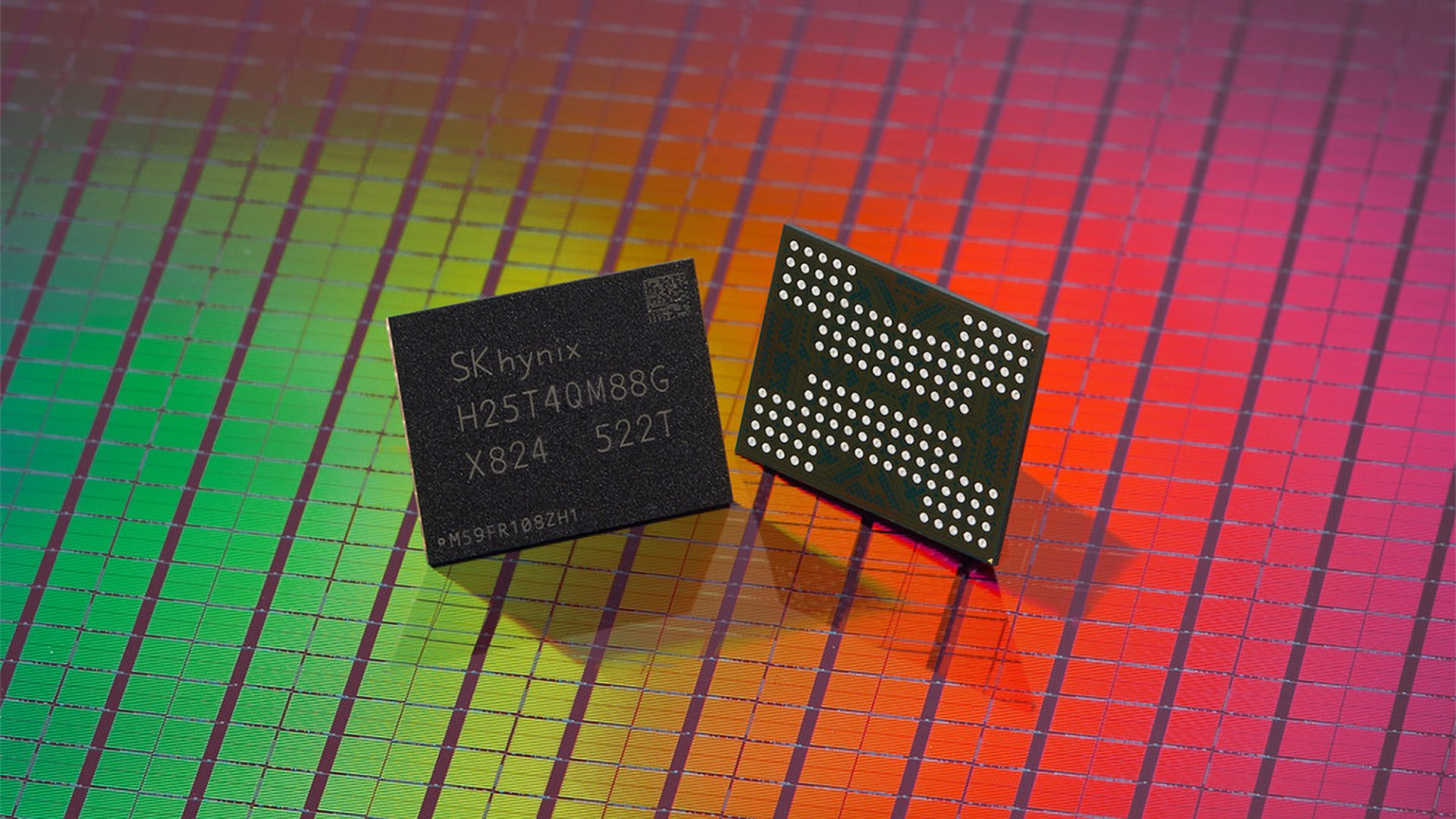

Samsung and SK Hynix are restructuring memory contracts toward shorter durations with post-settlement pricing mechanisms, capitalizing on AI-driven demand and constrained supply to achieve 40-50% operating margins.

The memory market is undergoing a structural power shift as Samsung and SK Hynix implement fundamental changes to their supply agreements. Both companies have moved away from traditional long-term fixed-price contracts, adopting shorter-term agreements with post-settlement pricing mechanisms that shift financial risk toward buyers. This strategic pivot coincides with DRAM and NAND prices increasing 20-30% quarterly since Q4 2023, driven by unprecedented demand for AI infrastructure components and constrained production capacity at advanced nodes.

Post-Settlement Pricing Mechanics

Under conventional contracts, memory prices were locked at signing with limited quarterly adjustments (±10%). The new post-settlement model delivers products at initial prices but calculates final payments based on prevailing market rates at contract expiration. If prices rise during the term, buyers pay supplemental charges; if prices fall, suppliers absorb the difference. This mechanism favors memory makers during upward price cycles—currently exemplified by DRAM spot prices climbing 15% month-over-month since March 2024.

Industry sources confirm Samsung, SK Hynix, and Micron have deployed this model primarily with North American hyperscalers. One procurement executive noted: "Supply assurance now outweighs cost predictability—we'll accept retroactive pricing to secure HBM3E and DDR5 inventory." This shift indicates supplier confidence in sustained price elevation, with contract durations simultaneously shrinking from 6-12 months to quarterly or even monthly terms.

Margin Expansion and Supply Constraints

The financial impact is substantial: Samsung and SK Hynix now report operating margins of 40-50% for memory products—levels unseen since 2018. DRAM profitability leads this surge, while NAND margins reached 20% in Q4 2025 and are projected to climb further through staged Q1-Q2 2026 price hikes. Conservative capital expenditure ($27 billion industry-wide in 2024 vs. $38 billion in 2023) continues constraining supply growth despite demand for advanced nodes like SK Hynix's 1bnm DDR5 and Samsung's 12nm-class DRAM.

Market Implications

Buyer impact varies significantly:

- Apple shifted negotiations from biannual to quarterly cycles, absorbing projected 15-20% LPDDR cost increases for iPhone 18 series rather than raising prices

- Chinese smartphone brands face allocation shortages, forcing hardware downgrades and launch delays

- Hyperscalers struggle to secure multi-year commitments, accepting shorter contracts with price-adjustment clauses

TF International Securities data indicates server DRAM contract prices will rise another 13-18% in Q3 2024, while mobile DRAM increases could reach 25%. The imbalance stems from production limitations—only three companies (Samsung, SK Hynix, Micron) control 92% of DRAM capacity suitable for AI accelerators.

Structural Shift Outlook

This represents more than a cyclical upturn—it's a fundamental rebalancing of buyer-supplier dynamics. Memory makers prioritize margin protection over volume stability, leveraging AI-driven scarcity to enforce favorable terms. While historical patterns suggest eventual capacity expansion could ease constraints, current fab timelines indicate no significant production increases before late 2026. Until then, post-settlement pricing and quarterly contracts will likely remain the norm, with suppliers maintaining pricing power through disciplined supply management.

Data sources: DRAMeXchange, IC Insights, SK hynix Investor Relations

Comments

Please log in or register to join the discussion