Meta plans to lay off approximately 10% of its Reality Labs division, disproportionately affecting teams working on VR headsets and Horizon Worlds, signaling a strategic retreat from its metaverse ambitions.

Meta is preparing to cut roughly 1,500 jobs from its 15,000-person Reality Labs division, according to sources cited by The New York Times. The layoffs, expected to be announced this week, will disproportionately impact teams developing VR hardware and the Horizon Worlds metaverse platform. This restructuring comes as Meta redirects billions in resources toward artificial intelligence infrastructure, marking a significant recalibration of the company's long-term vision.

What's Actually Changing

Reality Labs has consistently operated at a loss, reporting a $13.7 billion deficit in 2025 alone. The division encompasses Meta's Quest VR headsets, Ray-Ban smart glasses, and Horizon Worlds—the social VR platform central to Zuckerberg's metaverse vision. Insiders indicate the cuts specifically target teams working on consumer-facing hardware and metaverse experiences, while research-focused groups may be spared.

Strategic Pivot to AI

The layoffs coincide with Meta's aggressive investment in AI compute infrastructure. CEO Mark Zuckerberg recently announced a new "Meta Compute" initiative targeting "tens of gigawatts" of AI-specific data centers by 2030. This infrastructure supports Meta's generative AI products (like Llama models) and ad targeting systems—areas delivering tangible revenue growth compared to Reality Labs' experimental projects. The reallocation suggests Meta is deprioritizing Zuckerberg's decade-long metaverse bet in favor of competing in the generative AI race dominated by OpenAI, Google, and Anthropic.

Context and Limitations

Meta's metaverse ambitions have faced multiple setbacks:

- User Engagement: Horizon Worlds reportedly struggled to retain users beyond initial curiosity, with internal metrics showing low sustained activity.

- Hardware Challenges: The Quest Pro headset underperformed commercially, while Apple's Vision Pro captured developer attention despite its higher price point.

- Financial Reality: Reality Labs lost $42 billion between 2020-2025, straining investor patience amid rising AI investments.

Implications

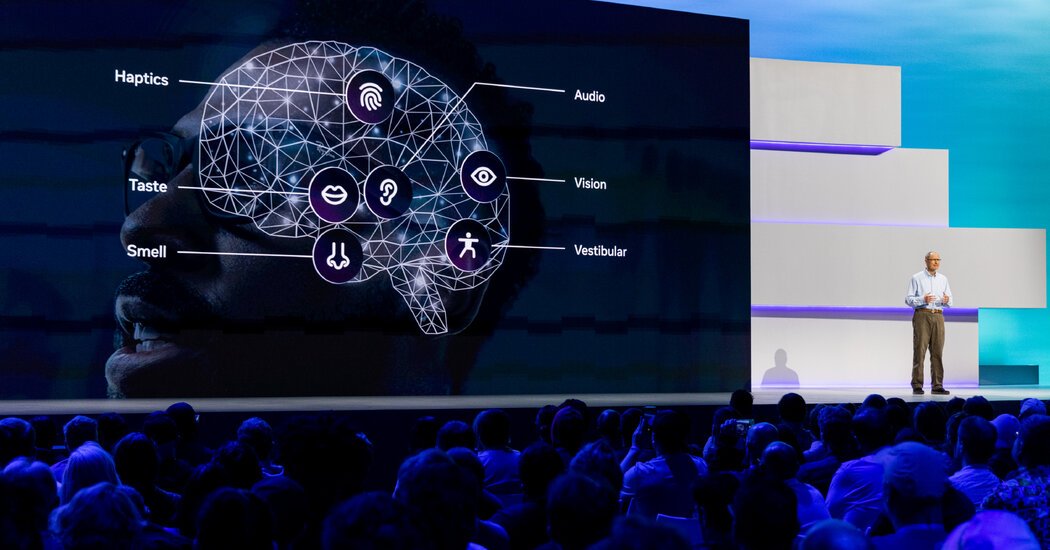

This downsizing doesn't signal a complete abandonment of VR/AR. Meta continues developing neural interfaces and AR glasses, but the cuts reveal a narrowed focus on foundational technologies rather than consumer metaverse experiences. For the industry, it underscores the difficulty of monetizing immersive environments at scale. Competitors like Apple and Sony now face reduced pressure to match Meta's former spending levels, potentially slowing ecosystem development.

The restructuring highlights a broader industry pattern: capital is rapidly shifting from speculative metaverse projects toward generative AI applications with clearer enterprise and consumer use cases. Meta's move may accelerate consolidation in the VR hardware space, where only companies with diversified revenue streams can sustain long-term bets.

Comments

Please log in or register to join the discussion