Texas-based Noveon Magnetics raised $215 million in venture funding to scale domestic rare earth magnet manufacturing, part of a record $630 million invested in U.S. critical mineral startups during 2025 as America accelerates efforts to reduce dependence on Chinese supply chains.

Noveon Magnetics, a Texas-based manufacturer specializing in rare earth permanent magnets, has secured $215 million in venture capital funding to expand its U.S. production capabilities. The investment, led by Rajeev Misra's One Investment Management with a $200 million contribution, positions the firm to become a significant player in America's strategic reshoring initiative for critical materials. This funding arrives amid escalating U.S.-China trade tensions that have exposed vulnerabilities in global supply chains for essential industrial components.

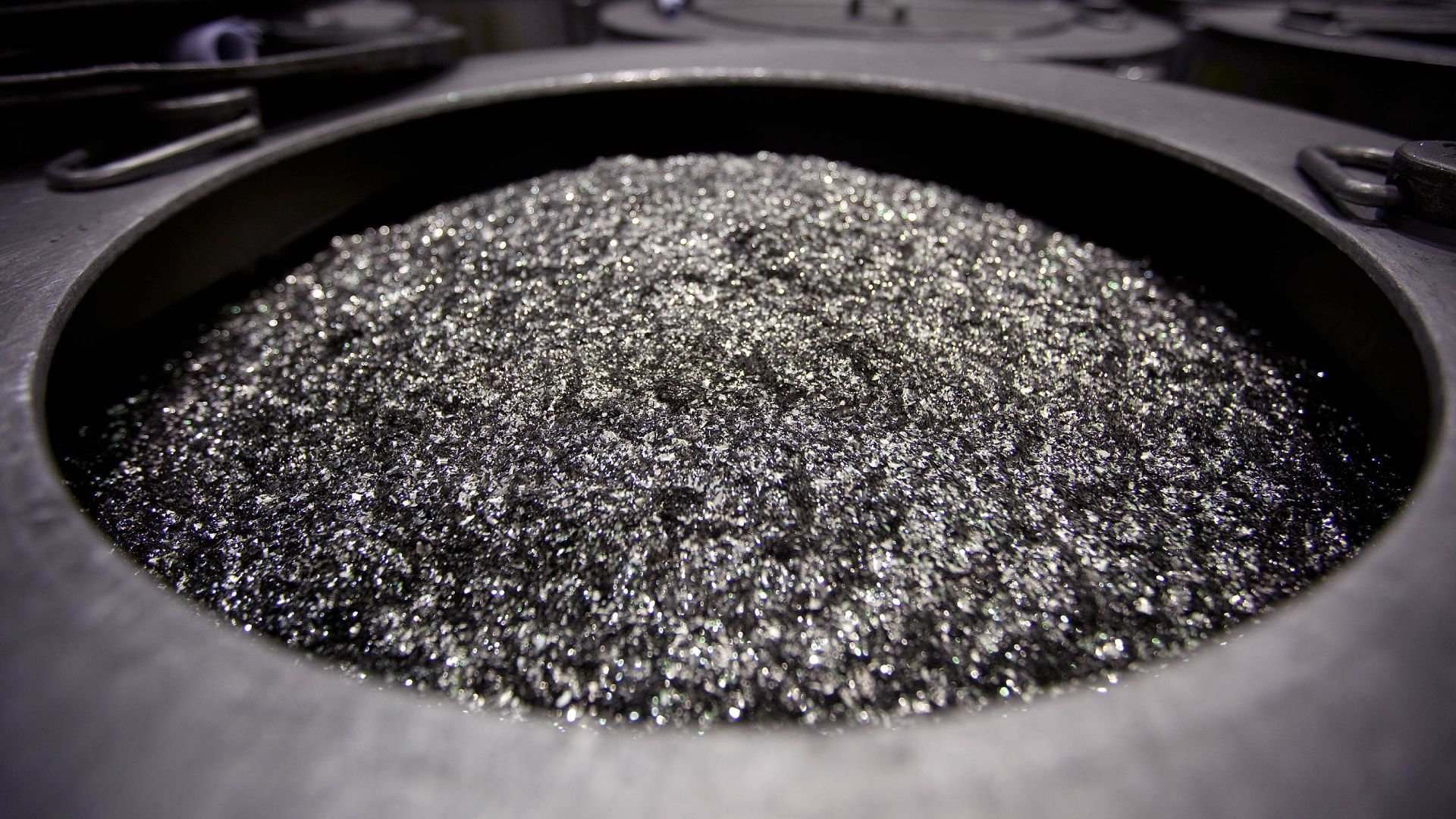

Rare earth magnets, particularly neodymium-iron-boron (NdFeB) variants, deliver exceptional magnetic strength in compact form factors. They enable critical performance characteristics in multiple industries: hard disk drives require them for actuator arm precision (enabling capacities exceeding 20TB like Western Digital's  Gold 24TB models), electric vehicle motors depend on their flux density for efficiency, and defense systems utilize them in guidance systems and sensors. China currently controls approximately 90% of global refined rare earth production and 80% of magnet manufacturing, creating significant supply chain risk.

Gold 24TB models), electric vehicle motors depend on their flux density for efficiency, and defense systems utilize them in guidance systems and sensors. China currently controls approximately 90% of global refined rare earth production and 80% of magnet manufacturing, creating significant supply chain risk.

Noveon's funding is part of a broader $630 million venture capital influx into U.S. rare earth startups during 2025 – a record annual investment for the sector. Parallel developments include:

- $670 million in combined loans and equity for Vulkan Elements' North Carolina magnet factory

- $80 million for Indiana-based ReElement Technologies' magnet recycling operations

- The Pentagon acquiring a 15% stake in MP Materials, which is building a Texas magnet production facility

These investments target vertical integration, from mining ( rare earth ores) to magnet sintering and recycling. While scaling will take years due to complex metallurgy and stringent quality requirements, the collective projects aim to establish redundant U.S.-controlled supply lines. The strategy prioritizes strategic resilience over immediate market displacement; even optimistic projections show U.S. production capturing under 15% of global magnet supply by 2030.

rare earth ores) to magnet sintering and recycling. While scaling will take years due to complex metallurgy and stringent quality requirements, the collective projects aim to establish redundant U.S.-controlled supply lines. The strategy prioritizes strategic resilience over immediate market displacement; even optimistic projections show U.S. production capturing under 15% of global magnet supply by 2030.

Market implications are multifaceted. First, hard drive manufacturers like Seagate and Western Digital gain potential alternatives to Chinese-sourced magnets, though qualification cycles for new suppliers typically require 18-24 months. Second, the investments include unprecedented government-industry financial entanglements, such as the U.S. receiving $50 million in Vulkan equity. Third, geopolitical leverage shifts: China's November 2026 suspension of rare earth export controls gives the U.S. a finite window to build domestic capacity before potential future trade actions.

Complementing these efforts, U.S. lawmakers recently proposed a $2.5 billion national stockpile for critical minerals. This acknowledges that while partnerships with allies like Japan and Korea provide interim supply solutions, long-term security requires both domestic production and strategic reserves. The magnet supply chain reshoring exemplifies a broader trend of technology nationalism, mirroring the CHIPS Act's semiconductor focus but addressing an equally critical materials bottleneck in electronics and defense manufacturing.

Comments

Please log in or register to join the discussion