The Trump administration's decision to lift restrictions on NVIDIA's H20 AI chip sales to China reverses Biden-era 'freeze-in-place' export controls, aiming to keep China dependent on U.S. technology. This policy pivot risks accelerating China's AI deployment capabilities while testing a 'sliding-scale' approach to tech containment. The move underscores deepening geopolitical tensions and forces developers to navigate unstable dependencies amid China's relentless self-reliance push.

The Trump administration’s abrupt reversal of NVIDIA’s H20 AI chip export ban to China isn’t just a policy tweak—it’s an attempt to rewind three years of tech containment strategy. By granting licenses for the restricted H20 GPU, the White House aims to undercut Huawei’s rise and tether Chinese developers to the U.S. AI stack. But in a world where China’s technological self-reliance has become existential, this gambit exposes a high-stakes clash of ideologies and could inadvertently fuel the very independence it seeks to prevent.

The Great Unwind: From Freeze-in-Place to Sliding Scale

In October 2022, the Biden administration deployed a "freeze-in-place" strategy: aggressive export controls throttled China’s access to cutting-edge AI chips, aiming to cement a U.S. lead by capping the computational power available to Chinese firms. NVIDIA’s H20 chip—a deliberately neutered variant of its flagship GPUs—was designed to comply with these rules, trading raw compute for enhanced memory bandwidth optimized for AI inference (deploying models, not training them).

Now, the Trump administration has pivoted. Following CEO Jensen Huang’s White House meeting on July 10, NVIDIA announced it would resume H20 shipments after receiving "assurances" licenses would be approved. The rationale? A "sliding-scale" approach that eases restrictions as Chinese rivals like Huawei advance, allowing U.S. firms to compete directly in China’s market. Commerce Secretary Howard Lutnick framed it bluntly: The goal is to "get Chinese developers addicted to the American AI stack."

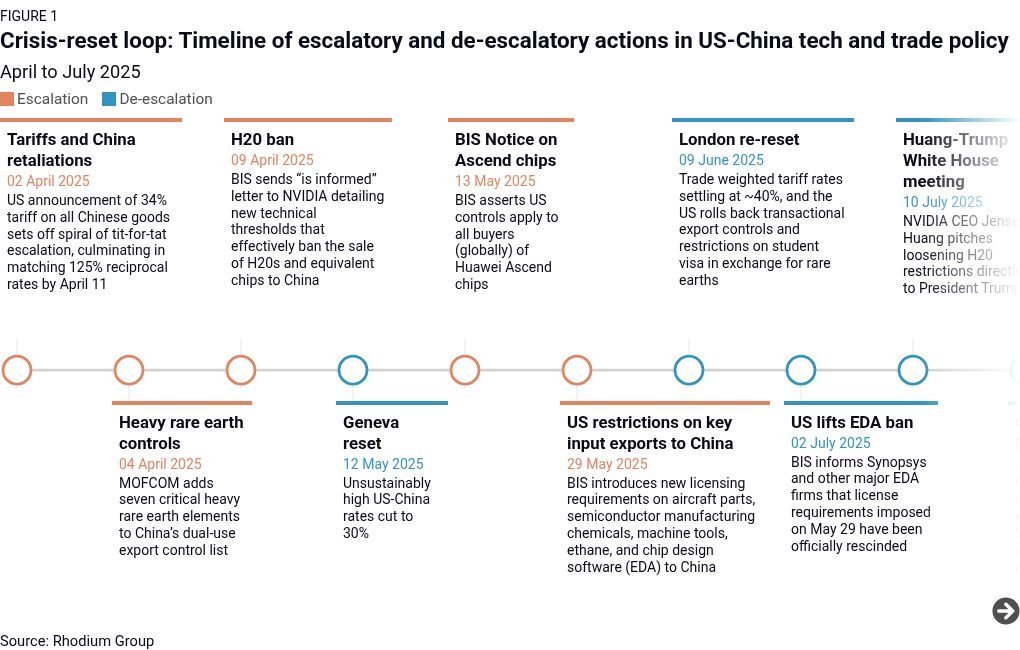

Timeline of U.S. chip control policies and key geopolitical events. (Source: Rhodium Group)

Timeline of U.S. chip control policies and key geopolitical events. (Source: Rhodium Group)

Why This Isn’t 2022 Anymore

China’s relentless three-year sprint toward self-reliance has reshaped the battlefield. Huawei’s Ascend GPUs, despite U.S. sanctions, now achieve performance rivaling restricted NVIDIA chips—a feat amplified by clandestine maneuvers like using shell companies (Sophgo, PowerAir) to procure components from TSMC. Meanwhile, breakthroughs like DeepSeek’s R1 reasoning model proved Chinese firms could innovate with limited resources, challenging the core premise of U.S. controls.

"There’s no stopping the pace of domestic innovation. If one layer of the AI stack lags, smart engineers at other layers compensate, and the whole stack moves forward." — NVIDIA CEO Jensen Huang, speaking in Beijing.

The H20 reversal thus arrives as a tactical concession, driven by China’s coercive leverage:

- Rare Earth Dominance: China restricted licenses for critical minerals like gallium and germanium, threatening global supply chains.

- Anti-Monopoly Pressure: SAMR (China’s market regulator) strategically approved U.S. chip design mergers (e.g., Synopsys-Ansys) while probing NVIDIA, signaling quid-pro-quo potential.

The Six Faulty Assumptions Behind the H20 Gamble

Administration officials argue that reopening the H20 spigot will starve Huawei of market oxygen. But this relies on risky assumptions:

Sliding Scale = Dependency: Easing controls as Chinese chips advance assumes Huawei won’t close the ecosystem gap. Yet Huawei is already bridging NVIDIA’s CUDA moat with translation software (mirroring its HarmonyOS strategy for Android), lowering switching costs for developers.

Inference Chips Are ‘Safe’: The H20 excels at inference—powering real-world AI in smart factories, logistics, and edge computing. Unrestricted sales could turbocharge China’s "AI+" initiatives, where deployment scale trumps raw training power.

# Simplified comparison: H20 vs. Huawei Ascend 910B

H20_spec = {

"FP32 Performance": "148 TFLOPS",

"Memory Bandwidth": "1.5 TB/s",

"Use Case": "Inference-optimized"

}

Ascend_910B_spec = {

"FP32 Performance": "320 TFLOPS",

"Memory Bandwidth": "1 TB/s",

"Use Case": "Training & Inference"

}

# H20 trades peak compute for memory—ideal for deployment, not cutting-edge R&D.

Non-Interventionist Beijing: Wishful thinking. China’s "Autonomous and Controllable" policies already favor domestic chips via procurement rules, cybersecurity mandates, and energy efficiency standards that technically bar H20 installations.

Foundational Controls Hold: While H20 sales ease, stricter semiconductor manufacturing equipment (SME) rules remain to hobble China’s chip production. But SME giants like ASML argue this only accelerates Chinese toolmakers like Naura.

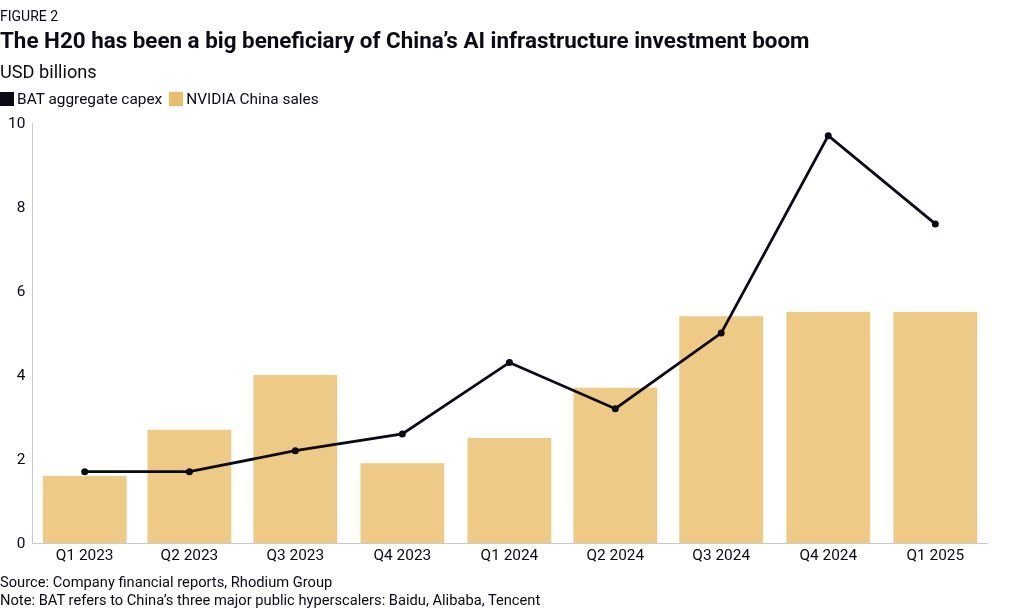

Projected AI chip production capacity: Huawei vs. NVIDIA. (Source: Rhodium Group)

Projected AI chip production capacity: Huawei vs. NVIDIA. (Source: Rhodium Group)

The Unstable Equilibrium Ahead

For developers, this policy whiplash forces brutal trade-offs. Chinese firms will buy H20s to relieve compute bottlenecks but continue hedging with Huawei—fueled by fears of future U.S. crackdowns. As one Beijing-based AI engineer noted: "Every license approval feels like a stay of execution, not a pardon."

Globally, the U.S. risks alienating allies if ad-hoc concessions to China undermine multilateral tech containment. Measures like the pending "Chip Security Act" (requiring hardware-level tracking of exports) or economic security clauses in trade deals could face delays as partners hedge.

The H20 saga reveals a painful truth: Geopolitics now shapes silicon as much as innovation. With a potential Trump-Xi summit looming, the reversal offers China a window to extract more concessions—but also hardens Beijing’s resolve to break free. In the high-stakes game of AI supremacy, dependency is a vulnerability, and every chip sold today could arm tomorrow’s rival.

Source: Rhodium Group - Back to the Future: From Freeze-in-Place to Sliding-Scale Chip Controls

Comments

Please log in or register to join the discussion