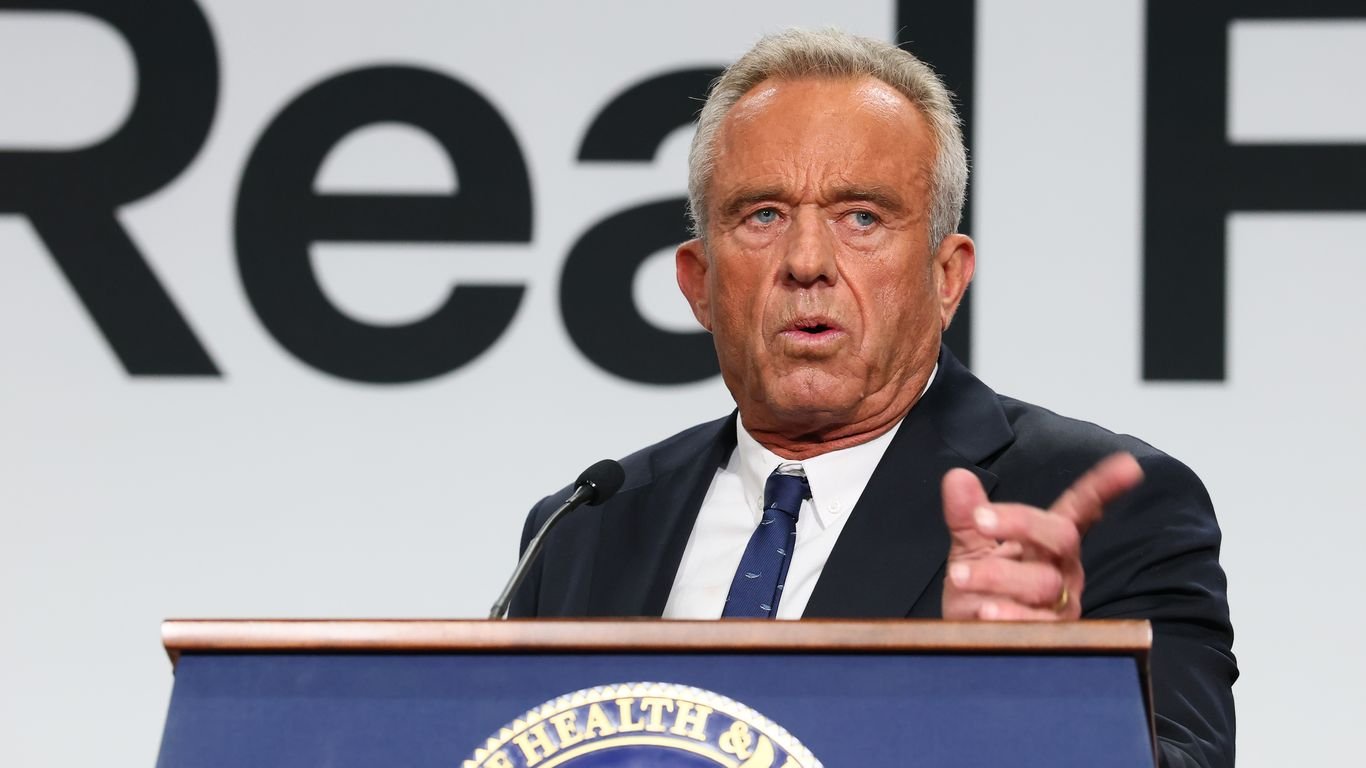

HHS Secretary Robert F. Kennedy Jr. pledges FDA action on ultra-processed foods but signals regulatory restraint, leaving food companies navigating voluntary compliance pathways.

Health and Human Services Secretary Robert F. Kennedy Jr. announced the FDA will respond to a citizen petition demanding action on ultra-processed foods, but conspicuously avoided committing to new regulatory mandates. This measured approach signals the administration's preference for voluntary industry cooperation over hardline food policy interventions.

Market Context

The $1.5 trillion global processed food industry faces mounting pressure as research links ultra-processed products to chronic health conditions. A recent JAMA Network study correlated these foods with 57% higher cardiovascular mortality risk, while OECD data shows U.S. obesity rates exceeding 40%. Major manufacturers like Kraft Heinz and General Mills derive over 60% of revenue from ultra-processed items, creating significant exposure to regulatory shifts.

Regulatory Calculus

Kennedy's stance reflects pragmatic governance constraints. Formal rulemaking would require years-long FDA processes under the Food Safety Modernization Act, whereas leveraging existing authorities allows faster action. The FDA could:

- Update voluntary sodium reduction targets

- Expand front-of-package labeling pilots

- Enhance enforcement of existing 'healthy' claim standards

- Fund research on food additives like titanium dioxide

Industry Implications

Food stocks showed muted reaction to the news, with the S&P Packaged Foods Index holding steady. This suggests investors anticipated Kennedy's restrained approach. Companies now face strategic decisions:

- Accelerating product reformulation (Nestlé allocated $2.3B for this in 2024)

- Preemptively adjusting marketing claims

- Diversifying into cleaner-label segments Startups in plant-based and functional foods could benefit from shifting R&D budgets.

What's Next

The FDA's response timeline remains unspecified, but food manufacturers should monitor:

- Guidance on acrylamide and phthalate reduction targets

- Potential updates to the Nutrition Facts panel

- State-level legislation (California's proposed food additive ban) With congressional gridlock limiting federal action, Kennedy's FDA appears poised to drive change through incremental pressure points rather than sweeping mandates.

Comments

Please log in or register to join the discussion