STMicroelectronics reports Q4 revenue of $3.33B, up 0.2% YoY but operating income down 66% to $125M, forecasting Q1 2026 revenue of $3.04B above estimates.

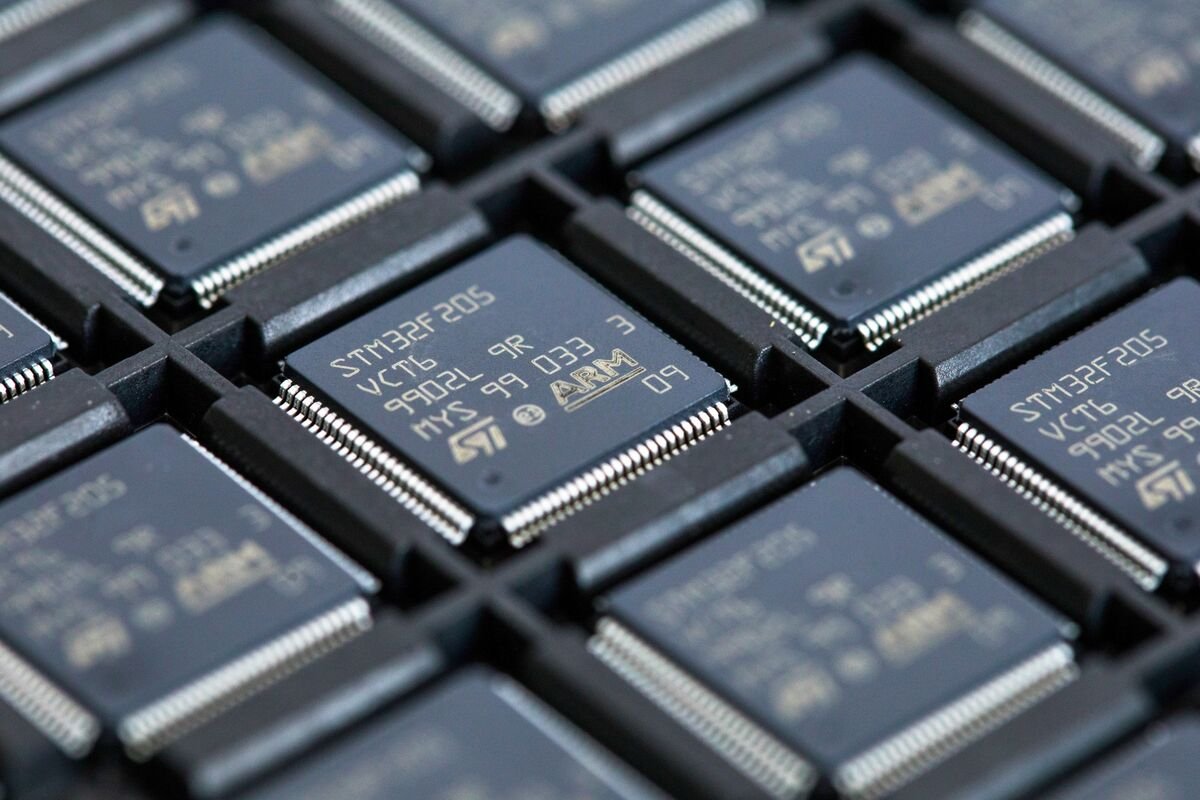

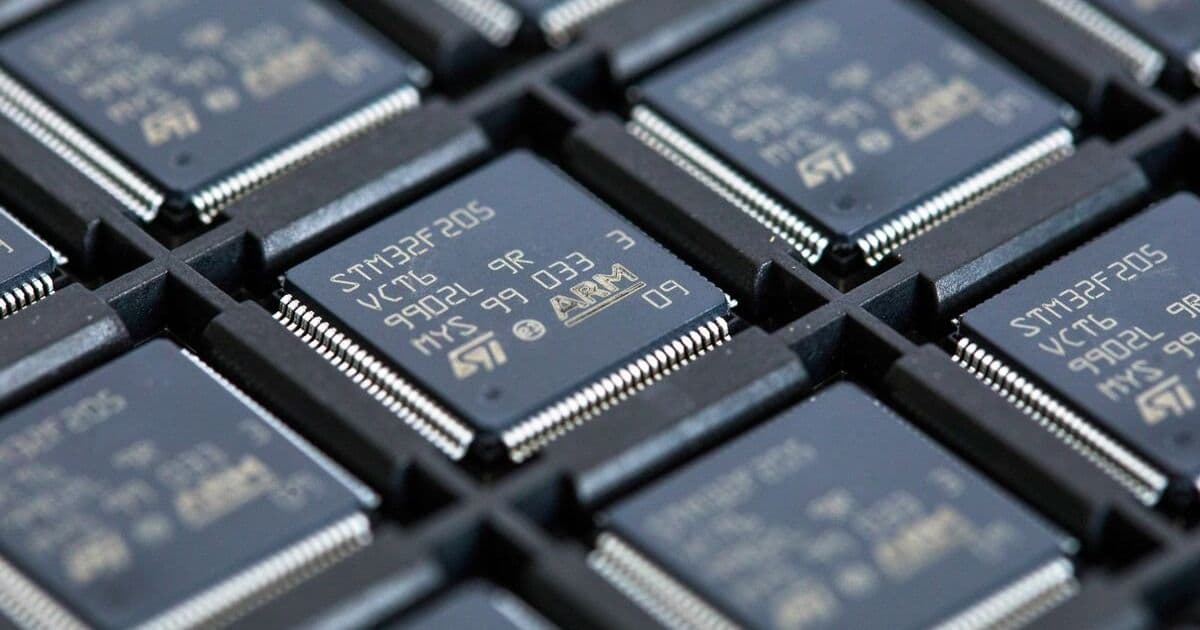

STMicroelectronics NV, a major chip supplier for Tesla Inc. and Apple Inc., delivered mixed Q4 2025 results that highlight the semiconductor industry's ongoing challenges. The company reported net revenue of $3.33 billion, representing a modest 0.2% year-over-year increase, while operating income plummeted 66% to $125 million compared to the same period last year.

This stark contrast between revenue stability and profit collapse reflects the broader semiconductor sector's struggle with pricing pressures and margin compression. While STMicro managed to maintain flat revenue growth, the dramatic drop in operating income suggests significant cost pressures or pricing challenges in its core markets.

Looking ahead, STMicro forecasts first-quarter 2026 net revenue of $3.04 billion, which exceeds analyst estimates of $2.92 billion. This optimistic outlook indicates the company expects continued demand strength despite the profit challenges it faced in Q4.

The company's performance comes amid a complex semiconductor landscape where memory chip prices have risen, benefiting some players like Samsung, while others face intense competition and margin pressure. STMicro's ability to maintain revenue growth while seeing such a dramatic operating income decline suggests it may be absorbing costs to maintain market share or facing pricing pressure in key customer segments.

As a supplier to major tech companies including Tesla and Apple, STMicro's results provide insight into the health of the broader electronics supply chain. The company's forecast beat suggests it anticipates continued strength in demand from these key customers, even as it works to address the profitability challenges that became apparent in the fourth quarter.

The mixed results highlight the semiconductor industry's current state of transition, where companies are navigating between maintaining growth and protecting margins in an increasingly competitive global market.

Comments

Please log in or register to join the discussion