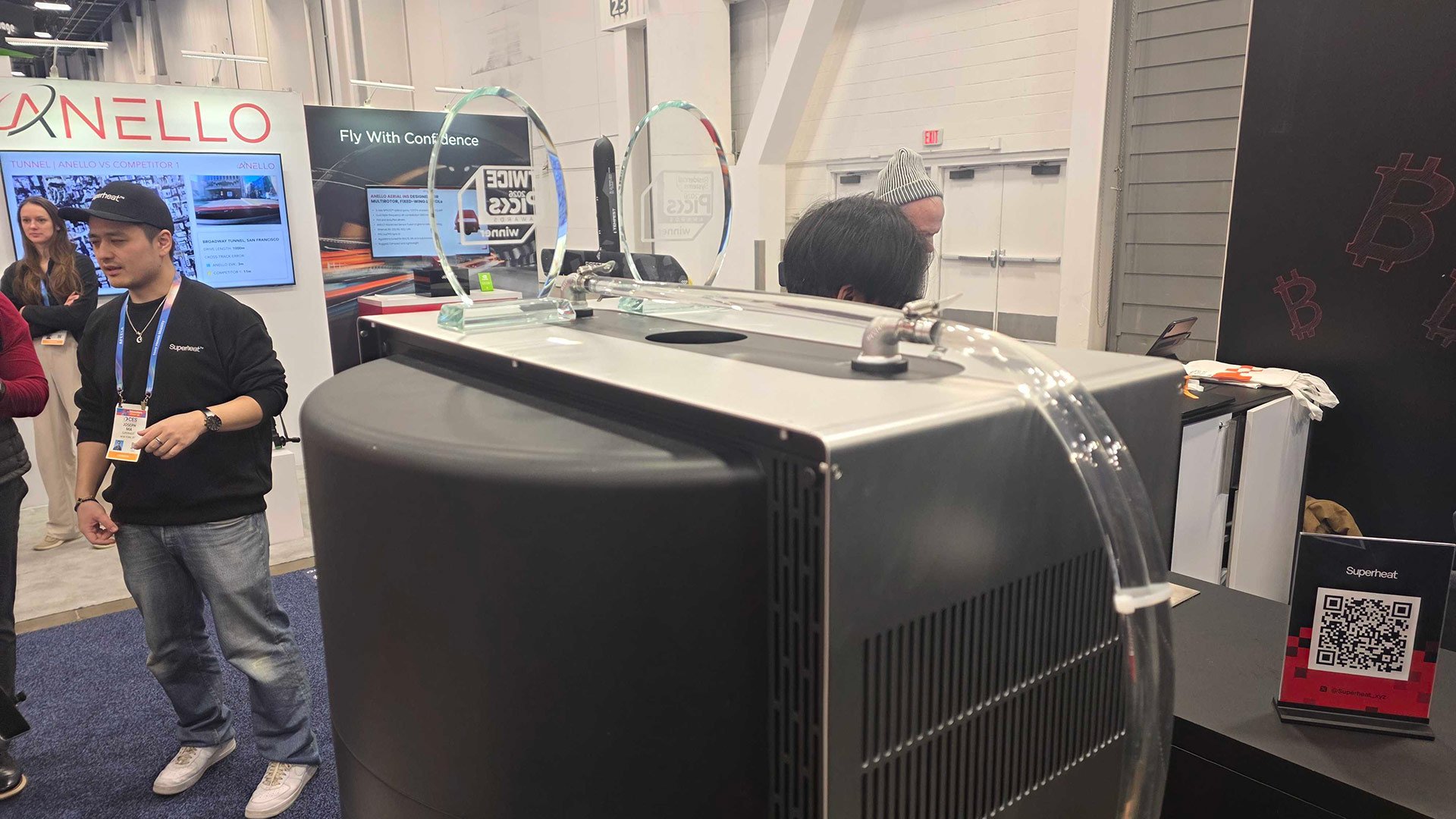

Superheat unveiled its H1 hybrid device at CES 2026, combining ASIC Bitcoin mining hardware with water heating functionality to offset energy costs.

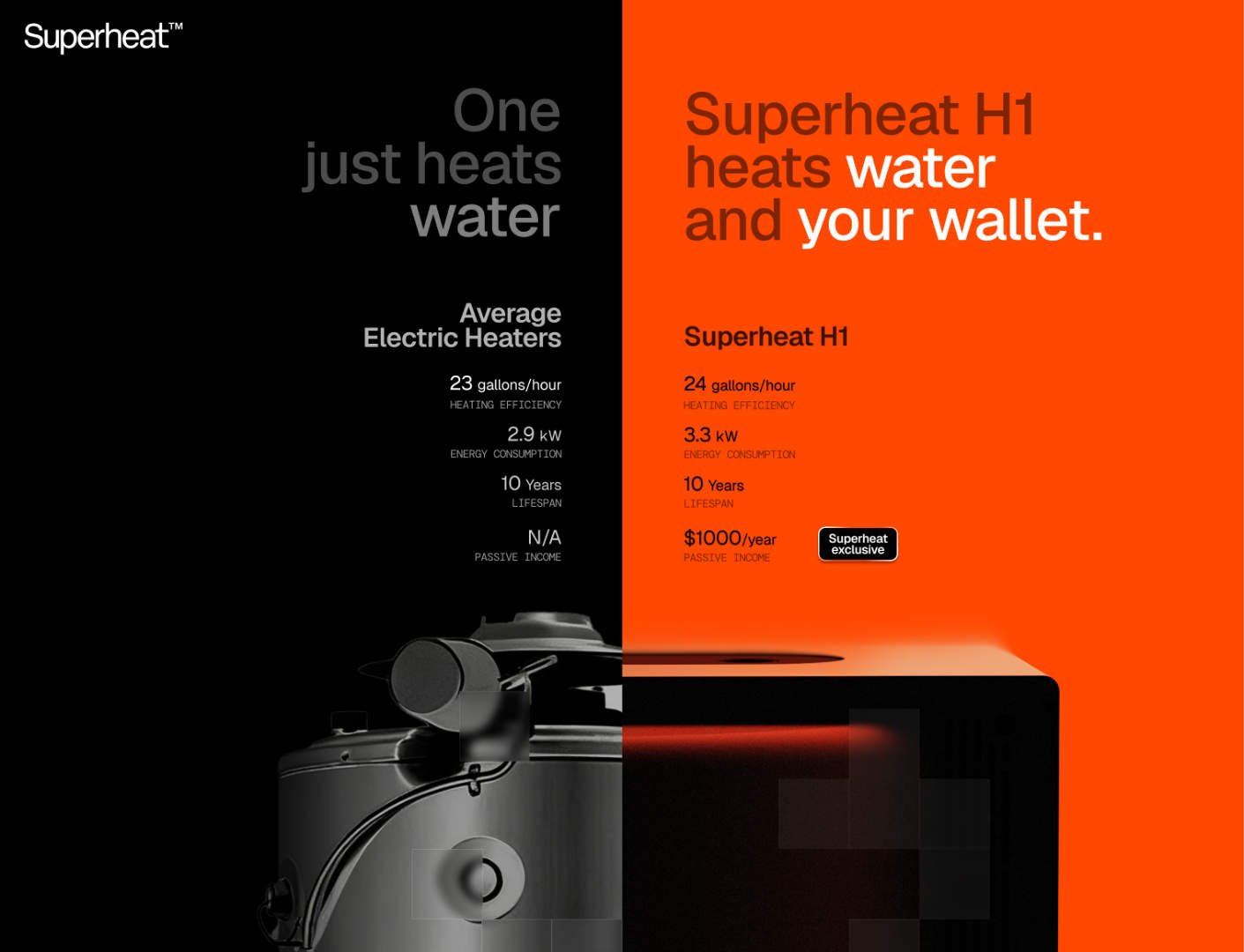

Superheat has introduced the H1, a $2,000 residential appliance that integrates Bitcoin mining ASICs with conventional water heating technology. Unlike traditional electric water heaters that use resistive heating elements, the H1 repurposes waste heat generated by its mining hardware to warm water. According to company specifications, this dual-function design requires comparable energy input to standard water heaters while generating cryptocurrency earnings.

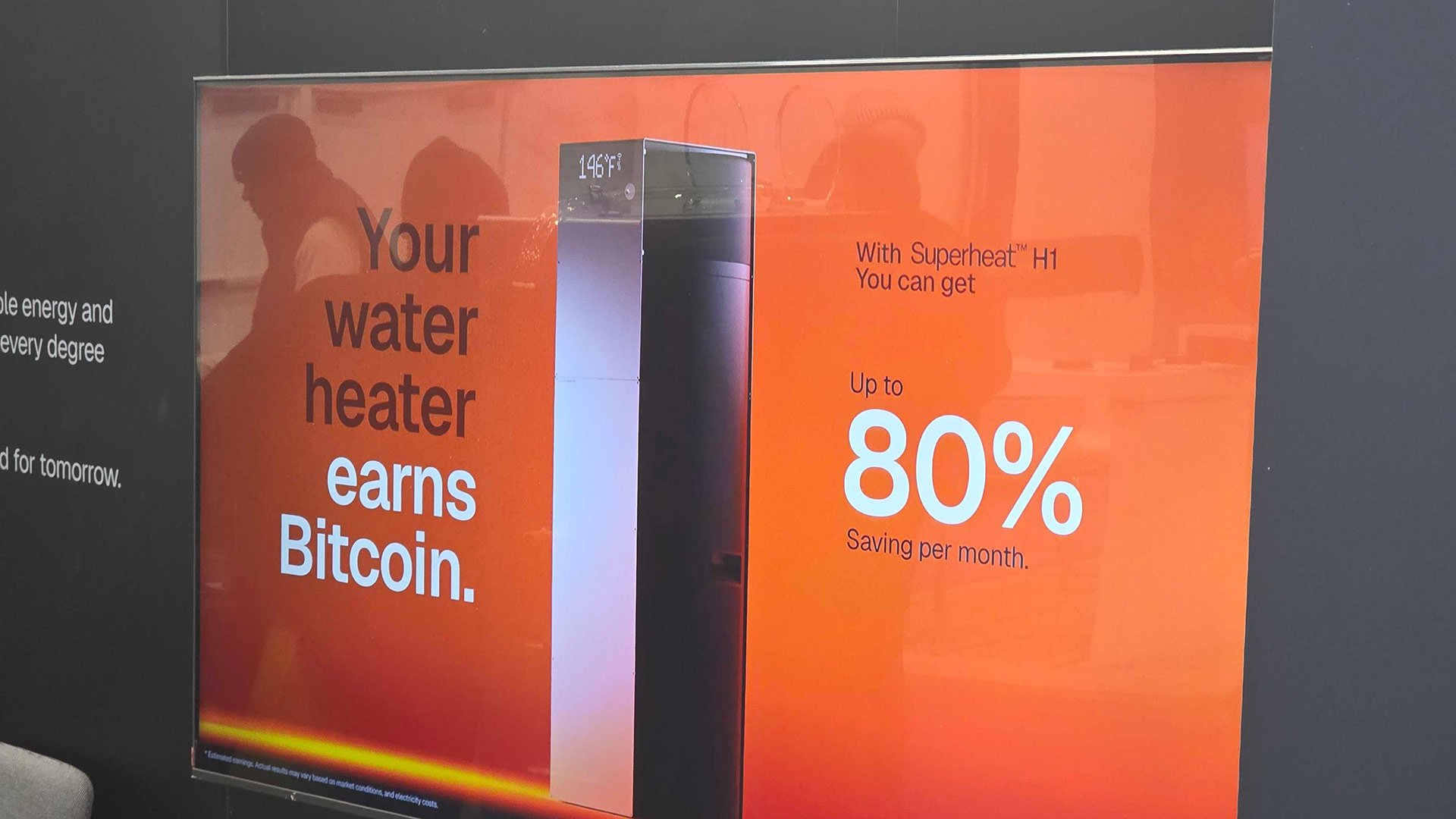

The manufacturer claims the unit can offset up to 80% of combined electricity and water costs through Bitcoin mining revenue, projecting approximately $1,000 in annual earnings under current market conditions. This would translate to a two-year return on investment for the hardware. The device carries an estimated 10-year operational lifespan, aligning with conventional water heater durability expectations.

Technical documentation indicates the integrated ASIC miners operate at approximately 3.5 terahashes per second (TH/s) with dynamic workload adjustment based on hot water demand. During peak usage periods, mining intensity scales down to prioritize thermal transfer efficiency. Superheat's internal testing shows the system captures over 90% of generated heat for water heating applications, reducing typical cooling requirements for cryptocurrency mining operations by 97%.

Market projections suggest scalability beyond single-family homes. Superheat calculates that a 700-unit apartment complex could generate nearly $1 million in annual revenue through clustered deployment. Commercial applications in hotels and laundromats appear viable, though the company hasn't released detailed performance data for these scenarios.

Bitcoin price volatility introduces significant uncertainty to these projections. Current valuations hover around $91,000 per BTC, down from Q3 2025 peaks exceeding $125,000. Financial analysts from firms tracked by CNBC forecast 2026 prices between $75,000 and $225,000, creating a potential 200% variance in projected earnings. This market dependency requires owners to actively monitor cryptocurrency valuations to realize advertised savings.

The technology addresses two distinct energy challenges: cryptocurrency operations typically expend 30-40% of power budgets on cooling systems, while residential water heating accounts for approximately 18% of household energy consumption in developed markets. By converting waste heat into a functional output, Superheat claims a 55% reduction in net energy expenditure compared to operating separate mining rigs and water heaters.

Andrew Geng, Superheat's Co-Founder and CTO, stated: 'Our thermal recapture architecture demonstrates how computational processes can directly contribute to household economics. As distributed computing workloads evolve toward AI inference tasks, this model could extend beyond cryptocurrency applications.'

The H1 enters limited production in Q4 2026 with preorders available through Superheat's official portal. Independent verification of the company's efficiency and earnings claims remains pending from third-party laboratories.

Industry observers note that while heat-recapture systems exist in industrial settings, this marks the first consumer appliance attempting to monetize computational waste heat at scale. Success hinges on maintaining mining efficiency as Bitcoin's proof-of-work difficulty increases approximately 7% quarterly and semiconductor thermal constraints during sustained operation.

Comments

Please log in or register to join the discussion