Jeff Bezos' Blue Origin has unveiled TeraWave, a satellite internet constellation designed to deliver up to 6 terabits per second of symmetrical bandwidth. Unlike SpaceX's Starlink, which serves millions of individual users, TeraWave is laser-focused on enterprise, data center, and government customers who need massive, predictable throughput for large-scale operations.

Blue Origin's announcement of TeraWave marks a significant entry into the satellite internet market, but with a strategy that deliberately diverges from the consumer-focused approach of its primary competitor, Starlink. The company's vision is to create a high-capacity backbone for organizations that require sustained, symmetrical bandwidth for critical operations, rather than a service for residential browsing or streaming.

What's New: A Multi-Orbit Architecture for Terabit Throughput

TeraWave's core differentiator is its ambitious technical architecture, designed from the ground up for enterprise-grade performance. The system will rely on a constellation of 5,408 satellites, but unlike the single-orbit approach of Starlink and Amazon's Kuiper, TeraWave employs a multi-orbit design.

The majority of these satellites will operate in Low Earth Orbit (LEO), forming the primary access layer. These LEO satellites will connect to ground terminals using radio frequency links, with Blue Origin claiming speeds of up to 144 Gbps per terminal. This layer is designed to provide the final-mile connectivity for enterprise campuses, data centers, and government facilities.

The true innovation, however, lies in the 128 satellites planned for Medium Earth Orbit (MEO). This smaller group will function as a high-capacity optical backbone. Instead of relying on radio waves, these MEO satellites will use laser-based optical inter-satellite links (OISLs) to move data at a terabit scale between satellites and ground infrastructure. Optical links offer distinct advantages: they can transmit vast amounts of data with lower latency and are less susceptible to radio frequency interference. However, they also present significant engineering challenges, requiring precise alignment and stable operating conditions to maintain the laser connections.

This hybrid approach aims to create a network where data can be efficiently routed across the globe via the MEO backbone and then delivered to end-users through the LEO access layer. The target is a symmetrical 6 terabits per second of aggregate network capacity, a figure that positions TeraWave as a direct competitor to terrestrial fiber for certain enterprise use cases.

How It Compares: Enterprise Focus vs. Consumer Scale

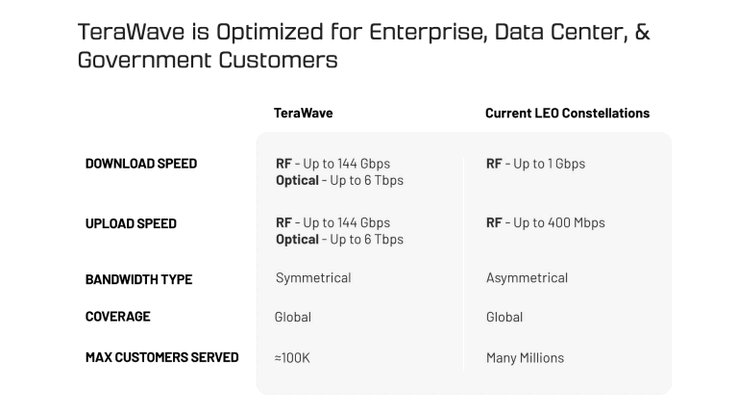

The contrast between TeraWave and its rivals is stark. SpaceX's Starlink has aggressively pursued a mass-market model, deploying thousands of satellites to provide internet access to millions of individual subscribers, including those in rural and underserved areas. Its recent expansion into government and military services through Starshield demonstrates a broadening scope, but its foundation remains in consumer connectivity.

Amazon's Project Kuiper is also building a LEO constellation, with a stated goal of serving both consumer and enterprise markets. The company has already announced enterprise-grade terminals, signaling its intent to compete in the business sector.

TeraWave, by contrast, is not trying to win the consumer market. Blue Origin is targeting approximately 100,000 customers globally—a fraction of Starlink's subscriber base. These customers are specifically enterprises, data centers, and government entities that require reliable, high-throughput connectivity for critical operations. For these users, the key metrics are not just speed, but also predictable performance, low latency for specific applications, and the ability to handle massive data transfers consistently.

This focus allows TeraWave to design its network for a different set of priorities. While Starlink must balance capacity across millions of users, TeraWave can optimize its infrastructure for the sustained, high-volume data flows typical of data center interconnects, government communications, and large enterprise networks.

Who It's For: The Enterprise and Government Sector

TeraWave is designed for organizations where connectivity is a strategic asset, not just a utility. The primary target markets include:

- Data Centers: For hyperscale operators and colocation facilities, TeraWave could offer a new option for redundant, high-speed connectivity between geographically dispersed sites or for linking to cloud infrastructure.

- Enterprise Networks: Large corporations with global operations could use TeraWave to connect regional offices, manufacturing plants, or retail locations with guaranteed bandwidth.

- Government and Defense: Agencies requiring secure, resilient communications for operations in remote or contested environments are a natural fit. The network's design for critical operations aligns with government needs for reliability.

- Research Institutions: Universities and research facilities that need to transfer enormous datasets (e.g., from particle physics, astronomy, or genomics) could benefit from the high-capacity links.

For these customers, the value proposition is not about replacing their home internet, but about providing a new, space-based alternative to terrestrial fiber or microwave links, especially in regions where laying fiber is impractical or prohibitively expensive.

The Challenges Ahead: Execution in a Competitive Market

While the technical vision is ambitious, Blue Origin faces significant hurdles in execution. The company has not yet begun deploying the TeraWave constellation, with launches planned to start toward the end of 2027. This timeline puts it years behind SpaceX's operational Starlink network and Amazon's ongoing Kuiper deployments.

Manufacturing and launching 5,408 satellites is a monumental task. SpaceX has leveraged its Falcon 9 rocket and Starlink's own production lines to achieve rapid deployment. Blue Origin will need to scale its satellite manufacturing and prove the reliability of its New Glenn rocket (or other launch vehicles) to meet its ambitious launch schedule.

Furthermore, the optical inter-satellite links, while promising, are a complex technology to deploy at scale. Ensuring stable, precise laser connections across thousands of satellites in different orbits will require advanced pointing, acquisition, and tracking systems. Any failure in this system could degrade the network's core capacity.

The market itself is also becoming crowded. In addition to Starlink and Kuiper, other players like OneWeb and Viasat are targeting enterprise and government customers with their own satellite constellations. TeraWave will need to demonstrate clear performance and cost advantages to win over customers who may already have established relationships with terrestrial providers or other satellite operators.

Pricing remains a critical unknown. Blue Origin has not disclosed any pricing details or early customer commitments. For enterprise customers, the cost per bit will be a decisive factor. If TeraWave's service is priced competitively against terrestrial fiber and other satellite options, it could find a receptive market. If it is too expensive, even its advanced technology may not be enough to attract customers.

The Road to 2027

TeraWave represents a bold bet by Blue Origin to carve out a lucrative niche in the satellite internet market. By focusing on high-capacity, symmetrical bandwidth for enterprise and government users, the company is avoiding a direct, head-to-head battle with Starlink's consumer empire. Instead, it is positioning itself as a provider of a new class of connectivity infrastructure.

The next few years will be critical. Blue Origin must translate its technical announcements into a functioning constellation, prove the reliability of its optical backbone, and secure its first enterprise customers. The success of TeraWave will depend not just on its technology, but on its ability to execute a complex satellite program on schedule and deliver a service that meets the demanding requirements of its target market.

For now, TeraWave is a promise—a vision of a terabit-scale satellite network. Whether that promise becomes a reality will be determined by Blue Origin's engineering prowess, its launch capabilities, and the market's appetite for a new player in the high-stakes world of satellite internet.

For more information on Blue Origin's projects, visit their official website. For details on Starlink, see the Starlink website. To learn about Amazon's Project Kuiper, refer to the Amazon Kuiper announcement.

Comments

Please log in or register to join the discussion