Recent diplomatic talks between the U.S. and Iran, described by President Trump as 'very good', signal potential sanctions relief that may create new market access for cloud providers, telecom equipment makers, and cybersecurity firms.

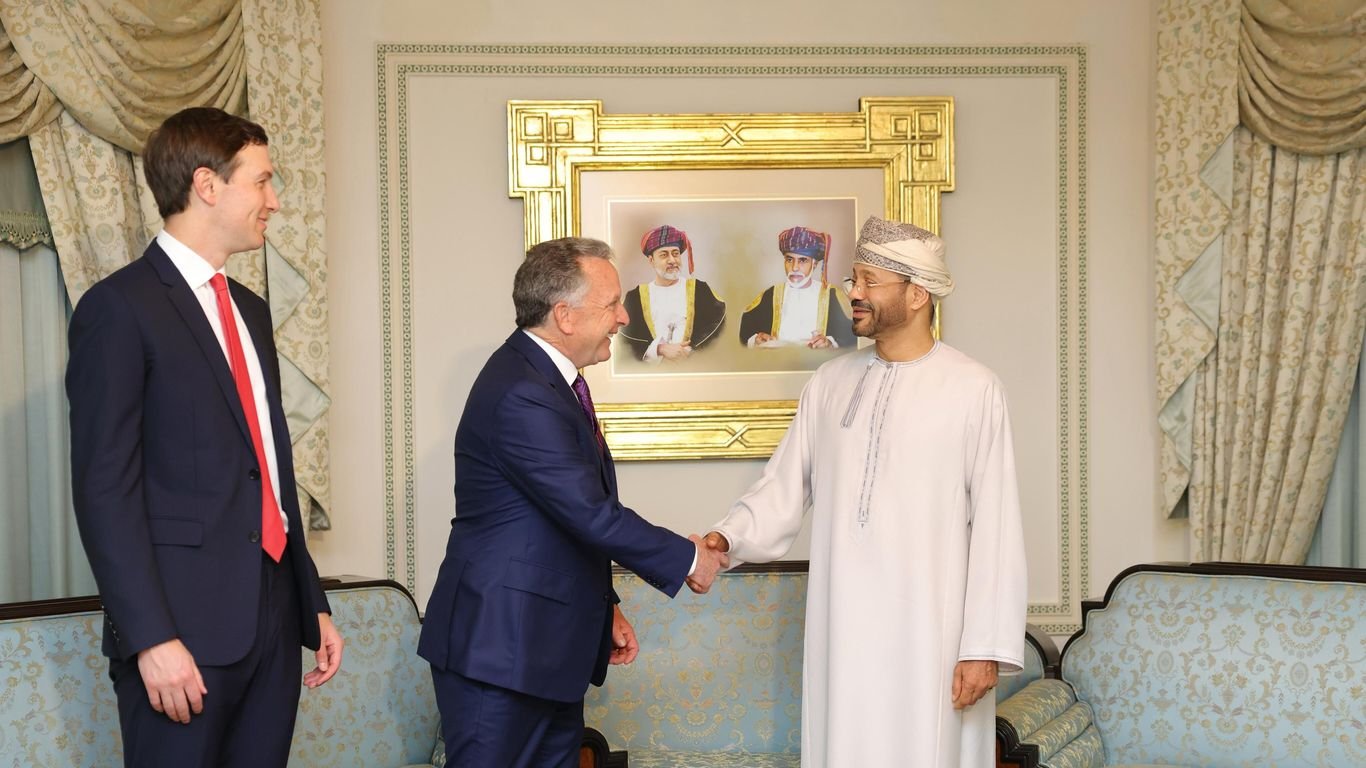

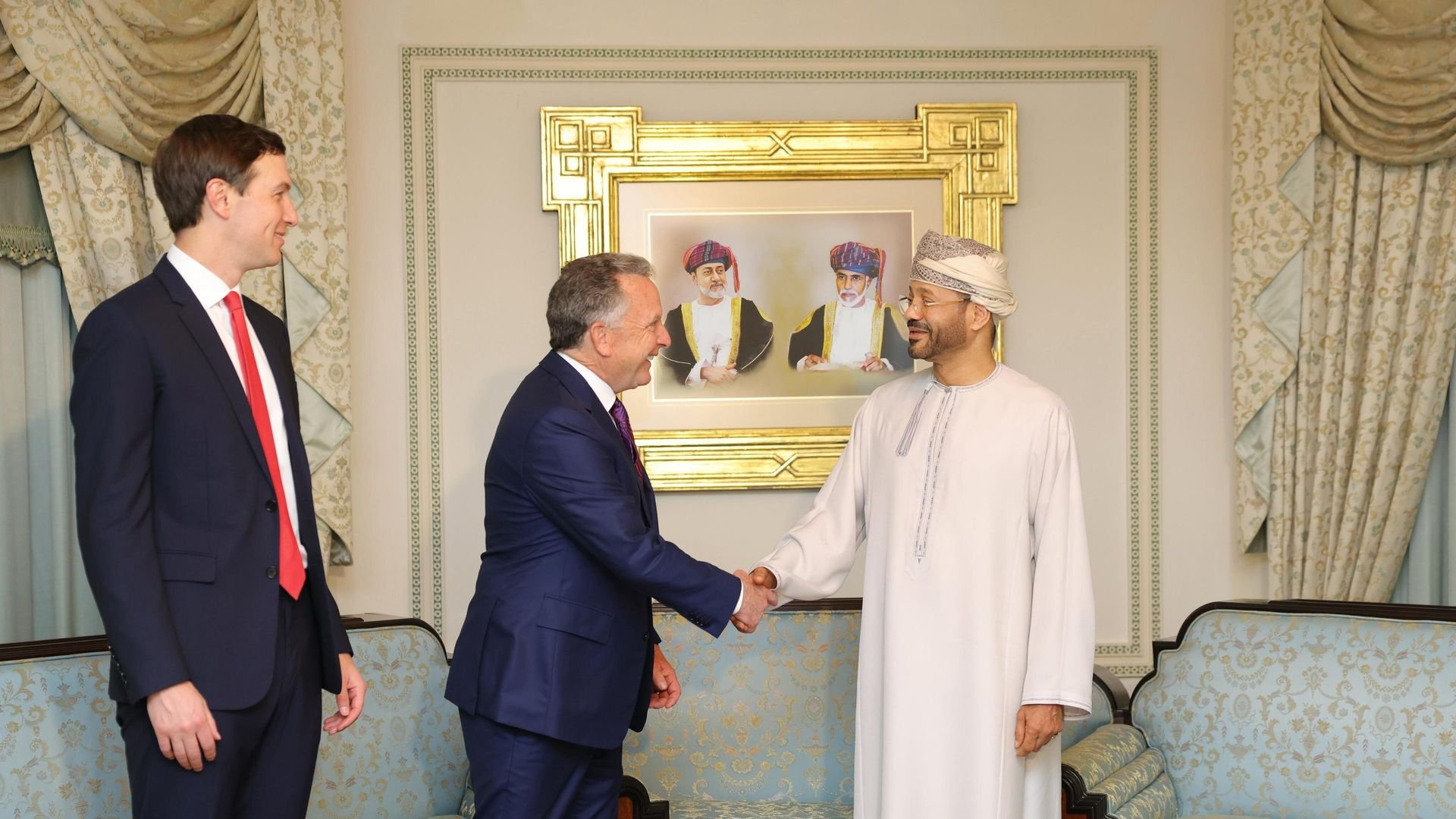

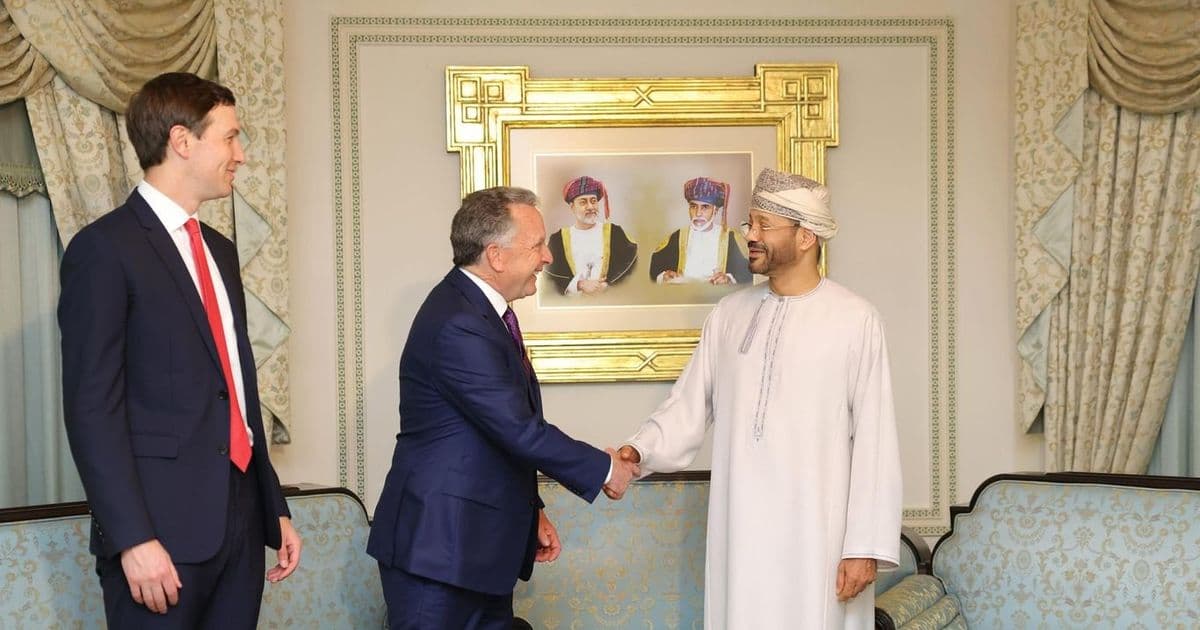

Diplomatic progress between Washington and Tehran could reshape technology market dynamics across the Middle East. President Trump confirmed that U.S. and Iranian officials held "very good talks" this week in Muscat, Oman—a development confirmed by Omani Foreign Minister Sayyid Badr Hamad Al Busaidi. The discussions involved Trump's Middle East envoy Steve Witkoff and senior advisor Jared Kushner, signaling potential shifts in a relationship historically defined by sanctions.

For technology companies, the implications center on Iran's restricted but substantial market. Currently under comprehensive U.S. sanctions, Iran represents one of the largest untapped technology markets in the region. With 82 million citizens and internet penetration exceeding 76%, the country's potential value for cloud infrastructure, e-commerce platforms, and 5G equipment providers remains largely inaccessible. Market analysis by McKinsey estimates Iran's digital economy could generate $32 billion annually within five years of sanctions relief.

The current sanctions regime explicitly prohibits U.S. tech companies from operating in Iran and blocks Iranian entities from accessing major cloud platforms like AWS and Microsoft Azure. Semiconductor manufacturers face export controls, while cybersecurity firms operate under strict monitoring protocols when engaging with Iranian networks. Should negotiations progress toward sanctions easing, technology sectors positioned for immediate opportunity include:

- Telecommunications infrastructure: Ericsson and Nokia could compete for 5G rollout contracts currently dominated by Chinese vendors

- Cloud computing: Hyperscalers like Google Cloud and Oracle might establish local data centers to serve Iranian enterprises

- Fintech: Payment processors could facilitate cross-border transactions currently routed through third countries

- Cybersecurity: Threat intelligence sharing and security operations centers would become feasible

Market strategists caution that any sanctions relief would likely occur in phases, with initial focus on humanitarian and civilian technology sectors. Energy markets also factor heavily—reduced geopolitical tension typically lowers oil prices by 7-12%, decreasing operational costs for data centers and hardware manufacturing globally. However, risks persist: Congressional opposition to Iran deals remains strong, and cybersecurity concerns linger following Iran-linked attacks on U.S. infrastructure, including the 2023 water utility breach in Pennsylvania.

Technology firms should monitor two key indicators: OFAC licensing updates for permissible activities and API access changes to Iranian developer ecosystems. As diplomatic channels reopen, Iran's young, tech-literate population (60% under age 30) represents both a talent pool and consumer base that could accelerate regional digital transformation—provided geopolitical winds hold steady.

Comments

Please log in or register to join the discussion