Financial analysis reveals Microsoft's massive AI investments aren't translating to proportional Azure growth, while questionable accounting practices and ballooning capital expenditures threaten long-term sustainability.

When examining Microsoft's decade-long transformation under Satya Nadella, a disturbing pattern emerges beneath the surface of record revenues and AI hype. What appears as technological dominance is increasingly revealing itself as a precarious financial house of cards, propped up by aggressive accounting tactics and unsustainable spending.

The Culture Contradiction

Microsoft's public image promotes a 'growth mindset' philosophy, yet internal realities tell a different story. Since Nadella took the helm in 2014, Microsoft has conducted near-annual layoffs totaling over 80,000 employees. This includes:

- 18,000 cut months after his appointment

- 16,000 in 2023

- 15,000 in both 2024 and 2025

This workforce reduction occurred alongside revenue tripling from $83B to $300B annually – a disconnect underscoring the company's operational priorities.

The Capex Mirage

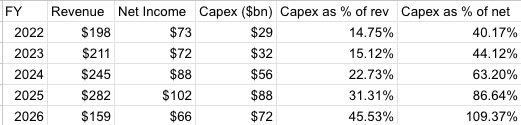

Microsoft's capital expenditures tell the most alarming story. Since 2020:

- Property, plant and equipment exploded from $41B to $261B

- Capex now consumes 45.5% of revenue (FY2026)

- Depreciation charges surged from $2.7B to $9.1B quarterly

This spending is overwhelmingly directed toward AI infrastructure, particularly NVIDIA GPUs with notoriously thin margins (9-26% for A100/H100 series). Worse, these chips face annual obsolescence cycles while being depreciated over artificially extended six-year periods.

Stagnant Cloud Performance

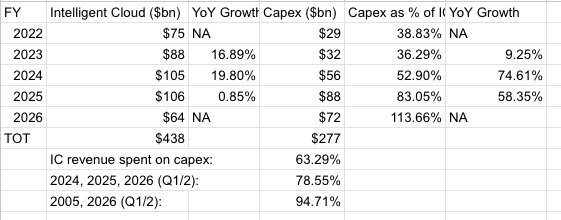

Despite this spending surge, Microsoft's Intelligent Cloud segment shows worrying stagnation:

- Revenue plateaued around $30B quarterly since 2023

- Growth slowed to single digits (8.8% YoY)

- Capex now consumes 94% of Intelligent Cloud revenue

The company obscured this by recasting segment definitions in 2025 filings, making historical comparisons difficult. When Azure revenue was finally disclosed separately ($75B in FY2025), it revealed Microsoft spent 117% of Azure's revenue on capex that year.

Questionable Accounting Tactics

Microsoft's financial engineering raises red flags:

Remaining Performance Obligations (RPOs)

- Added $227B in commercial RPOs Q1→Q2 FY2026

- Yet projected 12-month revenue dropped from $159B to $156B

- Suggests longer-term contracts with slower recognition

OpenAI/Anthropic Paper Gains

- $9.97B of Q2 FY2026 net income came from recapitalizing OpenAI stake

- $30B Anthropic deal announced in 2025 hasn't materialized in RPOs

- Neither company generates sufficient revenue to justify projected cloud spending

The Unsustainable Equation

Microsoft's fundamental problem: Its GPU-fueled spending vastly outpaces revenue growth while delivering negative margins. With:

- Capex consuming 109% of net income

- Intelligent Cloud margins declining (69.89% → 68.59%)

- More Personal Computing segment shrinking to 17.6% of revenue

The company needs $500B in new AI revenue by 2030 to justify investments – a target requiring 3x OpenAI's entire projected 2029 revenue from every Microsoft customer combined.

As depreciation charges accelerate and GPU upgrade cycles loom, Microsoft's bet appears less like innovation and more like financial desperation disguised in AI hype. The empire isn't crumbling yet, but its foundations are showing alarming cracks beneath the glossy surface of Copilots and cloud promises.

Financial data sourced from Microsoft SEC filings including 10-K reports and earnings releases

Comments

Please log in or register to join the discussion