The U.S. Department of Commerce has published new export rules that create a narrow pathway for advanced AI accelerators like Nvidia's H200 and AMD's MI325X to reach Chinese customers, but the regulations impose strict supply-priority requirements that effectively cap China-bound shipments at 50% of U.S. volumes, transforming the policy into a controlled-release mechanism for American semiconductor dominance rather than a true market opening.

The U.S. Department of Commerce has unveiled new export rules for shipments of advanced AI and HPC processors designed in America to China and Macau. However, while the new rules permit limited exports of specific accelerators — most notably AMD's Instinct MI325X, Nvidia's H200, and comparable lower-performance products — on a case-by-case basis, licenses are granted only if the products are readily available in the U.S. and if shipments to the People's Republic remain capped relative to U.S. volumes, which effectively rules out China-only SKUs.

Technical Thresholds and Eligibility

When it comes to specifications, approved devices must feature a total processing performance (TPP) score below 21,000 points and total DRAM bandwidth under 6,500 GB/s, which means relaxation of performance-tied export rules. The TPP metric, derived from the export control framework established in October 2023, calculates performance by multiplying peak FP16/FP32 throughput by bit-width, creating a composite score that captures both compute density and data movement capability.

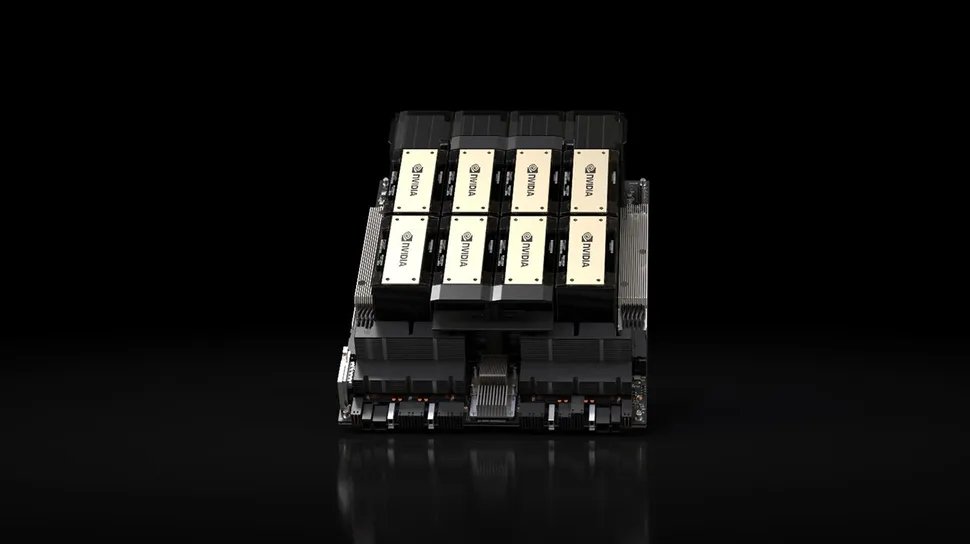

The U.S. DoC names AMD's Instinct MI325X and Nvidia's H200 GPUs as models of accelerators that may qualify. The MI325X delivers 1,300 TFLOPS of FP16 performance, which translates to a TPP score of 20,800, and pairs 256 GB of HBM3E memory with 6 TB/s of bandwidth. Nvidia's H200 offers 989.5 TFLOPS of FP16 throughput, which converts to a TPP score of 15,832, alongside 141 GB of HBM and 4.8 TB/s of bandwidth. Both processors fall below the stated thresholds and are therefore eligible for shipments to China, provided a license is approved.

Products that exceed the limits, or include re-exports that involve D:5 countries remains subject to denial. The D:5 country designation covers destinations subject to comprehensive arms embargoes, including China, Iran, North Korea, and Syria, making any re-export through third countries a violation.

Supply Priority: The Real Constraint

However, while previous limitations focused solely on performance and specifications, the new compliance requirements extend well beyond specifications. The key constraint is now U.S. supply priority: exporters must prove that domestic demand is fully met, that no U.S. orders are delayed, that advanced-node foundry capacity serving U.S. customers is not diverted, and that aggregate PRC-bound shipments do not exceed 50% of the same product shipped into the United States.

This creates a fundamental volume constraint that operates independently of the technical thresholds. For example, if a company had supplied 100,000 model A processors to American clients, it cannot ship more than 50,000 model A processors to Chinese customers at the same time. The policy effectively treats China as a secondary market that receives only what remains after U.S. demand is satisfied.

This mechanism addresses a key concern from previous export control rounds: that manufacturers might create China-specific variants with reduced performance but optimized for Chinese market needs. The 50% cap combined with the "readily available in the U.S." requirement makes China-only SKUs economically unviable, since any product designed exclusively for China would have zero U.S. shipment history to anchor the ratio.

Verification and Compliance Burden

Every shipment must undergo verification of TPP, memory bandwidth, interconnect bandwidth, and copackaged DRAM capacity in an independent U.S.-headquartered testing laboratory with no financial ties to the exporter or importer. The U.S. DoC can revoke a lab's qualification at any time, creating ongoing risk for compliance programs.

This testing requirement adds significant cost and delay to the export process. Unlike previous rules where manufacturers could self-certify based on published specifications, the new framework demands third-party validation for each shipment or product variant. The laboratory must be headquartered in the U.S., which limits the pool of qualified testers and creates geographic constraints for global supply chains.

In addition, exporters must meet strict Know Your Customer and cloud-usage rules, disclose end users, prevent unauthorized remote access, and bar transfers of model weights or trained algorithms to restricted parties, such as Chinese military or secret service organizations. These requirements effectively prohibit Chinese cloud providers from using these accelerators for training foundation models that could be accessed by military-affiliated entities, even indirectly.

Market Implications and Competitive Effects

The new rules create a two-tier market structure. Europe, Japan, and other regions remain normal destinations for AI and HPC hardware without the supply-priority constraints. Chinese customers face both technical thresholds and volume caps that make large-scale deployment difficult.

For hyperscale AI training deployments, the 50% cap creates a practical ceiling. If a Chinese cloud provider needs 10,000 accelerators for a training cluster, the supplier must demonstrate 20,000 units shipped to U.S. customers first. Given that U.S. hyperscalers (Amazon, Google, Microsoft, Meta) are already consuming most of the available supply of H200 and MI325X, the incremental capacity available to China is limited.

The rules particularly disadvantage smaller vendors that have limited access to advanced production and packaging capacities and can rarely offer performance comparable to that of AMD's or Nvidia's GPUs. A smaller player cannot easily scale U.S. shipments to unlock China access because they lack the production capacity and customer base to meet the 50% ratio requirement. This consolidates advantage with incumbents who can orchestrate global allocation.

Strategic Context

The policy represents a shift from absolute performance bans to controlled market access. By allowing previous-generation or near-threshold products while maintaining strict supply priority, the U.S. preserves American technology presence in the Chinese AI sector without enabling cutting-edge capability development.

This approach acknowledges that complete decoupling is difficult and potentially counterproductive. American semiconductor companies lose revenue and market share if entirely locked out of China, while Chinese buyers accelerate development of domestic alternatives. The controlled-release model attempts to thread the needle: maintain commercial relationships and technology standards adoption while limiting capability advancement.

The 21,000 TPP threshold is strategically chosen. It sits below the performance levels where Chinese domestic alternatives are competitive, but high enough that American products remain attractive. The MI325X at 20,800 TPP is essentially at the limit, creating a moving target that can be adjusted based on Chinese indigenous development progress.

Implementation Timeline and Uncertainty

The rules are effective immediately but require case-by-case license approval for each shipment. This creates uncertainty for both suppliers and customers. Chinese buyers cannot plan multi-year capacity expansions because they don't know if licenses will be granted or what the U.S. shipment baseline will be in future quarters.

The U.S. DoC retains the right to revoke lab qualifications and modify thresholds, creating regulatory risk. Exporters must maintain compliance infrastructure that can adapt to changing requirements. This ongoing overhead favors large companies with dedicated trade compliance teams.

For Nvidia and AMD, the rules provide a path to continue serving Chinese customers but with significant constraints. Both companies have reported that China represents 20-25% of their data center revenue historically. The new rules will likely reduce this substantially, though not to zero.

Looking Forward

The framework establishes a template for future controls. As next-generation products like Nvidia's Blackwell series (B100/B200) and AMD's MI350 series approach commercialization, they will far exceed the 21,000 TPP threshold and remain export-restricted. The current rules effectively create a product lifecycle where new generations launch for U.S. and allied markets, while previous generations become eligible for controlled China export after U.S. supply is saturated.

This creates a permanent lag between leading-edge availability in the U.S. and access in China, potentially widening the AI development gap over time. Chinese organizations will always be one or two generations behind, which in the fast-moving AI field represents a significant competitive disadvantage.

The rules also incentivize Chinese investment in domestic accelerator development. While the controlled access reduces immediate pressure, the long-term trajectory points toward technological separation. The U.S. maintains market presence today while building time for domestic manufacturing scale-up through the CHIPS Act and allied production partnerships.

For the broader semiconductor industry, these rules demonstrate how export controls have evolved from simple performance cutoffs to complex supply-chain management. Future regulations may incorporate additional metrics like interconnect topology, memory configuration flexibility, or software stack capabilities. The burden of compliance will continue to favor incumbents with scale and political relationships, potentially reshaping the global competitive landscape in ways that extend beyond the immediate technology restrictions.

The policy's success will ultimately be measured by whether it slows Chinese AI advancement enough for U.S. and allied ecosystems to maintain a sustainable lead, while avoiding complete market abandonment that would accelerate indigenous development and fragment global technology standards.

Comments

Please log in or register to join the discussion