Apple has secured the top spot on Brand Finance's Global 500 for the third year running, with an estimated brand value of $607 billion. While hardware growth remains steady, the company's continued dominance is increasingly fueled by its services ecosystem, which has grown to support a 6% year-over-year increase in brand valuation.

For the third consecutive year, Apple has been named the world's most valuable brand by Brand Finance, with an estimated brand value of $607.6 billion. This marks a 6% increase from the previous year's $574 billion valuation, solidifying Apple's position at the top of the Global 500 list. The ranking, which has been tracking brand value since 2007, highlights a dramatic shift in the global economy where technology companies now dominate the upper echelons of brand value.

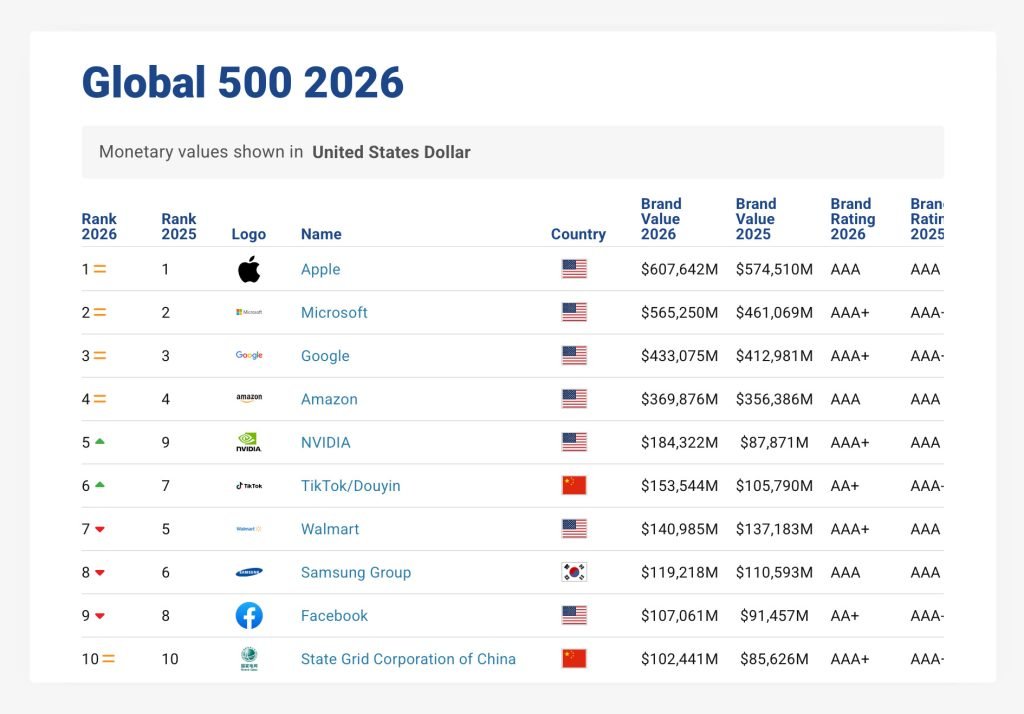

The broader context of the 2026 ranking reveals just how much the tech sector has come to define global brand value. Apple, Microsoft, Google, Amazon, NVIDIA, and TikTok/Douyin secured the top seven spots with a combined brand value of approximately $2.31 trillion—a staggering 15.8% year-over-year increase. While the top four positions remained unchanged from last year, NVIDIA made a significant leap to fifth place, posting a 109% surge in brand value that reflects the explosive demand for AI infrastructure and GPU technology.

Brand Finance's analysis of Apple's performance points to a nuanced picture of the company's growth strategy. "Apple retains its position as the world’s most valuable brand with a 6% brand value growth to USD607.6 billion," the report states. "While hardware growth remains measured, Apple continues to strengthen its ecosystem through services. Growth in advertising, cloud services and the App Store has supported overall performance, while steady demand across the Americas, Europe and Asia Pacific has reinforced Apple’s global scale and resilience."

This assessment aligns with Apple's recent financial reporting, where services revenue has become an increasingly critical component of the company's overall performance. The App Store, iCloud, Apple Music, Apple TV+, and advertising services have created a recurring revenue stream that complements the cyclical nature of hardware sales. For users, this means the value proposition extends beyond the initial device purchase to an ongoing relationship with Apple's ecosystem.

The ecosystem lock-in effect is particularly relevant when examining Apple's brand strength. A user who invests in an iPhone, Mac, iPad, and Apple Watch, while subscribing to iCloud and Apple Music, creates a deeply integrated experience that becomes difficult to replicate with competing platforms. This "walled garden" approach, while sometimes criticized for limiting consumer choice, has proven to be a powerful driver of brand loyalty and recurring revenue. The services division alone generated over $85 billion in revenue during Apple's last fiscal year, representing more than 20% of the company's total revenue.

Brand Finance also assigns a brand rating alongside its valuation, and Apple maintained an AAA rating this year. This rating considers factors like marketing investment, stakeholder equity, and business performance. The AAA rating indicates exceptional brand strength and resilience, suggesting that Apple's brand can command premium pricing and maintain customer loyalty even during economic downturns.

Looking at the historical context provides perspective on Apple's remarkable journey. When Brand Finance first launched its Global 250 ranking in 2007, Coca-Cola was the world's most valuable brand at $43 billion. Apple ranked 43rd with an estimated brand value of $12 billion and an AAA+ brand rating—below most tech companies at the time and only slightly above News Corp. In less than two decades, Apple has not only climbed to the top position but has seen its brand value multiply by more than 50 times.

The geographic distribution of Apple's brand strength is also noteworthy. The company's performance across the Americas, Europe, and Asia Pacific demonstrates its truly global scale. In China, where competition from domestic brands like Huawei and Xiaomi remains intense, Apple has maintained strong brand perception among premium consumers. In Europe, regulatory challenges and privacy-focused positioning have helped Apple differentiate itself from American tech giants facing scrutiny. In the Americas, particularly the United States, Apple's brand is deeply embedded in consumer culture and business environments.

For consumers and tech enthusiasts, this brand valuation translates to several practical implications. First, Apple's continued investment in services means users can expect more integration between hardware and software, with features like Continuity, Handoff, and Universal Control becoming more sophisticated. Second, the company's financial strength allows for substantial R&D investment in future technologies, from AR/VR headsets to potential automotive projects. Third, the premium brand positioning suggests Apple will likely continue focusing on the high-end market rather than competing directly in budget segments.

However, this dominant position also comes with challenges. Regulatory scrutiny around the App Store's commission structure, antitrust investigations in multiple jurisdictions, and concerns about ecosystem lock-in are all factors that could impact Apple's brand perception and future growth. The company's response to these challenges—balancing its business interests with user choice and regulatory compliance—will be crucial in maintaining its top brand position in coming years.

The full Brand Finance Global 500 2026 report provides additional insights into brand valuation methodologies and detailed analysis of other leading companies. The report can be accessed through Brand Finance's official website, offering deeper context for those interested in brand valuation trends and methodology.

As Apple approaches its 50th anniversary in 2026, this third consecutive #1 ranking represents more than just a financial milestone. It reflects a transformation from a computer company to a lifestyle brand that touches nearly every aspect of modern digital life. Whether this position can be maintained as new technologies emerge and competitive pressures intensify remains to be seen, but for now, Apple's brand remains the most valuable in the world.

Comments

Please log in or register to join the discussion