Chinese tech companies face a critical supply bottleneck as Beijing's new import restrictions hold Nvidia H200 AI GPUs at customs, forcing a scramble for black market alternatives at 50% premiums while the nation's domestic semiconductor industry struggles to keep pace with Western AI hardware advances.

Chinese technology companies are navigating a precarious supply chain crisis as Beijing's recent ban on Nvidia's H200 AI GPU imports creates a stark divide between regulatory intent and operational necessity. According to a report from the South China Morning Post, Chinese customs officials are currently holding H200 shipments at the border, creating uncertainty about when these critical AI accelerators might clear for domestic use. This regulatory freeze has pushed some enterprises toward illicit channels, where black market resellers are commanding premiums of up to 50% above official list prices for H200-equipped servers.

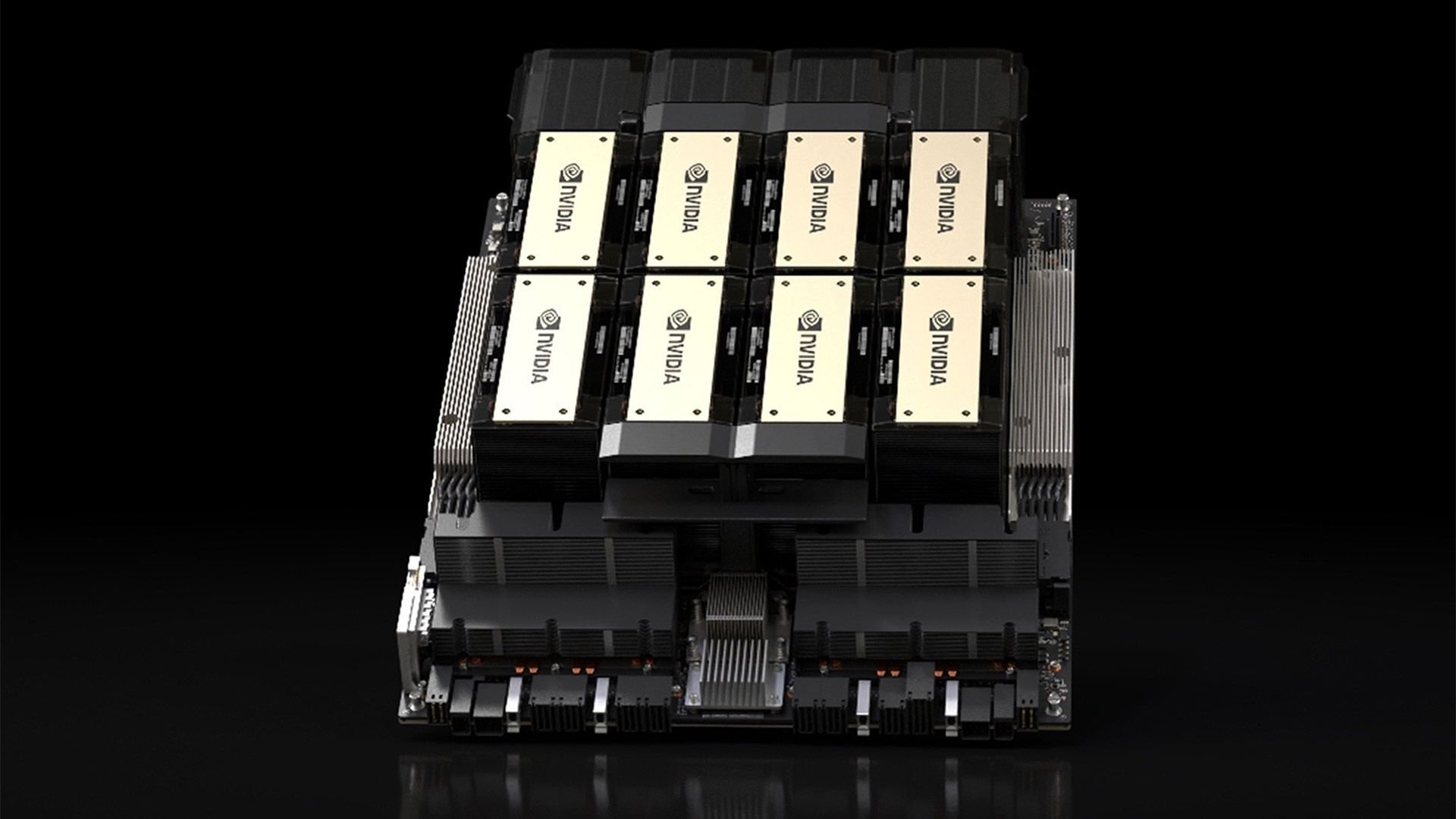

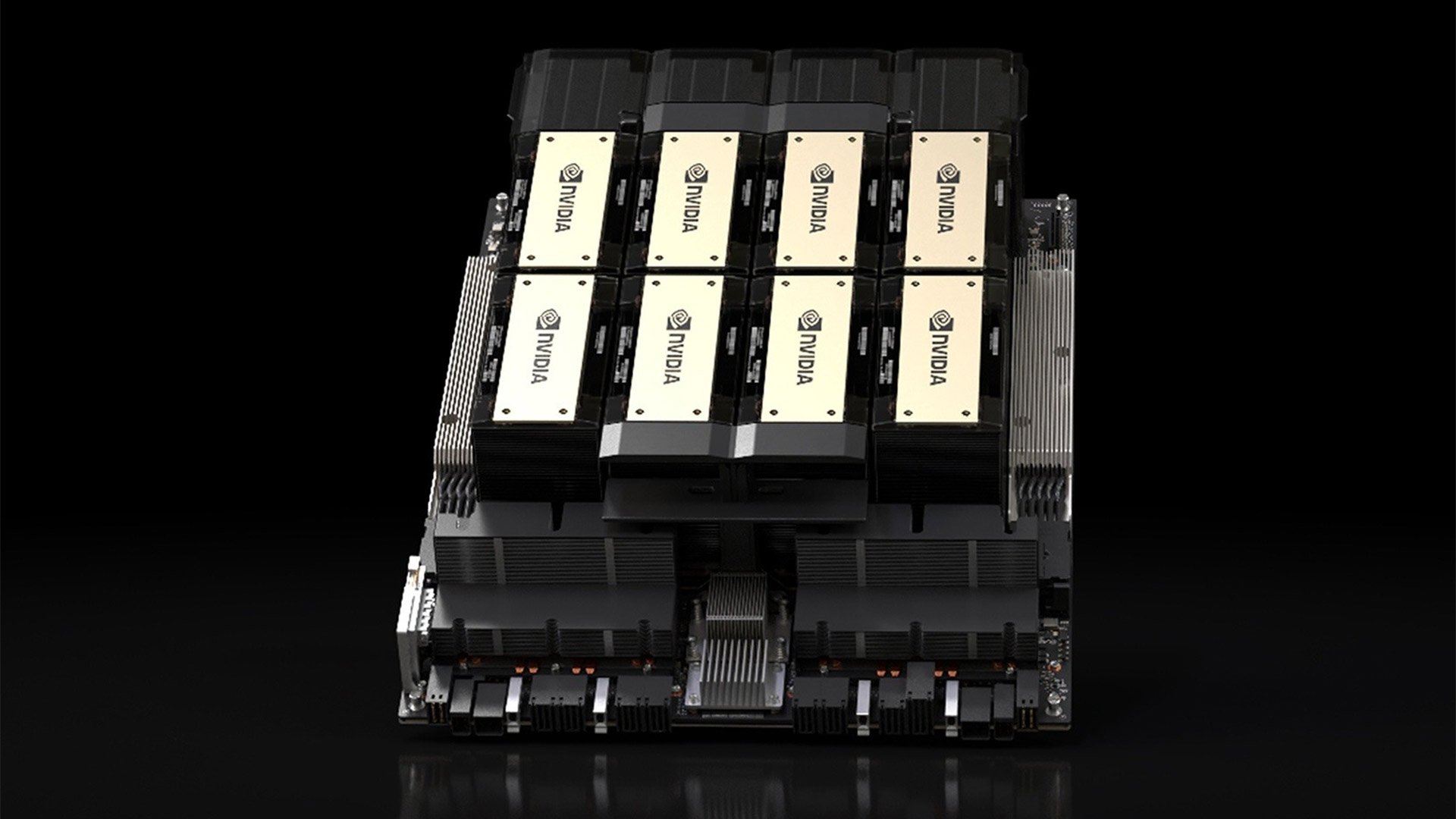

The timing of this restriction creates particular tension within China's AI development ecosystem. Nvidia CEO Jensen Huang had previously noted strong customer demand for the H200 in China following U.S. export approvals in December 2025. The H200 represents a significant advancement over its predecessor, the H100, offering substantially improved memory bandwidth and capacity that directly translates to faster training times for large language models and more efficient inference workloads. For Chinese companies racing to develop competitive AI models, access to these chips isn't merely advantageous—it's foundational to remaining competitive in the global AI landscape.

The supply disruption manifests in concrete financial terms. According to SCMP's sources, bundled servers containing eight H200 chips are now being offered on the underground market for approximately $330,000. This represents a 50% premium over the official China list price, a markup that reflects both the increased risk premium for smuggling operations and the acute demand from companies unwilling to compromise on computational power. The availability of these illicit channels, however, remains spotty as Chinese customs intensifies scrutiny following Beijing's directive.

This situation highlights a fundamental tension in China's technology strategy. On one hand, Beijing has explicitly pursued "silicon sovereignty" through massive investments in domestic semiconductor manufacturing and design capabilities. The government claims that homegrown AI processors can now match Nvidia's H20 and RTX Pro 6000D for inference workloads, representing meaningful progress for specific use cases. However, the gap remains substantial when it comes to cutting-edge training hardware. No domestic chip has yet matched the H200's capabilities, let alone Nvidia's newer Blackwell architecture or the upcoming Vera Rubin platform expected in late 2026.

The regulatory environment has evolved rapidly. Earlier this year, Beijing instructed tech companies to pause H200 purchases, with sources suggesting that only university R&D laboratories might receive exceptions. This followed an emergency meeting held by Chinese authorities shortly after the U.S. approved H200 exports in December 2025. The situation creates a strategic dilemma: China needs the most advanced chips to compete in the AI race against the United States, yet simultaneously seeks to reduce dependence on foreign technology.

Historical context reveals this isn't an isolated incident. Despite U.S. restrictions on advanced Nvidia chips, China hadn't previously banned these imports outright, creating a gray market that reportedly smuggled at least $1 billion worth of Nvidia AI chips in 2025 alone. Some importers even flaunted availability of Blackwell B300 chips well before their official launch, demonstrating the sophistication of these illicit supply chains. Beijing's recent command has made such operations riskier, potentially constraining this alternative supply route.

The current uncertainty extends beyond immediate supply concerns. It's unclear whether Beijing's H200 ban represents a permanent policy shift or a temporary negotiating tactic ahead of President Trump's planned visit to Beijing in April. Nvidia's Huang is also scheduled to visit China in late January, though it remains uncertain whether he'll meet senior Chinese officials to discuss the H200 situation directly. This diplomatic dimension adds another layer of complexity to what is fundamentally a supply chain and technology access issue.

For Chinese AI companies, the calculus is straightforward but painful. They must choose between paying substantial premiums through unofficial channels, accepting less powerful domestic alternatives that may slow development timelines, or waiting indefinitely for regulatory approval that may never come. Each option carries significant costs—financial, strategic, and operational. The black market route, while providing access to the necessary hardware, introduces legal risks and supply instability that complicate long-term planning.

The broader implications extend beyond individual companies to China's entire AI ecosystem. Training state-of-the-art models requires massive computational resources, and any constraint on access to the most powerful GPUs creates a cascading effect on research timelines, product development, and ultimately, competitive positioning. As the AI race intensifies globally, these supply constraints could widen the gap between Chinese and Western AI capabilities, despite China's significant investments in domestic chip development.

The situation also underscores the interconnected nature of global semiconductor supply chains. Even as China pours billions into building domestic chip manufacturing capacity through initiatives like SMIC and other foundries, the complexity of advanced GPU design and the ecosystem of supporting software and tools means that true independence remains a distant goal. The H200, built on TSMC's 4nm process and featuring advanced packaging technologies, represents a pinnacle of current semiconductor manufacturing that China's domestic industry has yet to replicate.

As the situation develops, the tension between regulatory restrictions and commercial necessity will likely continue to shape China's AI hardware landscape. Companies will navigate this uncertainty while the government balances its sovereignty goals against the practical demands of remaining competitive in the global AI race. The outcome will have lasting implications not just for Chinese technology companies, but for the global distribution of AI capabilities and the geopolitical dynamics surrounding advanced semiconductor technology.

Jowi Morales is a tech enthusiast with years of experience working in the industry. He's been writing with several tech publications since 2021, where he's been interested in tech hardware and consumer electronics.

Comments

Please log in or register to join the discussion