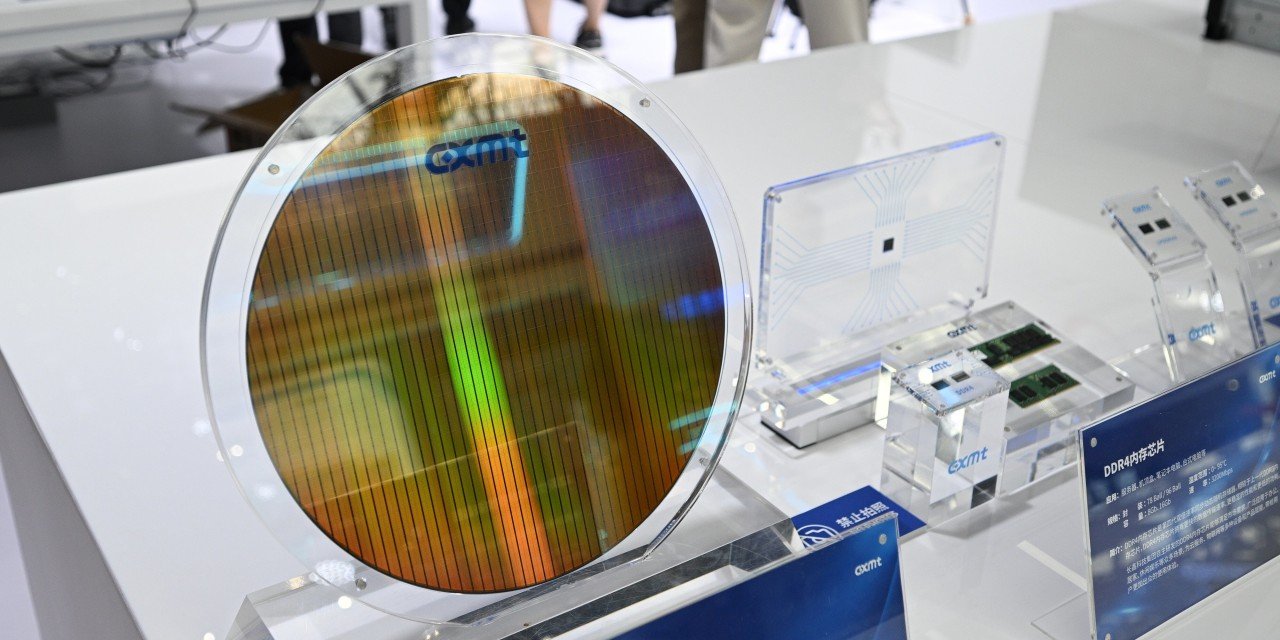

State-backed Chinese memory chipmaker ChangXin Memory Technologies (CXMT) is targeting a $4.2 billion IPO that would rank among the largest semiconductor debuts this century, despite navigating US export controls and South Korean technology restrictions.

China's ChangXin Memory Technologies (CXMT) is preparing for what could become one of the semiconductor industry's most significant public offerings this century. The state-backed company aims to raise $4.2 billion through an initial public offering, positioning itself to compete directly with global memory giants like Micron, Samsung, and SK Hynix.

CXMT specializes in DRAM memory chips, critical components in everything from smartphones to AI servers. As artificial intelligence applications fuel unprecedented demand for high-performance memory, the company has accelerated its production capabilities despite operating under stringent export restrictions imposed by the United States since 2022. These controls prevent CXMT from acquiring advanced chipmaking equipment from American suppliers like Applied Materials and Lam Research.

South Korea has implemented complementary restrictions, blocking equipment transfers that could enhance Chinese semiconductor manufacturing capabilities. This dual pressure creates significant hurdles for CXMT's technological advancement, forcing the company to develop workarounds using older generation equipment while accelerating domestic R&D efforts.

The planned IPO represents a strategic move to fund capacity expansion during a memory market upswing. Industry analysts note DRAM prices have surged nearly 40% year-over-year due to AI-driven demand, creating favorable conditions for CXMT's market entry. However, the company faces manufacturing limitations - its current technology lags approximately five years behind industry leaders, producing chips at 17-19nm nodes compared to the sub-10nm chips from Korean competitors.

CXMT's state backing through the China Integrated Circuit Industry Investment Fund provides crucial financial support, but also complicates international expansion. The company must navigate geopolitical tensions while attempting to gain market share in a sector dominated by US-aligned players. Industry observers note CXMT's progress in yield improvement and production scaling, suggesting the company could capture low-to-mid-range market segments initially.

The outcome of CXMT's public offering will test investor appetite for Chinese semiconductor ventures amid ongoing trade restrictions. A successful listing could accelerate China's efforts to build a self-sufficient chip ecosystem, while failure might signal limitations of state-backed semiconductor ambitions under current geopolitical constraints.

Market dynamics suggest CXMT's timing may be favorable. Memory industry cycles have historically rewarded manufacturers who expand capacity during shortage periods, and current AI-driven demand shows no immediate signs of slowing. Yet the company must overcome significant technological gaps and navigate an increasingly fragmented global supply chain to capitalize on this opportunity.

Comments

Please log in or register to join the discussion