The Federal Trade Commission is taking its case against Meta back to court, appealing a district judge's ruling that found the social media giant does not hold a monopoly in personal social networking. The appeal reignites a battle over whether Meta's acquisitions of Instagram and WhatsApp were anticompetitive moves that stifled competition.

The Federal Trade Commission has officially appealed a district court ruling that cleared Meta of maintaining an illegal monopoly, setting the stage for a renewed legal battle that could reshape the landscape of social media competition. The FTC's decision to appeal, filed this week, signals the agency's unwavering belief that Meta has illegally maintained its dominant position through anticompetitive conduct for over a decade.

What Happened: The FTC's Original Case and the District Court Ruling

The FTC first filed its landmark antitrust case against Meta (then Facebook) in December 2020, alleging that the company "is illegally maintaining its personal social networking monopoly through a years-long course of anticompetitive conduct." The agency's complaint centered on two primary allegations:

Acquisition of Potential Rivals: The FTC argued that Meta systematically acquired companies that could have challenged its dominance, specifically citing the purchases of Instagram in 2012 for $1 billion and WhatsApp in 2014 for $19 billion. The agency contends these acquisitions were not just business expansions but strategic moves to eliminate emerging competition before it could threaten Meta's core social networking business.

Anticompetitive Conditions on Developers: The complaint also alleged that Meta imposed restrictive conditions on software developers and third-party applications, effectively creating barriers that prevented competing social networks from gaining traction. This included policies that limited how other apps could integrate with Meta's platforms.

The FTC originally sought significant remedies, including the divestiture of assets—potentially requiring Meta to sell off Instagram and WhatsApp—and the removal of these alleged anticompetitive conditions.

However, in November 2024, U.S. District Judge James Boasberg ruled in Meta's favor, finding that the FTC had failed to prove that Meta holds a monopoly in the "relevant market" of personal social networking services. Judge Boasberg's decision was based on several key findings:

- Dynamic Market: The judge noted that the social media ecosystem is "constantly changing," with new platforms emerging and user preferences shifting rapidly.

- Declining Market Share: Evidence presented at trial suggested that Meta's market share "seems to be shrinking" rather than growing.

- Regulatory Approval: The judge pointed out that the FTC had approved both the Instagram and WhatsApp acquisitions when they occurred, raising questions about the agency's current position.

The Legal Basis: Why the FTC is Appealing

The FTC's appeal, filed with the U.S. Court of Appeals for the D.C. Circuit, argues that Judge Boasberg applied the wrong legal standard and misinterpreted the evidence. In its statement, the FTC "continues to allege, and robust evidence at trial demonstrated, that for over a decade Meta has illegally maintained a monopoly in personal social networking services through anticompetitive conduct."

Daniel Guarnera, Director of the FTC's Bureau of Competition, stated: "The Trump-Vance FTC will continue fighting its historic case against Meta to ensure that competition can thrive across the country to the benefit of all Americans and US businesses."

The appeal raises several critical legal questions:

Market Definition: The FTC argues that the "relevant market" should be defined more narrowly as personal social networking, where Meta's dominance is clearer, rather than the broader social media landscape that includes platforms like TikTok, Twitter (now X), and YouTube.

Evidence of Monopoly Power: The agency contends that it presented sufficient evidence of Meta's monopoly power, including high barriers to entry, control over a critical input (the social graph), and the ability to raise prices or reduce quality without losing customers.

Anticompetitive Intent: The FTC maintains that internal documents and testimony demonstrated Meta's leadership viewed acquisitions as a strategy to neutralize competitive threats.

Impact on Users and Companies

For Consumers

If the FTC ultimately prevails, the most significant impact could be the potential breakup of Meta's integrated ecosystem. A forced divestiture of Instagram and WhatsApp would mean:

- Increased Competition: Separate ownership could foster more innovation as Instagram and WhatsApp would no longer be constrained by Meta's overarching strategy.

- Potential for New Features: Independent companies might develop features that Meta currently suppresses to protect its core business.

- Data Portability: Users might gain better tools to move their social graphs between platforms, reducing lock-in effects.

However, consumers could also face short-term disruptions during any transition period, including potential changes to how these services integrate with each other.

For Meta

A loss in the appeal would represent a catastrophic business outcome. Beyond the financial implications of divesting assets worth hundreds of billions of dollars, it would:

- Set a Precedent: Establish a legal framework for future antitrust cases against other tech giants.

- Restrict Future Acquisitions: Make it nearly impossible for Meta to acquire any company that could be seen as a potential competitor.

- Change Business Strategy: Force Meta to compete through organic innovation rather than strategic acquisitions.

For the Tech Industry

The case has far-reaching implications beyond Meta:

- Acquisition Strategy: Other tech companies will closely watch the outcome, as it could redefine what constitutes an anticompetitive acquisition.

- Regulatory Environment: A successful FTC appeal would embolden regulators globally to pursue similar cases against dominant tech platforms.

- Innovation vs. Consolidation: The case forces a reexamination of whether tech industry consolidation has stifled innovation or enabled the development of integrated services that benefit users.

The Broader Context: Political and Regulatory Shifts

The case has unfolded against a backdrop of significant political and regulatory changes. The original case was filed in December 2020, after the November election but before President Biden's inauguration. The appeal is now being pursued under the Trump-Vance administration, with Director Guarnera's statement explicitly referencing the current administration.

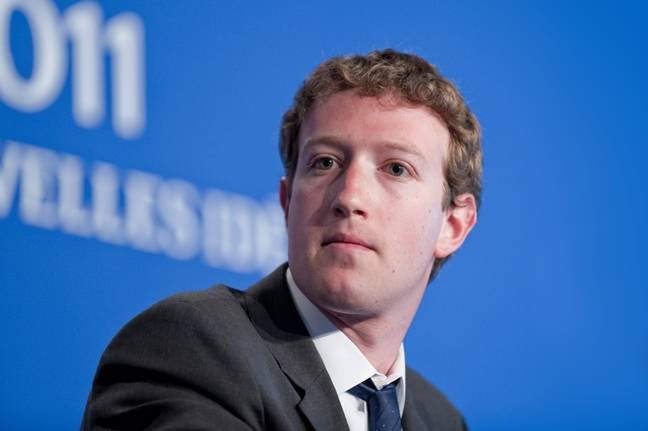

The political dimension adds complexity to the case. Meta CEO Mark Zuckerberg has cultivated relationships with both political parties. He attended President Trump's inauguration and has made significant donations. Recently, Meta appointed Dina Powell McCormick as president and vice chairman—a former Trump administration official who served as deputy national security advisor.

Simultaneously, Meta has scaled back its metaverse ambitions and shifted focus toward AI data centers, including the formation of Meta Compute and the acquisition of Chinese AI company Manus. These strategic pivots occur as Meta faces increasing scrutiny over its business practices across multiple jurisdictions.

What Changes: The Road Ahead

The appeal process will likely take 12-18 months, with several potential outcomes:

FTC Victory: If the appeals court reverses Judge Boasberg's decision, the case would return to district court for a new trial or potentially result in a settlement requiring significant concessions from Meta.

Meta Victory: If the appeals court upholds the district court ruling, the FTC could petition the Supreme Court, though success there is less certain.

Settlement: The parties could reach a settlement, though given the stakes, this seems unlikely unless one side faces significant legal setbacks.

The case represents one of the most significant antitrust challenges in the digital age, testing whether existing antitrust laws, developed in the industrial era, can effectively regulate 21st-century platform businesses. The outcome will influence not just Meta's future but the entire ecosystem of digital platforms and their relationships with users, competitors, and regulators.

For users, the case highlights the tension between the convenience of integrated services and the potential benefits of increased competition. While Meta argues that its integrated approach provides value through seamless connectivity, the FTC maintains that this integration has come at the cost of innovation and consumer choice.

As the legal battle continues, the tech industry watches closely, knowing that the precedent set could define the boundaries of acceptable corporate strategy in the digital economy for decades to come.

Comments

Please log in or register to join the discussion