A specialized glass fiber material essential for advanced processors and AI hardware has become the latest supply constraint, with Apple, Nvidia, Amazon, and Google competing for limited output from Japanese manufacturer Nittobo.

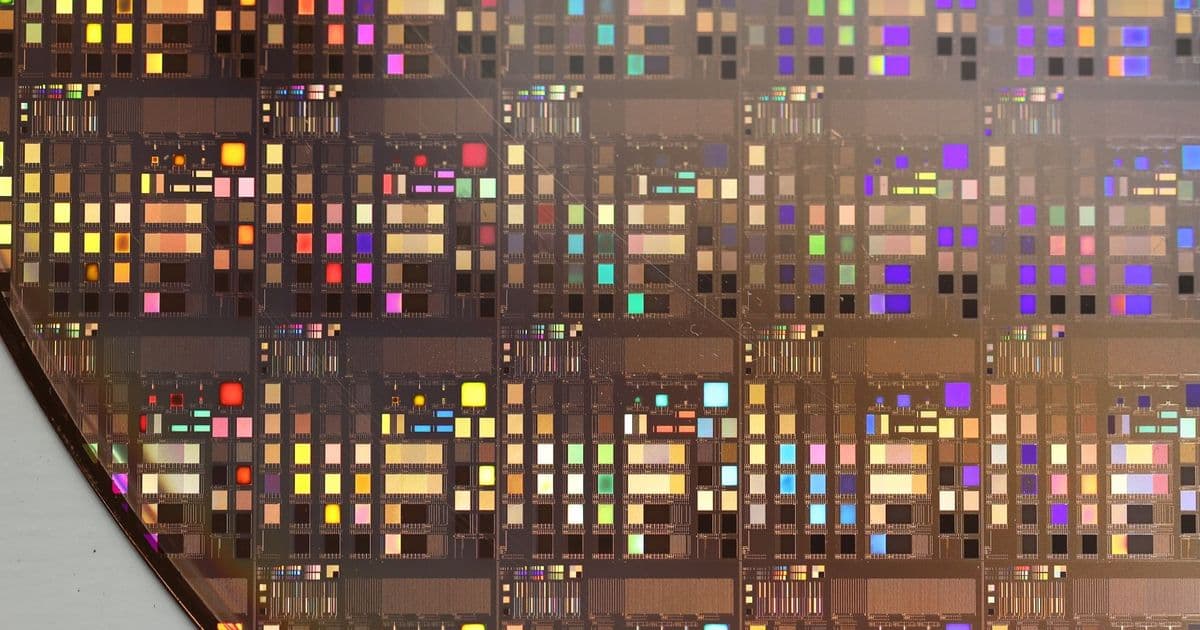

Advanced computing components face a new supply chain constraint as demand surges for low-coefficient-of-thermal-expansion (CTE) glass cloth, colloquially known as T-Glass. This specialized material forms the backbone of high-performance printed circuit boards (PCBs) and AI accelerator components, with its thermal stability enabling faster data transmission in next-generation chips. Japanese textile manufacturer Nittobo dominates production of this critical material, controlling an estimated 70% of the advanced glass cloth market alongside compatriots Asahi Kasei and Asahi Glass.

Technical specifications reveal why T-Glass is irreplaceable for AI infrastructure. The material maintains dimensional stability across temperature fluctuations below 3ppm/°C, preventing signal degradation in 5nm and 3nm process node components. Compared to standard FR-4 substrates, T-Glass enables 15-20% higher data transfer rates critical for HBM3 memory interfaces and GPU interconnects. Nittobo's decades-long development of quartz-based fibers results in tensile strength exceeding 3,400 MPa, allowing thinner PCB layers that accommodate complex multi-chip modules in data center GPUs and AI accelerators.

Market dynamics show severe imbalance: Nittobo's modest $37 million annual net income contrasts with customers like Nvidia ($27 billion quarterly revenue) and Apple ($383 billion annual revenue) fighting for allocation. Current annual T-Glass production capacity sits at approximately 200 million square meters, while AI data center demand requires 300+ million square meters annually. This 30% supply gap prompted Apple to dispatch executives to Japan for direct negotiations with Nittobo and Japanese government officials, seeking preferential allocation for iPhone and Mac PCB production. Simultaneously, Nvidia and AMD engineers visited Nittobo's Tokyo headquarters to secure priority access for server-grade A100 and MI300X components.

Alternative suppliers face significant technical hurdles. Taiwanese firm Nan Ya Plastics expects to produce advanced glass cloth by 2027 but projects output covering just 20% of current Nittobo volumes. Chinese manufacturers recently passed Nvidia certification for quartz-based alternatives but lack thermal consistency, with CTE variance exceeding Nittobo's standards by 40%. Unitika, another Japanese producer, operates at fractional scale with monthly output below 1 million square meters. These constraints compound existing shortages in HBM memory and power delivery systems, creating multiplicative bottlenecks across AI infrastructure.

Industry implications point to tangible product impacts through 2027. Apple's supply chain advantage faces unprecedented pressure as competing tech giants outbid traditional procurement channels. Component costs could increase 8-12% for premium devices, potentially raising consumer prices. More critically, project delays loom for data center deployments if PCB shortages persist. With AI accelerator shipments projected to grow 35% annually through 2026, the glass cloth bottleneck threatens to cap total industry output despite massive demand.

Material science complexity ensures no near-term resolution. T-Glass production requires proprietary quartz purification and weaving techniques perfected over 20 years, with yield rates below 60% even for established manufacturers. Nittobo prioritizes customers avoiding Chinese partnerships, further limiting market flexibility. While Intel and Samsung explore glass substrate alternatives for chip packaging, these remain distinct technologies unsuitable for PCB applications. Until alternative suppliers achieve thermal and mechanical parity, T-Glass scarcity will define AI hardware availability through the decade.

Jon Martindale is a contributing writer covering semiconductor manufacturing and supply chain dynamics.

Comments

Please log in or register to join the discussion