Despite OpenAI's astronomical valuation, our analysis reveals negative operating margins and unsustainable R&D recovery timelines for flagship models like GPT-5.

The Profitability Paradox

AI labs command valuations exceeding traditional software giants, yet fundamental questions about unit economics remain unanswered. When Sam Altman claims models eventually cover their own R&D costs, does reality match the rhetoric? Our forensic analysis of OpenAI's GPT-5 bundle (August-December 2025) reveals a complex financial landscape where gross margins offer hope but operating realities tell a different story.

Revenue vs. Costs: The GPT-5 Case Study

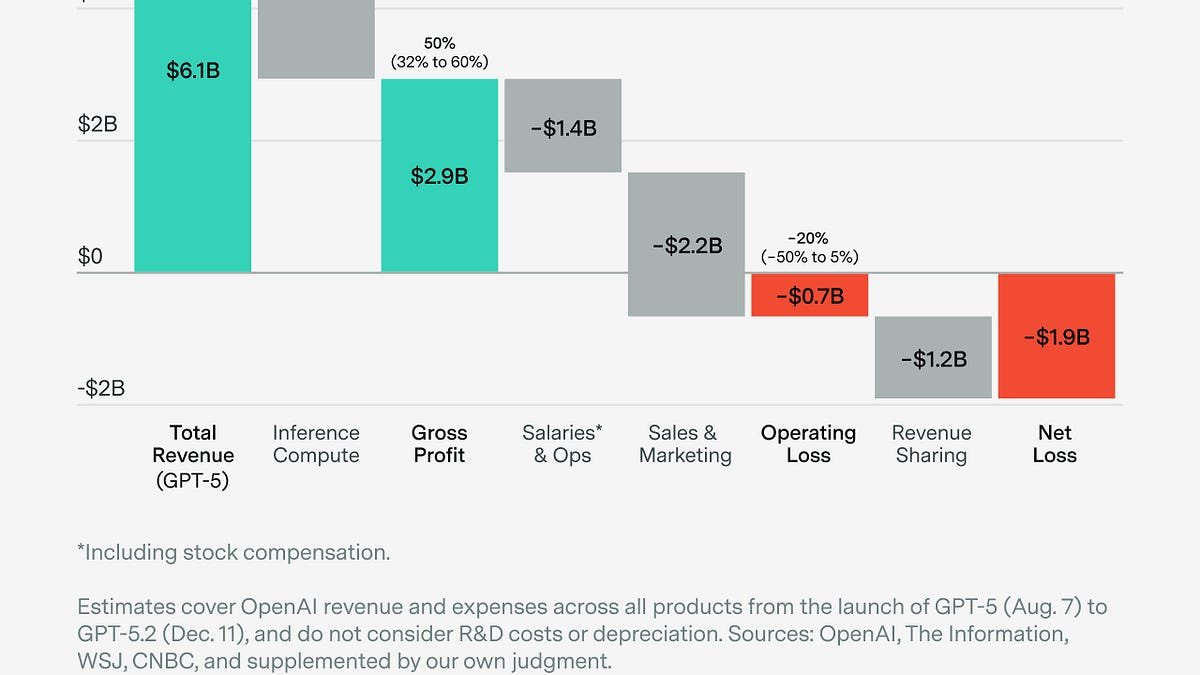

During GPT-5's 4-month tenure as OpenAI's flagship model, we estimate:

- $6.1B revenue from all offerings (ChatGPT, API, etc.)

- $3.2B inference compute costs (serving user requests)

- $1.2B operational staff compensation

- $2.2B sales & marketing

- $0.2B administrative overhead

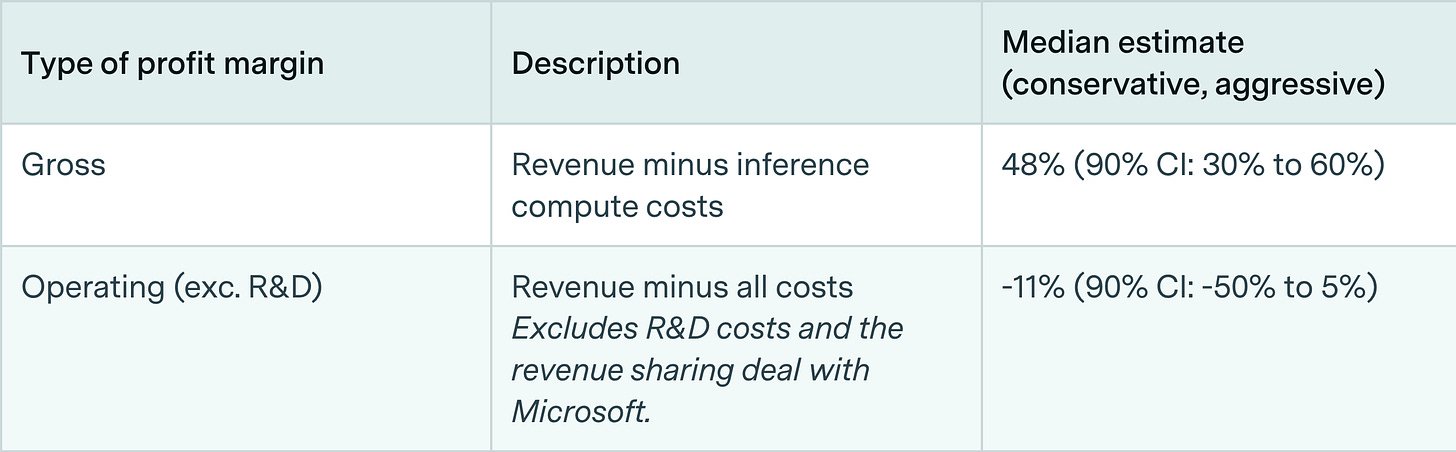

This yields a 48% gross margin ($2.9B profit) when considering only compute costs - already below the 60-80% typical for software. But including all operational expenses reveals an 11% operating loss (-$700M). Microsoft's reported 20% revenue share agreement further erodes margins.

Confidence intervals from Monte Carlo analysis show consistent losses across scenarios

Confidence intervals from Monte Carlo analysis show consistent losses across scenarios

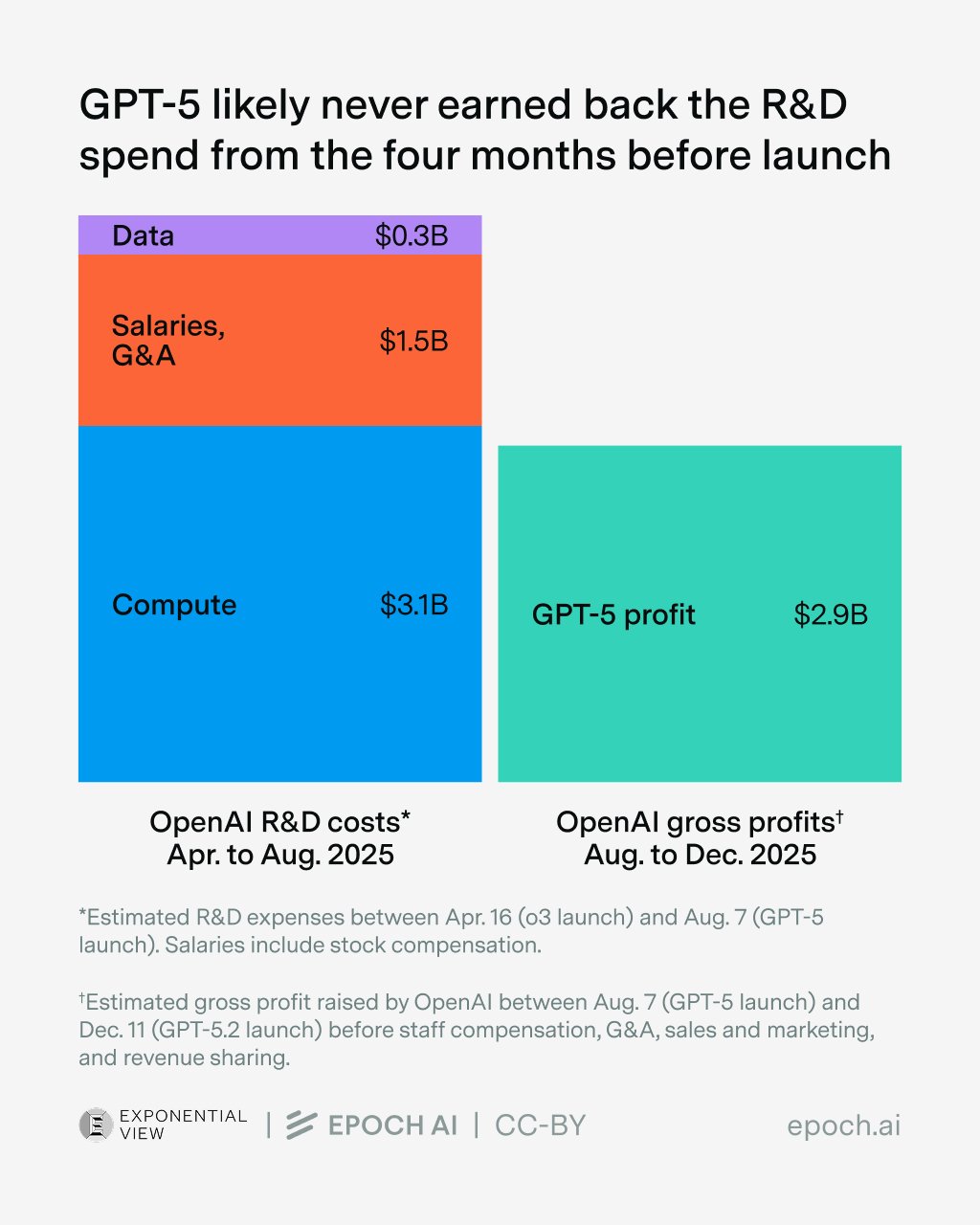

The R&D Recovery Problem

Even assuming optimistic gross margins, GPT-5's short lifecycle prevented R&D cost recovery. We estimate:

- $5B R&D investment in the 4 months preceding GPT-5's launch

- Just $3B gross profit during its active period

Model obsolescence accelerates this challenge - Gemini 3 Pro surpassed GPT-5 within months, forcing OpenAI to deploy GPT-5.2. This creates a depreciating infrastructure effect where R&D must be recouped before competitors displace the model.

Why Investors Still Bet on AI

Three factors sustain investment despite current economics:

- Growth trajectory: OpenAI's revenue tripled annually ($20B+ run rate)

- Enterprise stickiness: Corporate contracts increase switching costs

- Future efficiency: Algorithmic advances could slash compute costs 10x

The Path Forward

Profitability hinges on extending model relevance cycles and diversifying revenue. OpenAI is now testing ads (projected $2-15B annually) while pursuing vertical-specific enterprise solutions. As Anthropic's comparable margins suggest, the entire frontier AI sector faces similar economics. The question isn't whether AI creates value - it's which labs will build sustainable capture mechanisms before funding patience expires.

Competition forces rapid iteration, compressing revenue windows

Competition forces rapid iteration, compressing revenue windows

Comments

Please log in or register to join the discussion