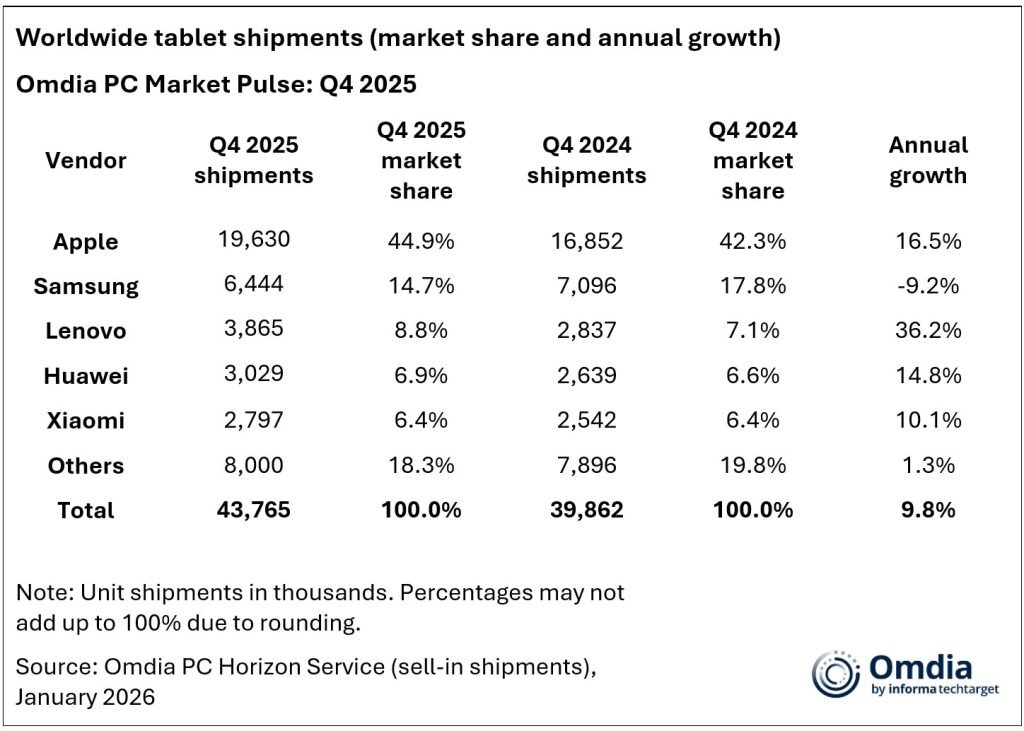

Apple's iPad shipments grew 16.5% year-over-year in Q4 2025, reaching 19.6 million units and maintaining a 44.9% market share, though memory constraints may impact 2026 sales.

Apple's iPad continued its strong performance in the final quarter of 2025, with shipments growing 16.5% year-over-year to reach 19.6 million units, according to new research from Omdia. This growth helped Apple maintain its dominant position in the tablet market with a 44.9% share, despite Lenovo's impressive 36.2% growth rate that saw it ship 3.9 million units during the same period.

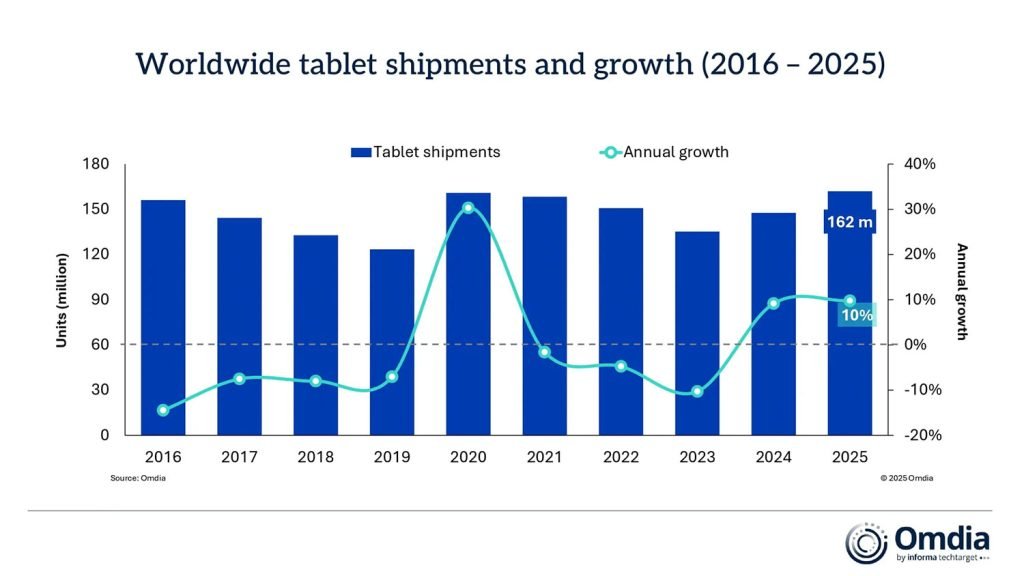

The broader tablet market also showed signs of recovery in Q4 2025, with worldwide shipments growing approximately 10% compared to the same quarter in 2024. This marks a significant turnaround after three consecutive years of decline that followed the pandemic-driven sales boom of 2020.

Omdia attributes Apple's strong performance to robust demand for two key product lines: the iPad 11th Generation and the M5-powered iPad Pro lineup. The research firm notes that Apple "had robust demand and grew their lead as the top tablet vendor" during the quarter.

However, the report also highlights potential challenges ahead. Memory constraints played a significant role in Q4 2025's performance, as vendors engaged in pre-build activity ahead of anticipated supply issues. Himani Mukka, research manager at Omdia, explains: "In 2025, the tablet market delivered its highest annual shipment volume since the pandemic-driven demand boom of 2020. Seasonal holiday demand, combined with vendor pre-build activity ahead of anticipated memory constraints, provided a meaningful uplift to shipments in the final quarter. However, tablet demand will come under increasing pressure in 2026."

The memory constraint issue is particularly noteworthy because it represents a shift in the tablet market dynamics. While tablets have traditionally been less affected by component shortages compared to smartphones and laptops, the increasing sophistication of iPad hardware—particularly with the M-series chips—has made them more susceptible to the same supply chain pressures affecting other computing devices.

Looking at the competitive landscape, Samsung maintained its position as the second-largest tablet vendor with a 14.7% market share, followed by Lenovo at 8.8%, Huawei at 6.9%, and Xiaomi at 6.4%. The remaining 18.3% of the market was distributed among other tablet manufacturers.

The strong Q4 performance suggests that Apple's strategy of regular hardware updates and maintaining a diverse iPad lineup continues to resonate with consumers. The combination of the affordable iPad 11th Generation and the high-performance M5 iPad Pro models appears to be effectively covering both ends of the market spectrum.

For developers and accessory manufacturers, this growth trajectory presents both opportunities and challenges. The expanding iPad user base creates a larger potential market for apps and accessories, but the looming memory constraints could affect production schedules and component pricing throughout 2026.

Apple's ability to navigate these supply chain challenges while maintaining its market leadership will be crucial in determining whether the tablet market's recovery can be sustained beyond the holiday-driven Q4 surge. The company's vertical integration and significant purchasing power may provide advantages in securing necessary components, but even Apple cannot completely insulate itself from global semiconductor market dynamics.

The full Omdia report provides additional insights into regional variations in tablet adoption and the performance of different price segments within the market. For those interested in the complete analysis, the report is available through Omdia's research portal.

As the tablet market enters 2026, all eyes will be on how memory constraints impact not just Apple but the entire ecosystem of tablet manufacturers and their ability to meet consumer demand for these increasingly versatile computing devices.

Comments

Please log in or register to join the discussion